The New Zealand government has legislated that banks are not allowed to charge for open banking, an about-face from the draft legislation stating that banks could charge up to $5 a month for consumers to have access to their own data. While this is a win for New Zealanders, it's worth keeping in mind that pay-to-play open banking should never have been on the table in the first place.

Money tips

Money tips

Investing can be a scary topic that many lack the confidence to tackle. Simran Kaur shares advice and knowledge to give you confidence to start dabbling in investments. Do you feel confident to kick-start your investing journey? Read on and find out how to overcome the gaps standing between you and the fruits of investing.

Interviews

Interviews

We asked some of our wonderful users to share how they use PocketSmith to be productive with their money and plan for the future. Read how Travis uses PocketSmith to forecast life's what-ifs and make confident money decisions for his family.

Interviews

Interviews

"The funny thing about risk is that not doing anything is the biggest risk. This is something true of investing as it is true about life." Prashant from share portfolio tracker Sharesight is a techie-turned-investor with a soft spot for diversification. We pulled up a chair with him for the latest Fireside Finance.

Company

Company

Intersekt 2025 in Melbourne was buzzing with ideas, energy, and connection. From debates on AI and financial inclusion to candid conversations about the human realities of money, the conference gave us both inspiration and clarity. The team shares what they learned, what inspired them, and what moments will stay with them long after the conference ended.

Money tips

Money tips

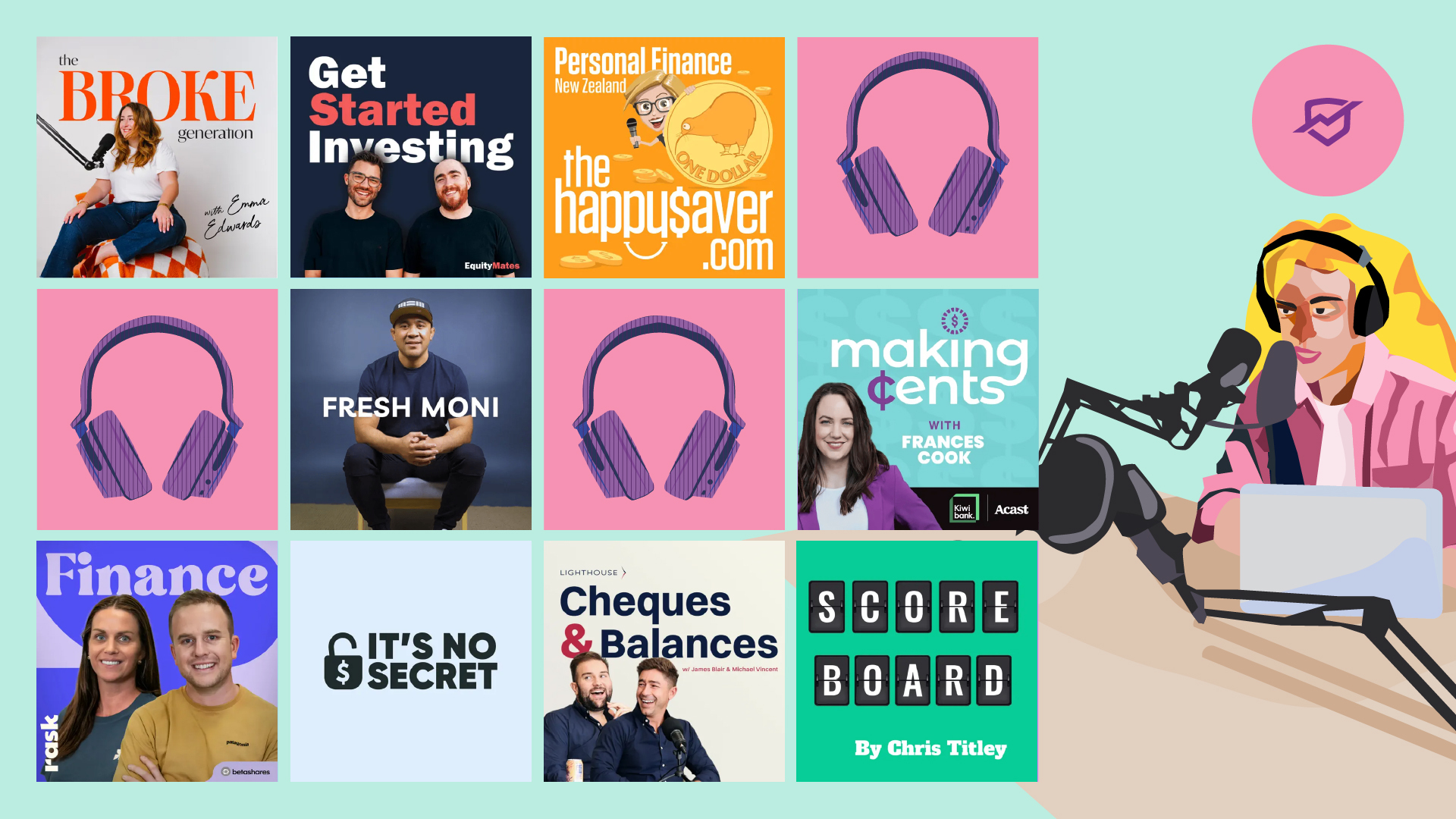

A podcast is the perfect low-effort entertainment for busy lives, and New Zealand and Australia do it best. Here are some of our favourite financial podcasts for 2025 from down under, full of financial knowledge to help you become more confident in managing your money.

