When you're self-employed, your finances do double duty. You need proper reporting for your business and clear visibility for your household. Accounting software covers the compliance side. PocketSmith helps you plan, forecast and stay in control of real life. Used together, they make a powerful pair.

Money tips

Money tips

What do you do when disaster strikes? After losing her house to an earthquake, Ruth understands the stress of a situation like this. In this edition of Ruth's Two Cents, she's answering a reader's question on how to prepare for, and ultimately get through, a financial emergency.

Money tips

Money tips

Being your own boss comes with many perks. You work on your own terms, get to choose when and where you spend your time, and you work towards building your own dream rather than someone else’s. Being solely responsible for your income can be overwhelming, but cash flow forecasting can help you feel more in control of your self-employed income.

Product feature

Product feature

We're pressing "pause" on how we've been serving people in Canada. The landscape for automatic bank feeds in the region has become untenable, and we cannot bear disappointing our customers anymore. So we're changing up how we do things in Canada, and the environment will need to change before things go back to how they were. Read on to understand what this means and what has prompted this change.

Money tips

Money tips

Us Kiwis are well known for our ingenuity! New Zealand is lucky to have such a deep pool of innovation, especially in fintech. Rachel details her favorite Kiwi-owned finance apps, and how she’s used them to create a living ecosystem for all aspects of her financial management.

Money tips

Money tips

There’s still debate whether a recession will hit this year, and where. But just the concept and its potential financial impacts can be stressful to many people. Ruth shares her mantra for prepping for a possible recession, and why she’s not conceding to the panic.

Money tips

Money tips

When you’ve got a rigid budget, it can be hard to mentally justify spending money on things outside the basics. But even a small amount invested regularly is amplified over time. Adam from The Stock Dork shares how you can still be an investor when you’re following a stringent financial plan.

Interviews

Interviews

We asked some of our wonderful users to share how they use PocketSmith to be productive with their money and plan for the future. Read how Louise keeps on top of her spending habits and adjusts accordingly using PocketSmith’s Trends and Reports.

Money tips

Money tips

In this new era of accessible tech and remote working, the world is your oyster! Digital nomadism is skyrocketing in popularity, where people can work and play completely location-independent. If you’re considering an overseas work adventure, check out these great tips to thrive while you’re traveling and earning.

Money tips

Money tips

You’ve just signed up to PocketSmith and you’re ready to fully harness its money management power — now what? If you’re looking to make the most out of your shiny new PocketSmith account, check out what user Rachel would have told her newbie self now that she’s a pro.

Money tips

Money tips

Many of you have probably asked yourself whether testing Buy Now Pay Later services out is a worthwhile move. If you take a frugal and no-nonsense approach to your finances like Ruth does, you might agree with her assessment. Read why she’s opting to stay clear of Buy Now Pay Later, and letting delayed gratification steer her budget instead.

Money tips

Money tips

The beginning of each year is the perfect time to get a handle on your personal finances, but with the explosion of content in the space it can sometimes seem overwhelming. Podcasts can be a great conversation to listen in on and help form a strategy for navigating your own way to financial freedom, so we’ve compiled a list of our favorites to get you started!

