After an exciting adventure of the #digitalnomadlife, Rachel returned to New Zealand, facing reverse culture shock and high food prices. Transitioning from freelancing to a new office job after two years, she joined a close-knit team. This return to office life not only taught Rachel about the work and organisation but also offered valuable lessons about money

Money tips

Money tips

Health struggles can shake up every part of life — including finances. In this edition of Ruth’s Two Cents, Ruth shares her practical advice for dealing with financial uncertainty amid a medical crisis.

Money tips

Money tips

Despite setting ambitious resolutions to cut back on drinking, Americans are spending as much on alcohol now as they did during the pandemic, according to PocketSmith's Global Spending Map. The data highlights a complex relationship with alcohol shaped by generational attitudes, historical habits, and post-pandemic life.

Money tips

Money tips

Money can be a tricky subject for couples, often surfacing in the most unexpected moments. On a shopping trip in Nebraska, Katie and Alan from The Rebel Finance school found themselves at a crossroads — not just over buying Fitbit trackers but over something deeper. How do couples navigate money without letting it become a source of division?

Money tips

Money tips

Hopefully, your journey toward financial independence isn't anything like Jurassic Park's famous tagline: "An adventure 65 million years in the making." In this blog, we roll out the red carpet to unveil how your treasured movie franchises are a reel reflection of your monetary management. Can you spot your faves?

Money tips

Money tips

Points hacking common rewards programs is a clever way to make your spending work harder, unlocking perks like free flights, discounts, and cashback. From grocery shopping to coffee runs, the UK offers a range of loyalty programs for everyone. We've rounded up the top seven rewards schemes to help you maximize value and make the most of your spending.

Money tips

Money tips

Are you feeling overwhelmed by the multitude of KiwiSaver options out there? Choosing the right KiwiSaver fund can be a daunting task, with numerous providers and funds vying for your attention. Ruth shares how she's simplified her process for picking, and provides you with a practical guide to selecting a fund that aligns with your financial goals and preferences.

Money tips

Money tips

Coffee can be a daily indulgence for many people, but it can also be a significant expense. Rachel wanted to test the effects that her daily coffee has on her budget and routine. Read about the lessons she learned about her money habits and mindset by taking a break from the jitter juice.

Money tips

Money tips

Personal finance expert Brynne Conroy explains how to push past ACA anxiety, navigate open enrollment, and make choices that protect your health and your budget in 2025.

Money tips

Money tips

Credit card debt can be overwhelming, especially when it feels like there’s no room in your budget to get ahead. But with the right plan, you can regain control and start making progress. In this edition of Ruth's Two Cents, Ruth addresses the challenges of juggling essential expenses while tackling credit card balances.

Money tips

Money tips

Off to do a working holiday, or joining the digital nomad community? You’ll need an arsenal of programs to make sure your work remains uninterrupted and effective. We’ve got you covered with our top five apps for working abroad — from finances to productivity and wayfinding.

Money tips

Money tips

Managing cash flow can feel tricky, especially in uncertain times. Sam Harith explores the key differences between cash flow and income, how to build visibility over your household finances, and actionable steps to manage outflows, boost inflows, and plan for the future.

Money tips

Money tips

Dealing with currency fluctuations is a daily reality for digital nomads, and it's akin to a thrilling, complex juggling act. As a freelancer working with clients from different continents, efficiently managing these multiple currencies is crucial. Rachel shares how she uses PocketSmith to ensure she’s always prepared for global economic shifts.

Money tips

Money tips

Burnout is overwhelming, but it’s also an opportunity to pause and recalibrate. Balancing mental health and financial stability can feel daunting, but with clarity and a plan, it’s possible. In this edition of Ruth's Two Cents, Ruth shares practical steps to address burnout while safeguarding your finances, so you can regain control and move forward with confidence.

Money tips

Money tips

Investing your hard-earned money is a great way to grow your wealth, but have you ever wanted to use your investments to promote positive change as well as generate returns? Your portfolio can go further if you invest in companies and funds that share your beliefs and values. Emma explores whether aligning your investments with your personal values is a worthwhile strategy.

Money tips

Money tips

Navigating travel insurance as a digital nomad is both essential and challenging. From a quick-fix solution that lasted only two days to a stable choice that lasted for months, Rachel's experiences with insurance while travelling as a freelancer highlight the unique challenges and solutions for digital nomads managing risks while on the move.

Money tips

Money tips

In an era of ever-increasing costs, many people are grappling with the question of whether they should prioritize investing their hard-earned money or focus on coping with rising expenses. As financial landscapes evolve, understanding the significance of investing during such challenging times becomes important.

Money tips

Money tips

Financial fraud takes many forms and is constantly evolving, making it challenging to stay ahead of scammers. However, by learning how to detect and prevent fraud, business owners and individuals alike can protect their hard-earned money. Sam shares his insights as an accountant on safeguarding financial systems against potential threats.

Money tips

Money tips

Whether you're commuting, cooking, or out for a walk, podcasts make the perfect companions. Check out some of our 2024 favorites and discover new ways to grow your financial knowledge. Packed with fresh financial insights, practical tips, and inspiring stories, each one will help you sharpen your money skills.

Money tips

Money tips

The constant pressure to meet financial obligations and strive for financial success can quickly deplete one's mental, emotional, and physical resources. Addressing the root causes, establishing realistic goals, and seeking support are key to navigating the challenges of financial burnout and cultivating long-lasting financial resilience.