Interviews

Interviews

Living abroad means more than a new address — it means navigating life across currencies, systems, and cultures. From their base in Guadalajara, Mexico, Americans Justin and Amanda have built both a life and a business around helping others do the same. In this interview with Brynne from Femme Frugality, they share how love, multi-currency living, and digital nomad entrepreneurship shaped their thriving expat journey.

Money tips

Money tips

Parenting doesn’t stop when your kids leave home, and sometimes that means offering financial help. But how do you support them without creating dependency? In the latest edition of Ruth's Two Ce, Ruth The Happy Saver shares her two cents on striking the balance and why financial literacy is key.

Interviews

Interviews

We asked some of our wonderful users to share how they use PocketSmith to be productive with their money and plan for the future. Read how Wendy keeps everything in one place with PocketSmith, from 29 business components to her grocery plan.

Money tips

Money tips

Spending half her income on rent might raise eyebrows, but for Rachel, it's about more than cost — it's about value. In a region known for its beauty and high living expenses, she's chosen safety, convenience, and a lifestyle that fits her priorities. Here's why, despite the price tag, she thinks it's worth every cent.

Money tips

Money tips

Travel doesn’t have to be expensive, and the cheapest option isn’t always the best. The real trick is finding the balance between cost and experience. With smart planning and the right tools, Michelle from Traveloka shows how you can save money while still enjoying a fulfilling trip.

Company

Company

PocketSmith joined industry leaders at FinTech Australia’s CDR Summit in Sydney, a key annual event exploring the potential of open banking and data rights. Representing Aotearoa New Zealand, CEO Jason Leong shared a perspective shaped by years of building with open banking across global markets.

Product feature

Product feature

Bring your partner, kids, parents, business, or clients together under one PocketSmith subscription and save 40% on extra accounts. With Family Groups and optional Shared Access, you can manage money collaboratively while keeping everyone's finances private, secure, and tailored to their needs.

Interviews

Interviews

We asked some of our wonderful users to share how they use PocketSmith to be productive with their money and plan for the future. Read how Luan simplified life’s big moves with PocketSmith’s budgeting tools.

Money tips

Money tips

The UK's neobanks and money apps are shaking up old-school banking with smart features and slick interfaces designed for modern money management. With smart features and sleek designs, these digital-first platforms are changing the way we manage money. Emma's rounded up the top contenders making waves right now.

Money tips

Money tips

Neurodivergent people often need flexible tools to manage money in ways that work for them. We explore how PocketSmith supports different neurodivergent needs with customisation, visual tools, and smart guardrails — featuring Sarah, an autistic user who shared how PocketSmith helps her budget confidently across currencies.

Money tips

Money tips

Is downsizing in retirement the smart move or an emotional minefield? In this edition of Ruth’s Two Cents, Ruth responds to a newly retired reader torn between the practical benefits of selling their longtime home and the emotional weight of leaving it behind.

Interviews

Interviews

We asked some of our wonderful users to share how they use PocketSmith to be productive with their money and plan for the future. Read how Murray brought all his finances together with PocketSmith to protect his family's future.

Money tips

Money tips

After an exciting adventure of the #digitalnomadlife, Rachel returned to New Zealand, facing reverse culture shock and high food prices. Transitioning from freelancing to a new office job after two years, she joined a close-knit team. This return to office life not only taught Rachel about the work and organisation but also offered valuable lessons about money

Money tips

Money tips

Online dating has become a standard avenue for romance. As the norms around digital dating have evolved, so too have the financial dilemmas it presents. While issues like who pays for dates or when to discuss finances are largely based on personal preference, protecting your financial safety is essential. With the rise of online scams, especially on dating apps, maintaining vigilance is essential.

Money tips

Money tips

Many families go through daily life without talking much about money, even though it influences everything from meals to milestones. Fresh Moni’s Willie Leota encourages simple, open conversations about money at home to build understanding and reduce stress.

Money tips

Money tips

If you're neurodivergent, traditional budgeting tools might not feel like they're built for your brain, which can be discouraging. We believe you're not bad at money, you just need tools that work the way you do. We're showing how PocketSmith's flexible features can support your unique thinking style and simpler financial planning.

Money tips

Money tips

It's tax time somewhere, and that means it's the perfect moment to get your finances in order. Whether you're self-employed, a business owner, or managing your own books, knowing what to tackle at the start of the financial year vs. the end can make all the difference. Sam Harith shares his tax time insights.

Money tips

Money tips

After months as a digital nomad, working from cafes and cabins around the world, Rachel realised she longed for stability. Ultimately, she decided to quit freelancing and return to New Zealand, embracing a more grounded lifestyle. Rachel shares why she chose to go local and find new fulfilment in her career and life.