It’s never fun to talk about debt. However, it is difficult to avoid debt as a working adult. You’ve got mortgages, credit cards, overdrafts, and Buy Now Pay Later schemes, all contributing to your personal debt.

But despite debt’s negative connotations, we all find ourselves in debt one way or another. So, we need to learn how to best manage it. Managing debt can be challenging for an employed individual. It is even more so for a self-employed professional (or business owner).

In today’s article, we’re talking about how you can better manage your debt and give yourself some financial breathing room for the future.

Well, yes. Obviously.

Debt can be roughly categorised into two types:

Good debt is debt that you take on, which will help you generate more wealth in the future.

Examples of good debt are:

The financial independence that comes from owning your first home is immeasurable. Also, home mortgage rates tend to be lower than other types of debt. It’s not very feasible to save up for your own home in cash, so it’s best to take on some debt to finance the purchase of your first home.

Just remember to purchase a house that is within your means. Have a talk with your mortgage adviser about what your weekly repayments will look like and use that to budget what your cash flow will look like in the near future. PocketSmith, as a home accounting tool, is really great for this sort of thing. If you’ve been updating your accounts regularly, you’ll find it easy to estimate the impact of mortgage repayments on your financial position.

A bit of a caveat here — business is inherently risky, and unless you have a sure-fire plan to make money, I’d be very careful about taking business debt. That being said, I’ve taken on debt during the COVID period to help with business operations, and I’m still paying it off today. The good news is that my business is doing better now than it was during COVID, and we can afford to pay the debt instalments easily.

But for every business debt success story, there are those who failed to use the loan to get their business up and running. This creates more trouble for them in the future as not only do they still need to pay their business overheads, but they have an additional debt repayment to worry about.

Always talk to your accountant first before you take on any form of business debt. Business loans can be expensive, with interest rates almost double those of mortgages. I would also strongly discourage securing your own home against the business loan — if you fail to pay off the loan, you could lose the roof over your head.

A bit like business debt, student debt is the debt you incur now to potentially generate more return in the future. That $30,000 degree should theoretically result in a $ 70,000-a-year job. Therefore it makes sense to borrow the money for your studies now and pay it off later.

Fortunately, student debt (in New Zealand) is interest-free (so long as you are working here). Also, you don’t have to make repayments against it if you’re earning below a certain threshold ($24,128 a year as of the 2025 tax year). That alone takes the risk of not landing a job after you get your degree.

Compared to mortgages and business debt, there is little downside to taking a student loan. If you’re planning on a career that requires a degree, taking a student loan is a no-brainer, even if you have the cash lying around for it, simply because repaying the student loan interest-free is financially better in the long run. Save that extra cash and stick it in an investment account instead!

On the flip side, we have bad debt like:

If you pay it off within the interest free period — sure, credit cards are harmless. What is dangerous about them is the exorbitant interest rates they charge you if you’re late. If you’re not confident in your ability to pay down credit card debt. Don’t take it! Spending points and rewards be damned.

I’ve always personally felt that these schemes are predatory. It encourages the consumer to purchase goods with money they don’t have. It erodes your financial discipline to keep spending on things you don’t really need. Sure enough, most of the Buy Now Pay Later schemes I see floating around are for things like luxury goods, games and appliances.

Like credit cards, if you pay these off on time, it is interest-free. But if you fail to make a repayment, well, it can get very expensive very quickly.

If you’re taking out a loan for a business vehicle and you need it to grow the business (food truck, utility vehicle, delivery van, etc), then yeah, go for it! If, however, you’re taking out a loan to get a fancy, expensive car that won’t really make you more money, I’d discourage taking out a loan for that.

Second-hand cars from reputable dealers are always cheaper. Plus, you should have the funds available to buy them in cash. Cars are an asset that depreciates. So don’t waste your future funds by taking a car loan. If you really want a fancy car — save up for it and buy it in cash.

