One year on from our blog post on the future of PocketSmith on mobile, it's time for an update on how things are tracking, and how our thinking has changed a little over the past year.

Interviews

Interviews

We asked some of our wonderful users to share how they use PocketSmith to be productive with their money and plan for the future. Read how Laurie manages her household's retirement financial plan in multiple currencies in PocketSmith to make their travel budget go further.

Money tips

Money tips

Reassessing finances is crucial, and for many, their home loan takes center stage. With interest rates fluctuating and economic dynamics shifting, refinancing emerges as a strategic move. However, amidst the promise of lower rates lie potential pitfalls. Finder’s Rebecca Pike shares this guide on how to refinance to save money, avoiding fees while still getting all the features.

Money tips

Money tips

Ever wondered how small changes in your spending habits could lead to significant financial gains? Inspired by the success of her own experience with a "no new clothes" challenge, Emma is sharing five new ideas challenge ideas to test yourself and improve your financial wellbeing in 2024.

Money tips

Money tips

Reducing your working hours from the typical 9-5 can be done for all sorts of reasons. For Ruth and her husband Jonny, it was a matter of changing priorities — while still remaining financially stable. Hear how she made the transition, and how it's still working for her a few years down the road.

Money tips

Money tips

Embarking on a journey to far-flung destinations is an exhilarating experience, but it often demands a fresh perspective on our finances. As intrepid traveler Rachel discovered, a system as personalized as her PocketSmith system needed some TLC to stay that way when her circumstances changed. Read how she's adapted her PocketSmith setup to match her lifestyle changes with confidence.

Money tips

Money tips

When it comes to budgeting, health insurance often lands on the chopping block for many. Insurance expert Tim from Finder helps us grasp the fundamentals of Australia's health insurance framework, and shares insights into his own personal insurance position to highlight the nuances of health insurance decisions.

Money tips

Money tips

"Cats can have a little salami, as a treat" is a classic meme of the late 2010s. Just as cats deserve the occasional indulgence, we delve into how people are redefining their financial strategies to include small financial treats whenever the urge arises. But it begs the question — are they part of a healthy financial lifestyle, or something more unfavorable?

Interviews

Interviews

We asked some of our wonderful users to share how they use PocketSmith to be productive with their money and plan for the future. Read how Vasti keeps on top of her personal and business finances while traveling the globe using a range of PocketSmith's features.

Money tips

Money tips

Looking to leave a legacy once you go? A will is crucial for helping outline your wishes. Offering clarity and guidance, a will can help alleviate the burden on your loved ones, helping spare them from the anguish of guesswork or potential disputes regarding your wishes. Public Trust CEO Glenys Talivai explains how a will empowers you to shape the legacy you envision.

Money tips

Money tips

When it comes to investing, you’ve got a lot of (stock) options. Whether you prefer the simplicity of ETFs or the potential rewards of stock picking depends on your investment goals and risk tolerance. In this edition of Ruth’s Two Cents, Ruth explores two different investment strategies.

Money tips

Money tips

Au revoir, sayonara, and all those nice goodbyes. Rachel, one of our treasured guest writers, has said “see you later” to the homeland and gone traveling on her big O.E. Read how PocketSmith helped her prep for such a big move, and how it’s playing a part in her new digital nomad lifestyle.

Money tips

Money tips

A poor credit score can feel like a financial ball and chain, limiting your access to funds and opportunities. If your credit score currently leaves much to be desired, don't despair. Shawn Plummer, CEO of The Annuity Expert, shares seven proven tactics to fix your credit score, from regular credit bureau check-ups to debt consolidation and expert guidance.

Money tips

Money tips

Barbie's been putting the "doll" in "dollar" since forever ago. From childhood playmates to coveted collectibles, Barbie has played a significant role in our lives. But did you know that the Barbies you adore might reflect certain aspects of your financial personality? As a tribute to one of our favorite movies of the past 12 months, find what your fave Barbie says about you and your money.

Money tips

Money tips

Our money beliefs often act as abstract barriers that hinder us from reaching our full financial potential. These beliefs create limiting mindsets, and can even instill fear and anxiety. In this final part of the series, Kate asks us to challenge our limiting beliefs and cultivate healthy financial behaviors.

Money tips

Money tips

Why do we avoid talking about money? The silence surrounding this topic often leads to increased stress and feelings of isolation. Kate explores the idea that by providing a supportive space for financial dialogue, we can help alleviate the burden and isolation that many individuals experience due to their financial challenges.

Money tips

Money tips

In a world where the demands of today often clash with the aspirations for tomorrow, finding an equilibrium between living in the moment and securing our future is an age-old challenge. Kate shares her thoughts on managing present pleasure and future preparedness for a healthy money mindset.

Money tips

Money tips

Instead of taking decisive steps toward their financial goals, those who experience analysis paralysis become immobilized by the fear of making a wrong choice or missing out on potential opportunities. To give your wealth-building a jump start this year, Kate suggests striking a balance between informed decision-making and taking action to dispel your stagnation.

Money tips

Money tips

Money management isn't just about accumulating wealth; it's also an opportunity to cultivate a spirit of generosity that can enrich both our own well-being and the lives of others. Avid giver Ruth shares the transformative power charitable giving holds for your financial journey and the world around you.

Interviews

Interviews

We asked some of our wonderful users to share how they use PocketSmith to be productive with their money and plan for the future. Read how PocketSmith veteran Chris manages his finances — from simple transaction categorization to the more complex, like forecasting cash flow.

