After an exciting adventure of the #digitalnomadlife, Rachel returned to New Zealand, facing reverse culture shock and high food prices. Transitioning from freelancing to a new office job after two years, she joined a close-knit team. This return to office life not only taught Rachel about the work and organisation but also offered valuable lessons about money

Money tips

Money tips

Netflix account sharing is over – what next?! The king of streaming services is finally enacting its "no password sharing" manifesto, which signals another potential monthly cost for thousands of people worldwide. So it begs the question: Do you consider your streaming services a valuable spend, or a pointless expense?

Money tips

Money tips

Home renovations can be a dreamy aspiration for would-be interior designers or an absolute nightmare for those who are DIY-adverse. Whether you’re renovating your forever home, getting ready to sell or want to provide a comfortable rental, check out how you can fight the financial stress of home renovations in the latest edition of Ruth’s Two Cents.

Interviews

Interviews

We asked some of our wonderful users to share how they use PocketSmith to be productive with their money and plan for the future. Read how Andrew is using PocketSmith’s Budget and Calendar features to get on top his expenses and look towards the future of his money.

Money tips

Money tips

When it comes to spending money, we’re big fans of maximizing your bang-for-buck value — and loyalty programs are a great way to do that. From cashback rewards to credit card bonuses, here are the top seven rewards programs to join in Australia to start earning those sweet, sweet perks.

Money tips

Money tips

For Ruth's husband Jonny, freelancing didn't feel so free anymore. By considering what financial freedom meant to them and using PocketSmith to get a clear picture of their financial position, Ruth says that "the move from a self-employed freelancer back to an employee could be made not based on money but on finding a good work/life balance".

Money tips

Money tips

While the end of a financial year usually comes and goes without much fanfare for most salaried workers, it can be an extremely busy and stressful time for those that are self-employed. Freelancer Rachel speaks from experience and outlines ways to maneuver your finances through an important part of the tax calendar.

Money tips

Money tips

While buying a house is a lifelong goal for many people, it’s become an incredibly expensive endeavor. But it’s not all doom and gloom if you’re part of the renting lifestyle! Here are five financial advantages that renting has over home ownership.

Money tips

Money tips

“Like the Fellowship, PocketSmith brings a bunch of different skills to the table.” In one of history’s greatest pieces of fantasy, the core of the Fellowship is a system that is greater than the sum of its parts. Tolkein fan and PocketSmith user Rachel joins the two for a delightful comparison that will have you more satisfied than second breakfast.

Money tips

Money tips

The dreaded T word: Tax. Whether you're feeling the pinch of the current cost of living or not, paying less tax is always a bonus. Accountant and tax agent Sam answers a reader's question on achievable tax-saving strategies to minimize the expense of one of life's inevitables.

Interviews

Interviews

We asked some of our wonderful users to share how they use PocketSmith to be productive with their money and plan for the future. Read how Andrei is tracking his expenses, net worth, and other aspects of his financial wellbeing, even on-the-go with the PocketSmith mobile app.

Money tips

Money tips

What do you do when disaster strikes? After losing her house to an earthquake, Ruth understands the stress of a situation like this. In this edition of Ruth's Two Cents, she's answering a reader's question on how to prepare for, and ultimately get through, a financial emergency.

Money tips

Money tips

Being your own boss comes with many perks. You work on your own terms, get to choose when and where you spend your time, and you work towards building your own dream rather than someone else’s. Being solely responsible for your income can be overwhelming, but cash flow forecasting can help you feel more in control of your self-employed income.

Product feature

Product feature

We're pressing "pause" on how we've been serving people in Canada. The landscape for automatic bank feeds in the region has become untenable, and we cannot bear disappointing our customers anymore. So we're changing up how we do things in Canada, and the environment will need to change before things go back to how they were. Read on to understand what this means and what has prompted this change.

Money tips

Money tips

Us Kiwis are well known for our ingenuity! New Zealand is lucky to have such a deep pool of innovation, especially in fintech. Rachel details her favorite Kiwi-owned finance apps, and how she’s used them to create a living ecosystem for all aspects of her financial management.

Money tips

Money tips

There’s still debate whether a recession will hit this year, and where. But just the concept and its potential financial impacts can be stressful to many people. Ruth shares her mantra for prepping for a possible recession, and why she’s not conceding to the panic.

Money tips

Money tips

When you’ve got a rigid budget, it can be hard to mentally justify spending money on things outside the basics. But even a small amount invested regularly is amplified over time. Adam from The Stock Dork shares how you can still be an investor when you’re following a stringent financial plan.

Interviews

Interviews

We asked some of our wonderful users to share how they use PocketSmith to be productive with their money and plan for the future. Read how Louise keeps on top of her spending habits and adjusts accordingly using PocketSmith’s Trends and Reports.

Money tips

Money tips

In this new era of accessible tech and remote working, the world is your oyster! Digital nomadism is skyrocketing in popularity, where people can work and play completely location-independent. If you’re considering an overseas work adventure, check out these great tips to thrive while you’re traveling and earning.

Money tips

Money tips

You’ve just signed up to PocketSmith and you’re ready to fully harness its money management power — now what? If you’re looking to make the most out of your shiny new PocketSmith account, check out what user Rachel would have told her newbie self now that she’s a pro.

