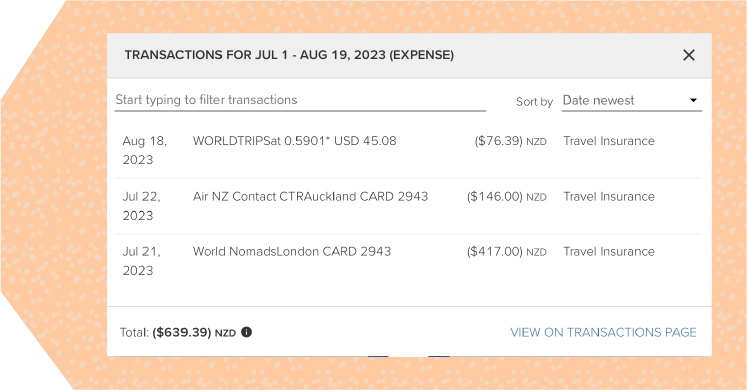

Looking through the ‘Travel Insurance’ sub-category in my PocketSmith Trends, it turns out I’ve had three different providers for travel insurance in six months of overseas travel as a digital nomad.

To be more exact, I had one provider for approximately 48 hours, one provider for a month, and the third provider for every month after that. For those curious: Yes, the first provider was by far the most expensive.

Travelling without insurance wasn’t an option. As a freelancer, I didn’t have an employer to cover work-related incidentals or pay out annual leave. I was a foreigner, so I would no longer have government-subsidised healthcare. Also, the first time I went to the USA in 2014, I landed in hospital with a major concussion and a bill for tens of thousands of dollars (which insurance covered). Given that, I wasn’t willing to leave it to chance.

At the time, I didn’t have much of a choice. I’d booked tickets to the USA a mere 24 hours before my flight, then realized how much I still had to organize and panicked. I simply didn’t have time. So I added that 48-hour Air New Zealand travel insurance to my ticket. Just to get me through, I rationalized. Just to buy me time to figure it out at the other end.

Provider 1: Air New Zealand

Cost: $146 NZD

Duration: 48 hours

Cost per day: $73 NZD

Lesson: Short-term thinking can cost you big time

Travel and health insurance for the USA is widely known to be exorbitant (more on that later), but even so. Ouch!

I found my second provider by rummaging through the top ten results on Google for “Best Travel Insurance” and “Insurance For Digital Nomads.” World Nomads had a reassuringly travel-focused name, good reviews, and broad country-specific coverage. Any traveller since 2019 will know to check for pandemic- or global-health-related clauses. As well, any digital nomad gets savvy at checking reimbursement amounts for lost or stolen clothing and — particularly — digital devices such as cameras, phones, drones, and laptops.

Through World Nomads, I could get comprehensive travel insurance for the USA, Canada, and the UK for $417 a month. Not bad… except for one thing.

Did I really want to pay an extra 45% every month on the slim chance that my laptop went missing? Well… no. Sure, my laptop is how I work. It’s my sole source of income. But compared to the cost of buying a new one, it seemed disproportionate. I took a breath, did some quick maths on how much my Macbook Air had cost in the first place and how much it had depreciated since, and bought the insurance without electronics coverage.

Provider 2: World Nomads

Cost: $417 NZD

Duration: 30 days

Cost per day: $13.90 NZD

Lesson: Run a quick cost-benefit analysis before committing — the add-ons might not be worth it

By the time that insurance was in its third week, I had moved through the USA and Canada to Scotland. I’d also finished a longstanding freelance project and had a different, regular client go radio silent on me. This meant I was looking at my PocketSmith income/expense reports and doing some hasty rejigging. I needed to slash that $417/month budget to something lighter.

This time, I found SafetyWing’s Nomad Insurance. The coverage wasn’t as comprehensive as World Nomads’, but for global travel and medical insurance, it was plenty adequate for my needs. I certainly didn’t need add-ons for high-risk activities like paragliding or extreme snow sports!

Even better, SafetyWing had an automatic policy rollover. No need to reset your policy every month, they’ll do it for you. As a footsore traveller with a million decisions to make, that was music to my ears. There was no list of countries that I would have to keep manually updated as I travelled, either. Simple is the name of the game: they offered one plan for global travel covering 180+ countries, including the USA, and one plan for the same excluding the USA.

What was the price difference, you ask? The US-inclusive plan cost more than the base plan with the extreme adventure add-on and electronics theft add-on combined. It would, in fact, double the monthly cost of the insurance. And I wasn’t planning to be back in the USA anytime soon. The base plan was good enough for me.

Provider 3: SafetyWing Nomad Insurance

Cost: $45 USD (around $72 NZD)

Duration: 28 days, automatic rollover

Cost per day: $1.60 USD (around $2.55 NZD)

Lesson: Don’t settle for “good enough”, keep searching until you find what best fits your needs

Third time’s the charm, as they say. It was in my case! I stuck with SafetyWing for the last five months of my travel. They had the cheapest plan I could find that was still comprehensive enough for my needs, and the automatic rollover makes things a breeze. I took a certain amount of joy in tracking that regular (small) budget in my PocketSmith account. Looking at the Trends page makes me smile, too.

In three payments, I went from a daily travel insurance rate of $73 down to $13.90 and down again to $2.55. You can’t get much better than that.

Rachel E. Wilson is an author and freelance writer based in New Zealand. She has been, variously, administrator at an ESOL non-profit, transcriber for a historian, and technical document controller at a french fry factory. She has a keen interest in financial literacy and design, and a growing collection of houseplants (pun intended).