The way we work is changing. Think about your friends and contacts. How many have a full-time job? How many earn extra income on the side, perhaps by offering their digital skills for hire, occasional childminding, or even renting out a spare room on Airbnb?

In recent years, alternative work — contract, freelance and gig employment — has entered the mainstream thanks to COVID-19, an online office has become the new normal. Many people have developed passive income streams and side hustles alongside their day job. This increase in understanding and acceptance of remote working and balancing multiple employment opportunities, correlates with an increase in opportunities for people to manage multiple income streams.

For multiple income stream managers, manual money management can be a tricky task, regardless of the industry. Juggling different income schedules and payment methods on top of your day-to-day can quickly become overwhelming.

Adapting to your new way of working is key to managing multiple income streams. Let’s look at how you can do so effectively.

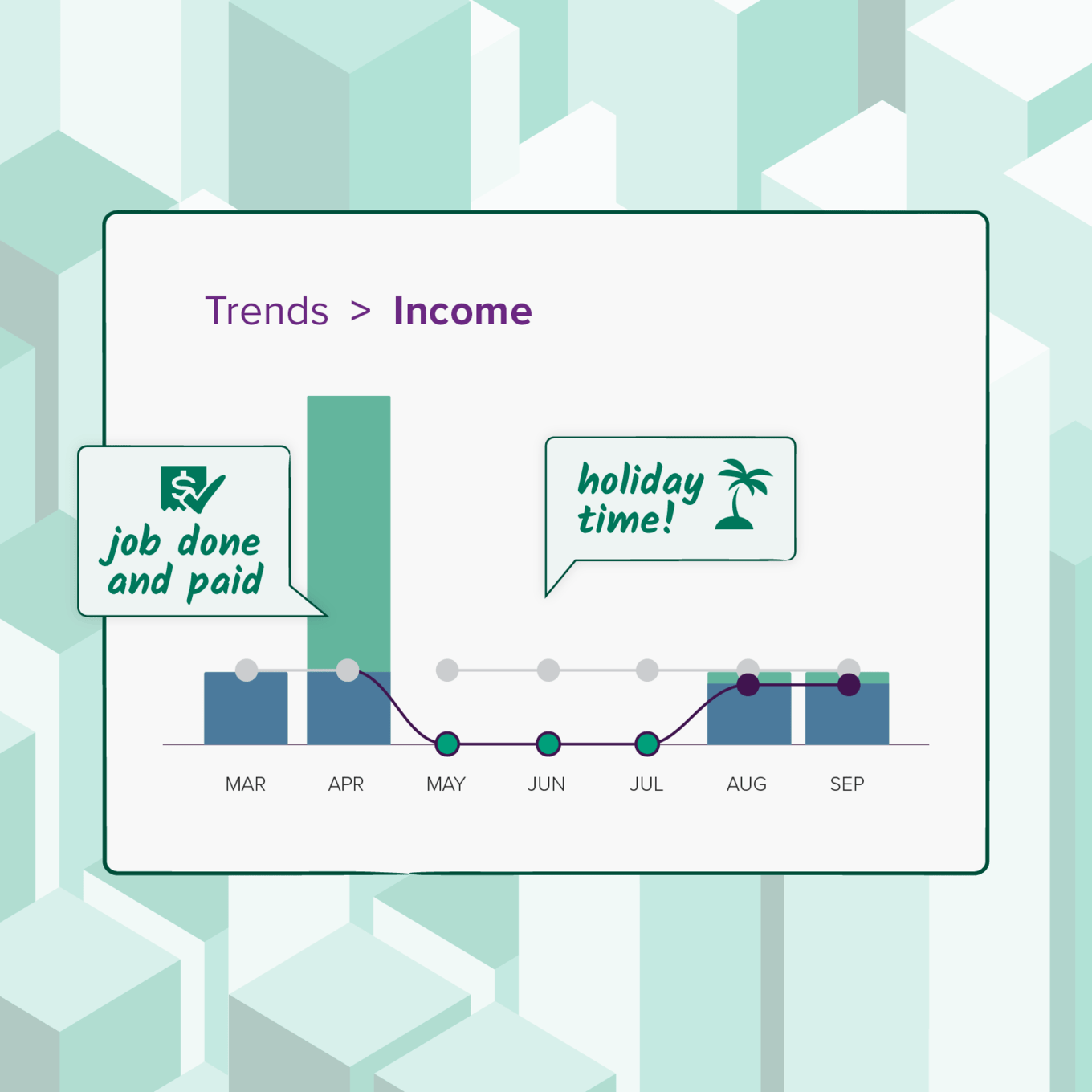

Being able to track all of your income automatically is the first step to managing multiple income streams. With more than one source of income, your accounts can quickly become too complicated to track manually.

Fortunately, there are modern solutions to help manage this. While some people still rely on complicated spreadsheets, online money management software like PocketSmith can connect directly to your accounts and sync automatically with live bank feeds.

Once you’ve started tracking your income streams, they can be further organized. This will allow you to easily refer back to them when required. In PocketSmith, you can categorize your transactions with labels and annotations.

“I sync my bank feeds and categorize my recent transactions on PocketSmith pretty much every day.” - Software engineer Kevin Plattret, who uses PocketSmith to track his expenses, freelance work and taxes

Think about how many accounts you may need to manage your personal finances effectively. Don’t stress, you can always add more or remove some later. Everyone will need a custom account setup that works best for them.

Read more about accounts, buckets, and The Barefoot Investor.

Some common bank account types include:

Managing multiple income streams requires you to track your finances and closely monitor your transaction history. Combining two or more sources of income into a single account can make the transaction history difficult to make sense of. If that account is also a checking account, going through your transactions will fast become a chore. Multiple bank accounts allow you to keep every transaction in the right place.

There are two main considerations when managing multiple bank accounts alongside multiple income streams:

Once you’re comfortable with multiple bank accounts, you may even want to consider the benefits that other banks may offer. Some multi-income managers take advantage of special offers from other banks to find the setup that works best for them. Different bank accounts have different interest rates and this extra money can be valuable, so you should look at the terms and conditions on your accounts to make sure you’re getting the best bang for your buck.

Tip: Most banks offer fee-free accounts, so do take some time to find the account that works best for you!

Your online banking app may be a lot more useful than you first thought. Automated payments are one of the biggest time-saving tools when it comes to managing your money.

Use automated payments to:

These common bank app features will further help organize and categorize your personal finances:

Add another layer of organization and customization to your personal finances. PocketSmith can use your financial data to forecast up to 30 years into the future.

People dealing with multiple income streams are often dealing with inconsistent cash flow as a result. Constantly fluctuating income can make it hard to plan ahead. Luckily, we live in a world full of tools to help us out:

Understanding your tax obligations is something every multi-income earner struggles with at first. After actually creating some income, tracking your tax is the next most important aspect to manage. When it comes to tax, income and expense tracking becomes incredibly important.

Whether you’re a freelancer, contractor or someone juggling different side hustles, your individual tax obligations will depend on where you live, how you earn your money, and who’s paying you.

In the UK, the Government offers the free HMRC app to help self-employed individuals manage their tax. Small business owners may also want to look into online accounting software like Xero.

In the USA, personal taxation information for those with multiple income streams can be found on the IRS website. They also offer the free app IRS2Go, which offers live tax assistance and daily tax tips.

In Australia, your taxes will be managed through the Australian Taxation Office. They have a bunch of useful information for multi-income earners on the ATO website.

In New Zealand, tax is managed by the Inland Revenue Department. You can find information for multi-income workers on the IRD website and also business.govt.nz.

When it comes to managing multiple incomes, it pays to figure out where your time is best spent. Put a figure on how much your time is worth. Then do the maths on whether you can save money, by saving time. An accountant may be a worthwhile expense if they can do the work in half the time that it takes you. If a piece of software can save you multiple hours of unpaid work every week, then it’s probably worth the subscription.

Once you’ve mastered the methods listed above, you’ll be ready to manage multiple income streams at scale. Time invested now will save you money in the future.