Read how Kina gains insights into her spending habits in an environment where her data is secure and easy to utilize.

I’m Kina, a product designer and personal finance blogger sharing tips and resources on my journey to financial independence.

I call New Zealand and Indonesia home and live with my partner Kees, a creative technologist with a background in marketing and design. We focus on spending based on our values, and enjoying life together while also taking steps towards a future that excites us.

I’m one of those people that enjoy planning, so I’m usually the one setting up a structure. Kees, on the other hand, is amazing at creating experiments for us to try.

For example, I’ll map out the fixed and variable expenses in our shared budget. Kees then shares ideas on how we can reduce our spending for a category like Eating Out by preparing easy dinners for nights when we don’t want to cook. Later on, we check in together to see how our spending is going.

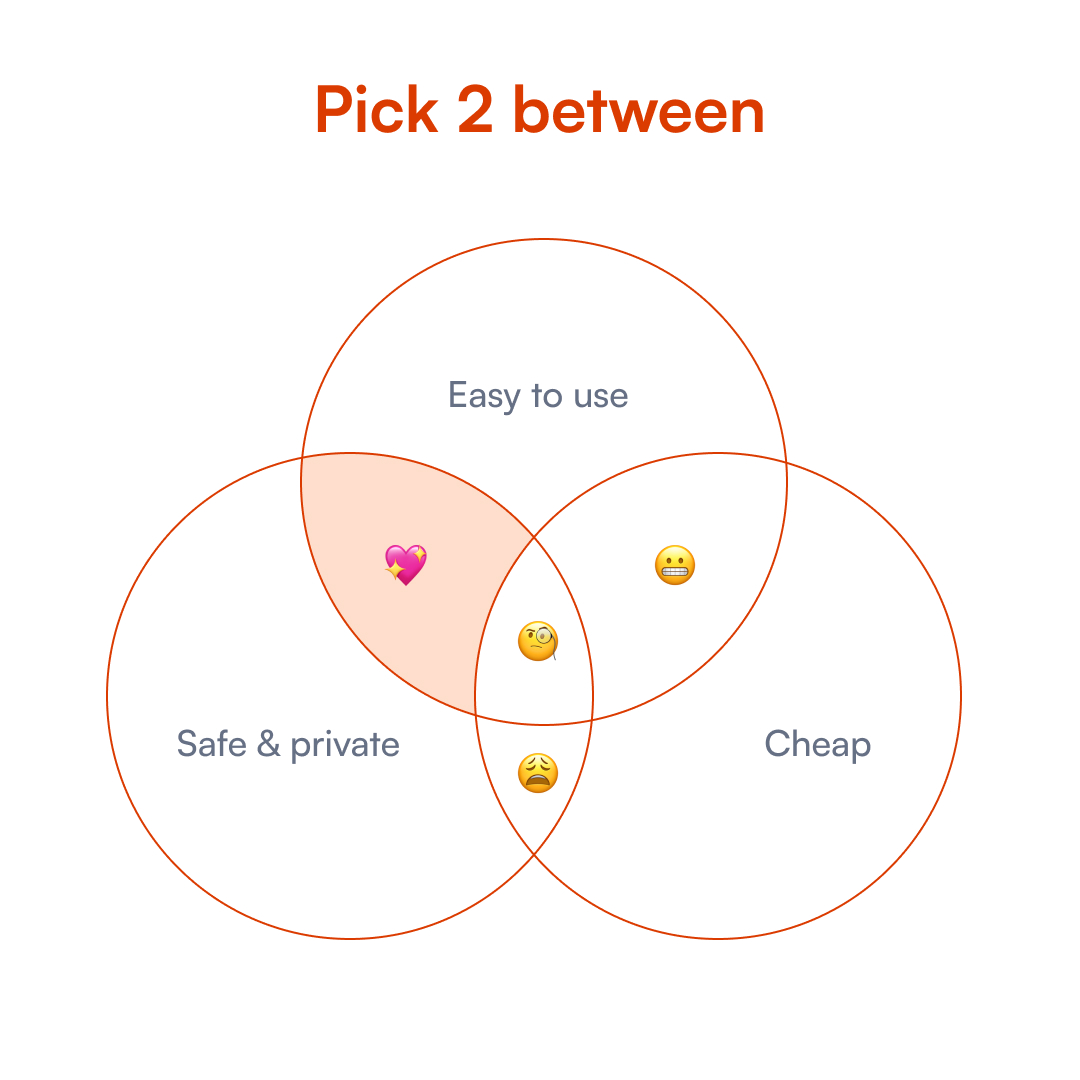

Having multiple accounts across many banks, credit cards, and other accounts got incredibly tedious to track manually, and I wanted to make sure my data was safe. With budgeting apps, I find that you have to pick between two: Cheap, easy to use, and secure. PocketSmith is easy to use and safe, so I’m happy to pay for the convenience.

Diagram provided by Kina

From early 2021, so coming up to two years soon. Before that, I’d use a swath of spreadsheets and restart anew every year. Nowadays, we use Notion and spreadsheets for high-level plans and goals.

Mostly categorizing our expenses, and seeing what we actually spent our money on. I’m currently trying to figure out how to use the Rollover Budgeting feature consistently — it’s a work in progress.

I love how it proves how we’re going with our plan — it’s easy to think it’s going fine, but having the data to back it up makes it really clear what’s working well and what needs to be adjusted.

We noticed that we consistently spent more than expected on Groceries recently, so we reduced spending on other categories because we love cooking new dishes together!

Besides the category rules that have saved me SO much time, I love the Earning and Spending chart! It makes it super clear where our money is going.

Start by taking a small action in the direction of your goals — you can always improve it later. There’s no such thing as a perfect plan to follow; we often learn and adjust our focus along the way. When I started investing outside of Kiwisaver a few years ago, I started with a small monthly amount. As I learned more about investing and personal finance, I increased it bit by bit, which made a huge difference!

If you asked me when I started, there’s no way I would jump straight to this point — building a consistent habit is a lot more impactful than focusing on one big goal to achieve. For more tips and resources about money and careers in tech, you can read my blog or follow me on Instagram.

Planning what we’ll do with income changes as soon as it’s confirmed to prevent lifestyle creep.

We’ve built a habit of putting extra money towards savings or investments, and it’s been quite motivating to see how the numbers behind it have changed over time.