Debt is unavoidable. So instead of avoiding all debt, learn how to manage it effectively.

Okay, so we sometimes make bad decisions in life. You could be in a position where you’ve taken on a lot of debt for various reasons. Life is complicated and sometimes you make decisions that seemed like a good idea at the time.

If you are a self-employed professional, here are some tips to manage debt that you may have already taken out:

As a self-employed individual, your income may be intermittent and irregular. You might have an awesome six months where you get heaps of work. This can be followed by three months of no work. The same goes for business owners. Clients could be paying you on time earlier in the year, but in the later part of the year, they are struggling to pay your bills.

To bring some certainty into your financial planning, you need to average out your income over a monthly basis. Why monthly? Simply because it is easier to work with 12 periods in a year instead of 52 periods ( weeks), and repayments tend to repeat on a monthly basis (or fortnightly).

To work out the average, take a look at your incomings over the past 12 months. Then divide it by 12 to get your monthly average. For example: Deshan made $60,000 over the past 12 months from his freelancing job after tax. $60,000 divided by 12 is $5,000 a month. With this figure established, Deshan can start planning how to budget the $5,000 that he is getting each month.

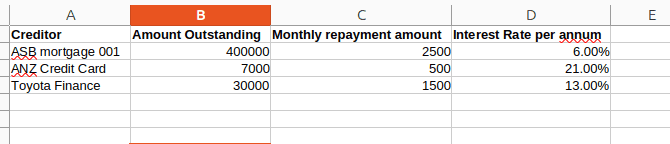

Open up a spreadsheet and start listing down the debt that you have. Be sure to list down the amount outstanding (as of today), the monthly repayment amount and the interest rate per annum that you have to make.

For example:

From here, you have a good idea of what loans need to be serviced. For more accuracy, you should use PocketSmith to keep track of your historical loan repayments. This will help you better estimate what your monthly repayment amounts are.

If you have a lot of debt, this can feel overwhelming. However, by prioritizing the debt that needs paying off first, you can start to get on top of your existing debt.

In the example shown above, let’s say your household take-home pay is $8,000 a month. Your monthly repayment amount is $4,500. Let’s also say that your monthly spending amounts to $3,000 a month (for groceries, insurance, etc). If you’ve been keeping track of your spending on PocketSmith, you can easily work out what your average monthly spend on these items is.

This leaves an additional $500 for savings. This $500 should be directed against the highest-interest loan that you have — your credit card loan. Any amounts paid against this loan will help reduce the overall interest that you get charged on it.

Paying off your high-interest debt is usually a good idea unless you have outstanding tax debt. The tax department generally has the resources to liquidate you and/or your business holdings if you’re not up to date on taxes. So if you have any tax debt, you must work on paying that off first!

In my experience dealing with tax agencies, you can often secure instalment arrangements to reduce the burden of repaying your tax debt. If you ever feel like your tax debt is starting to get out of hand, be sure to call the tax department immediately and work on a plan for repaying your debt. Remember that while the tax authorities can easily liquidate your assets, they’d really rather not do that. They will often work with you to come up with a repayment arrangement that suits both parties.

It goes without saying — if you don’t have any money coming in, you can’t service any of your debt. As a self-employed individual, you will need to plan in advance where your funds will be coming from. You can’t rely on the regularity of a paycheck to pay your bills.

Here are some tips that I’ve used and have shared with my self-employed clients:

You never know what challenges the next month holds. Always, always be saving. As a rule of thumb, I’m putting away 20% of my take-home pay into a savings account. On top of that, I also have short-term investments I can draw down on if things get really dire.

That being said, if you have outstanding high-interest debt that you need to pay — you should direct your savings there. Financially speaking, you’ll be better off paying off existing debt and saving on interest compared to just putting cash into a savings account.