Money tips

Money tips

If you're self-employed, the end of the year can be a reflective time. You might be looking at how much your business has made over the last 12 months, the things you've achieved as a business owner, or perhaps dreaming of what's next for you in 2024. Get your goal-setting on with Emma's experienced suggestions.

Money tips

Money tips

If you're a freelancer, you know that navigating the holiday period can be a tricky endeavor. It's a time when many clients and businesses wind down for the year, leaving freelancers with potential income gaps. This year, Rachel plans to make the most out of the holiday slowdown and come back refreshed and re-energized for the new year.

Money tips

Money tips

As the holiday season approaches, it's easy to get caught up in the festivities and overspend. But have you ever wondered why we tend to spend more during this time of year? From the pressures of tradition and year-end reflection to the temptations of buying for ourselves and justifying overspending, understanding these triggers is the first step toward regaining control of your holiday budget.

Product feature

Product feature

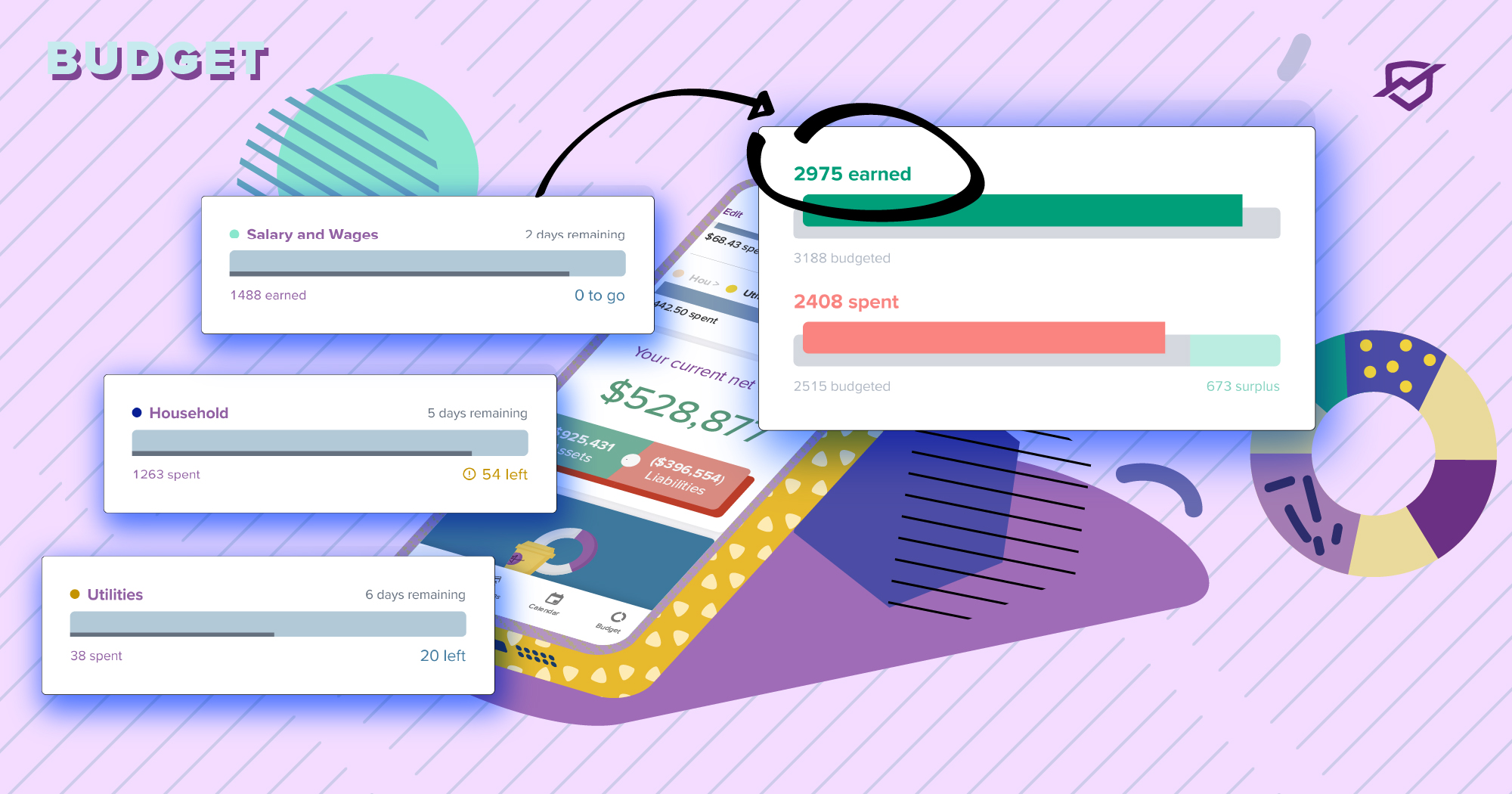

Mint's user migration to Credit Karma will mean the loss of Budgets, a much-loved and well-used feature. Here are ten reasons why you'll find PocketSmith's Budgets feature familiar and how our advanced features give you more insight, options, control, and flexibility.

Money tips

Money tips

Are you eager to explore the world but worried about the financial hurdles of holiday travel? As a passionate traveler herself, Ruth understands the challenges of balancing wanderlust with a limited budget. She shares her tried-and-true tips on how to save money while planning for your dream holiday, ensuring that you can embark on unforgettable adventures without breaking the bank.