Money tips

Money tips

As a Financial Adviser, Jess Hargreaves from Lighthouse Financial has seen firsthand how PocketSmith makes it easier for clients to manage their money and achieve financial success. She shares five essential budgeting tips that will not only help you take control of your finances but also make the process more manageable.

Money tips

Money tips

Invoicing isn't just admin, it's an art form. Like a lot of aspects of freelancing, invoicing freelancing clients can be a nuanced exercise. Rachel reveals her tricks of the trade for ensuring timely payment and maintaining a healthy, professional relationship with the businesses that rely on her services.

Money tips

Money tips

Part-time jobs for teenagers are more than just a way to earn extra money; they are invaluable opportunities for personal growth and skill development. Ruth shares how encouraging her daughter to work part-time has helped her develop independence and learn valuable financial lessons to set her up for future success.

Money tips

Money tips

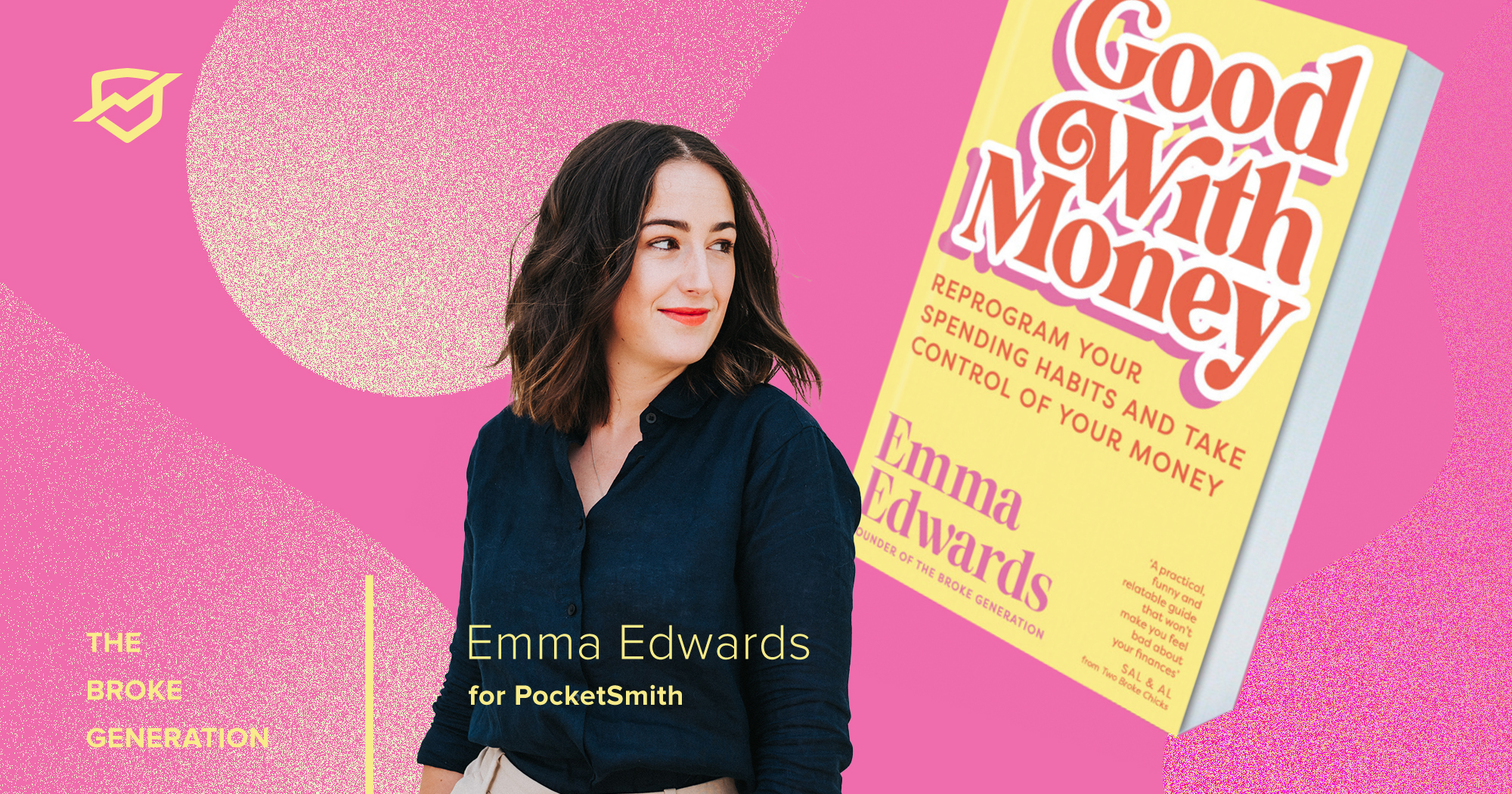

Embarking on the journey of writing a book can be both exciting and daunting, as Emma Edwards discovered when authoring her personal finance book "Good With Money". Whether you're looking to write for financial gain or just for the love of it, Emma's lessons learned offer practical advice for anyone embarking on the challenging yet rewarding adventure of writing a book.

Money tips

Money tips

Navigating the delicate balance between a side hustle and a traditional 9-to-5 job is akin to traversing a winding road, filled with twists and turns. From an initial streamlined approach that evolved into a multifaceted system of financial management, Rachel shares the ups and downs of juggling both freelancing and steady employment.