Money tips

Money tips

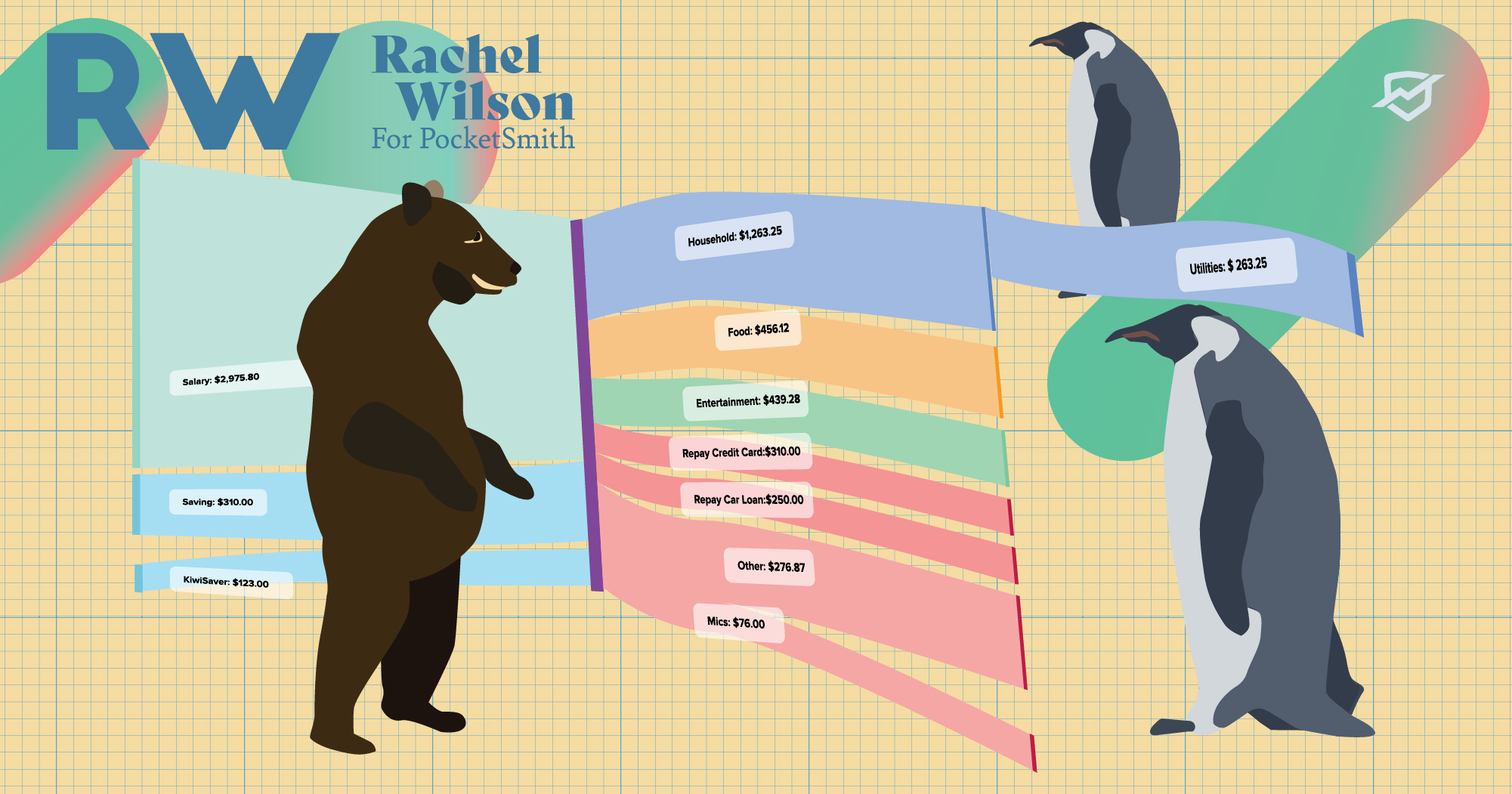

Go with the flow! Sankey diagrams are a technique to show the flow of resources, and can be a great tool for visualizing data. Hear how Rachel is using PocketSmith’s native Sankey widget to see trends and better understand and interact with her finances.

Interviews

Interviews

We asked some of our wonderful users to share how they use PocketSmith to be productive with their money and plan for the future. Read how Ian understands the effect of the cost of living on his finances with PocketSmith, and the bad habits he was able to identify and cut out.

Money tips

Money tips

New year’s resolutions are a contentious topic. Some love them, some hate them, and as the world falls out of love with toxic hustle culture, the way we set resolutions is changing. We’re big fans of healthy resolutions that help you get closer to your goals, without burning you out. Here are eight of our favorites.

Money tips

Money tips

"For now, just a simple three-month audit is all required to kick start lasting change that goes well beyond any New Year resolution." Follow Ruth as she rejects the new year's overhaul and looks to install manageable long-term money management improvements.

Money tips

Money tips

Thinking that this might be the year that you give freelancing a crack? Maybe Rachel, a flourishing freelancer herself, will give you some ideas and inspiration. Hear what goals she has for her freelancing endeavors in the upcoming year, and how PocketSmith is helping her achieve them.

Money tips

Money tips

A new year always means a clean slate, and it’s the same for businesses as they look to offload stock — time to grab yourself a good deal! Emma shares how you can stock up on helpful bargains without dressing yourself down later for regretful purchases.

Money tips

Money tips

“I’m not throwing away my shot!” Head of Marketing Dora recounts the dark patterns she encountered in her quest to score tickets to the hit musical Hamilton. She shares how these user interfaces are designed to trick people into doing things they wouldn’t normally do, and why it’s important to speak up.

Money tips

Money tips

“I don’t make new year’s resolutions, but I do make a new year’s plan.” What better time of year to check in on your finances than the start of a new one? Rachel’s already making a financial game plan for the new year — read how she’s using PocketSmith’s range of tools to do just that.

Interviews

Interviews

We asked some of our wonderful users to share how they use PocketSmith to be productive with their money and plan for the future. Read how Scott discovered the freedom of budgeting and how he’s made PocketSmith’s extensive toolkit a part of his everyday life.

Money tips

Money tips

While Christmas is a time for giving, it’s also when we see large amounts of excess and waste that are almost unavoidable in the modern world. But with a little outside-the-box thinking, you can make this holiday season just as joy-filled while keeping your purchases as sustainable as possible.

Money tips

Money tips

Opposites attract, as the old saying goes, so you may find how big (or little) you spend at Christmas at odds with your partner. Ruth explores how to reconcile a difference in Christmas money values to keep things merry these holidays in the latest edition of Ruth's Two Cents.

Money tips

Money tips

There’s nothing better than the joy of getting someone a great present, but the pressure of trying to find the right one can be a real bummer. Why not give them PocketSmith? Here’s how easy it is to gift PocketSmith, and who might benefit from this unique gift.

Money tips

Money tips

Unfortunately, inflation looks set to continue to rise for the timebeing — as well as the stress this can create on your bottom line. While you can’t budget your way out of the effects of inflation, there are little everyday things you can do to mitigate the crunch. Emma from The Broke Generation explores ten ways you can battle the cost of inflation.