For business owners like me, this usually means going out there and getting clients. Our accounting firm gets a steady stream of two to three new customers each month. This way, we’ve always got work going, and it’s enough to pay my team and myself. Getting new clients can be a challenge! However, I don’t have more industry-specific tips to offer. You just need to always be doing something about it. This can include networking, re-branding, advertising, or just getting your existing clients to refer more clients to you.

If you are a self-employed professional, you need to know when your contract is going to end. More importantly, you need to have work lined up at least three months before that contract ends. Sometimes it may be difficult to find contracts — in which case, you’ll be grateful that you’ve been saving up those funds!

We’ve written about insurance before, so I’m not going into great detail here. Suffice it to say, if you fall ill and can’t work, you’ll be grateful for income protection insurance to cover the bills whilst you recover and get better. It may seem like a bit of an expense now, but it is definitely insurance worth getting, especially as a self-employed professional.

As a self-employed professional, you shouldn’t have too many concerns about getting debt to fund your work. This is because, for the most part, your concerns are quite similar to employed individuals. Business owners, on the other hand, have more variables to worry about. Staff to keep hired, overheads to cover and suppliers to pay on time. So the need to manage debt is more pressing than for self-employed individuals.

So if you’re planning to get into debt as a self-employed professional/business owner, here are some good reasons to do so:

For the same reasons why student debt is good debt. Any funds spent towards upgrading your personal skills opens up new opportunities to make money in the future. You can be selective about the courses you choose. Do some research. Find out what is the current demand in the industry. Find out who the reputable providers are.

This is more relevant for business owners. An example of a revenue-generating asset is a commercial kitchen if you are in hospitality. If you are a tradesperson, your set of power tools is a revenue-generating asset. If you are a tech professional, a high-powered computer is a revenue-generating asset. If you are taking on debt to acquire an asset that will generate revenue for your work, that is usually a good idea.

You do need to be careful about what type of debt you use to acquire the asset. I wouldn’t recommend using Buy Now Pay Later or credit cards to purchase these assets, as it can take some time for them to start generating revenue. You may find that the repayment term may come up even before you’ve made money from your asset.

Business loans or overdrafts are a good place to start. Or you could look at borrowing from friends and family.

Managing debt can be overwhelming. Fortunately, there are finance professionals who can help you out.

If you are a business owner or self-employed professional, you really should get yourself an accountant. As an accountant, I’m always telling my clients, “Don’t take on any debt without talking to your accountant first!”. Like, seriously, always consult with your accountant before you take on any new debt.

Your accountant will help you work out the best form of debt for your given situation. As a bonus, your accountant will also help you keep track of your tax debt, making sure that you are putting away money to meet your tax obligations on time.

A financial advisor will be more knowledgeable about the different types of loans available on the market. So once your accountant has given you the go-ahead to take the loan, you may want to find a financial advisor who can choose the best loan provider for you.

A financial advisor can also review your current debt position and give you an idea of what sort of debt you can access. Or if you should even be taking any borrowings at all.

Life can get tough, and you may fall behind in your loan repayments. In this case, the best person to talk to is your banker. Generally speaking, most banks want you to pay off your loans. So they may show some lenience in allowing you mortgage holidays, loan consolidation, deferring your payment terms, etc.

As soon as you notice that things are getting tough for you, contact your banker and see what you can do about it.

Debt is, as mentioned before, unavoidable. So instead of avoiding all debt, learn how to manage it effectively. Remember that not all debts are made equal. The best kind of debt is the debt that will help you generate more wealth in the future. Stay away from easy credit and instead focus on how you can create long-term value for yourself and/or your business.

Stay positive!

Sam is the director of SH Advisory, an online accounting firm for small businesses and startups in NZ. He is also the creator of The Comic Accountant, an internationally-read finance comic blog. With 15 years experience in accounting and finance, he loves sharing quality financial advice with small business owners everywhere. In his spare time, he likes to nerd out over the latest board game launches and great PC gaming deals online. If you need help with your small business and startup, Sam is the person you want to talk to!