Money tips

Money tips

Many of you have probably asked yourself whether testing Buy Now Pay Later services out is a worthwhile move. If you take a frugal and no-nonsense approach to your finances like Ruth does, you might agree with her assessment. Read why she’s opting to stay clear of Buy Now Pay Later, and letting delayed gratification steer her budget instead.

Money tips

Money tips

The beginning of each year is the perfect time to get a handle on your personal finances, but with the explosion of content in the space it can sometimes seem overwhelming. Podcasts can be a great conversation to listen in on and help form a strategy for navigating your own way to financial freedom, so we’ve compiled a list of our favorites to get you started!

Money tips

Money tips

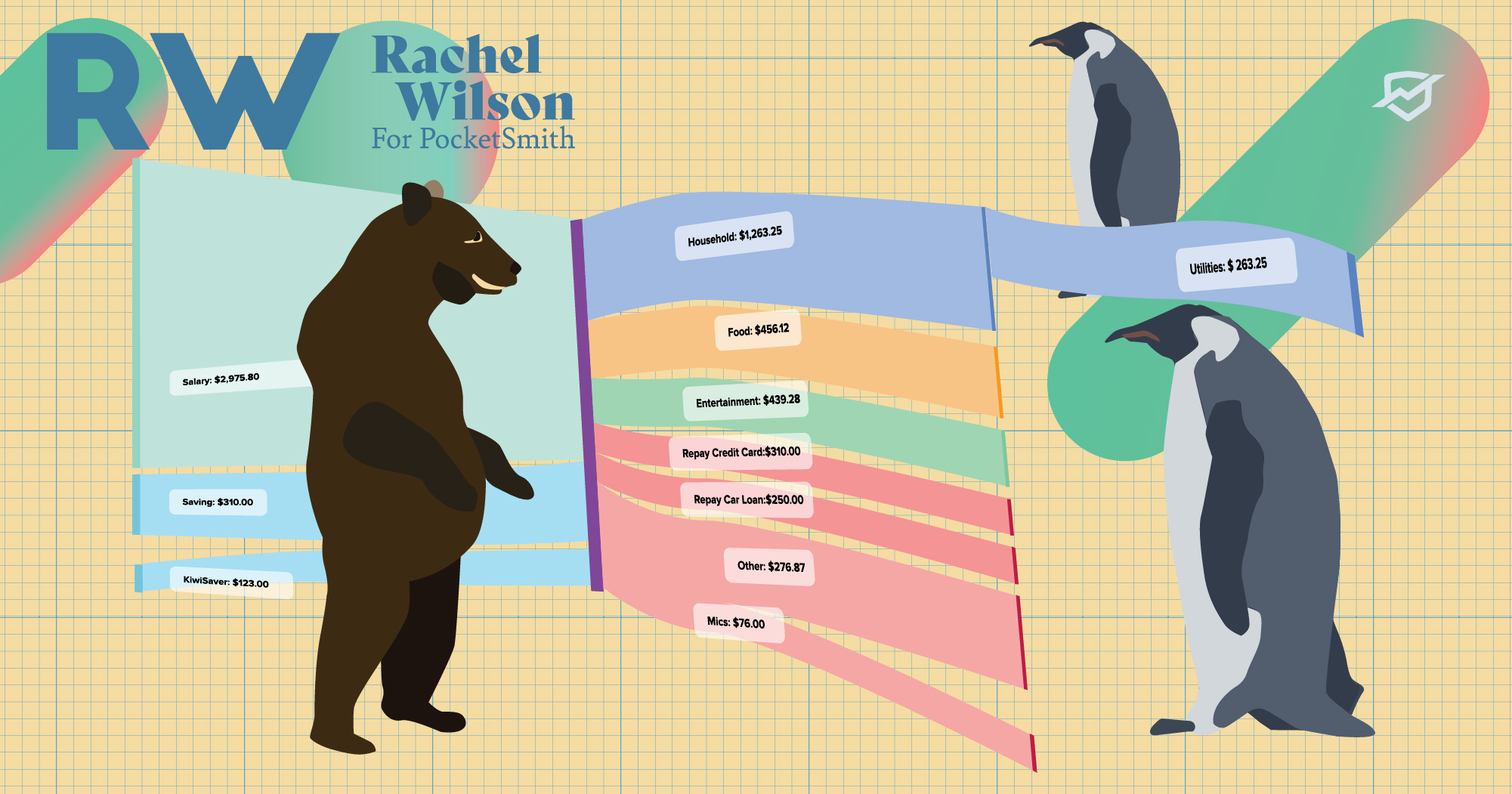

Go with the flow! Sankey diagrams are a technique to show the flow of resources, and can be a great tool for visualizing data. Hear how Rachel is using PocketSmith’s native Sankey widget to see trends and better understand and interact with her finances.

Interviews

Interviews

We asked some of our wonderful users to share how they use PocketSmith to be productive with their money and plan for the future. Read how Ian understands the effect of the cost of living on his finances with PocketSmith, and the bad habits he was able to identify and cut out.

Money tips

Money tips

New year’s resolutions are a contentious topic. Some love them, some hate them, and as the world falls out of love with toxic hustle culture, the way we set resolutions is changing. We’re big fans of healthy resolutions that help you get closer to your goals, without burning you out. Here are eight of our favorites.