I started my investing journey with Sharesies in May 2022. Some three months later, I thought I would summarize what I have learned so far.

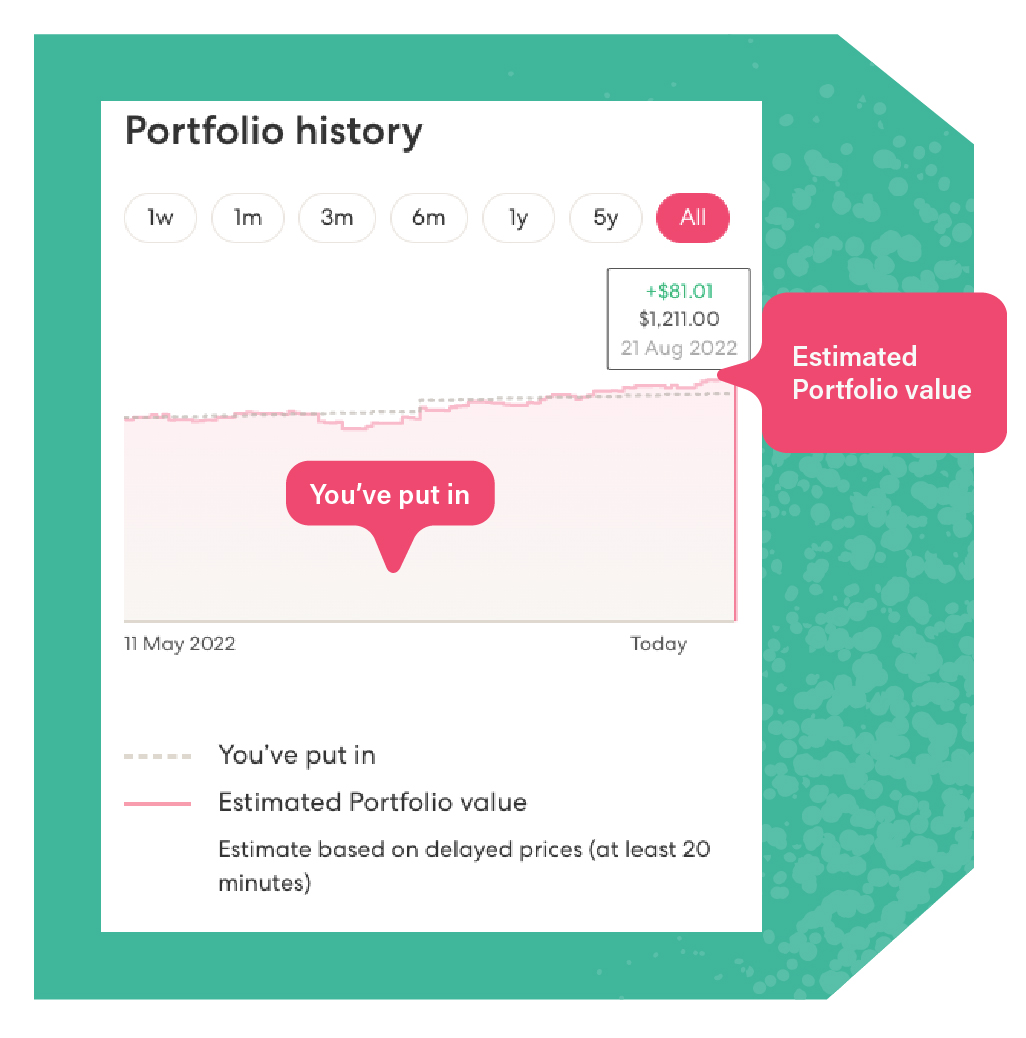

I have been investing $5 every week into Sharesies, sometimes adding a little extra here and there. I have put in $1,130, split between three ETFs, with my starting amount being $1,000.

The first month after I started my investing journey, the share market plateaued, and I didn’t make or lose much. I was never up or down more than $20. In June, the share market dropped, and I lost $80 out of the $1,000 I had invested. One month later, in July, the market went back up, and as of now (21 August 2022), I have made about $80 (7.16%) in returns.

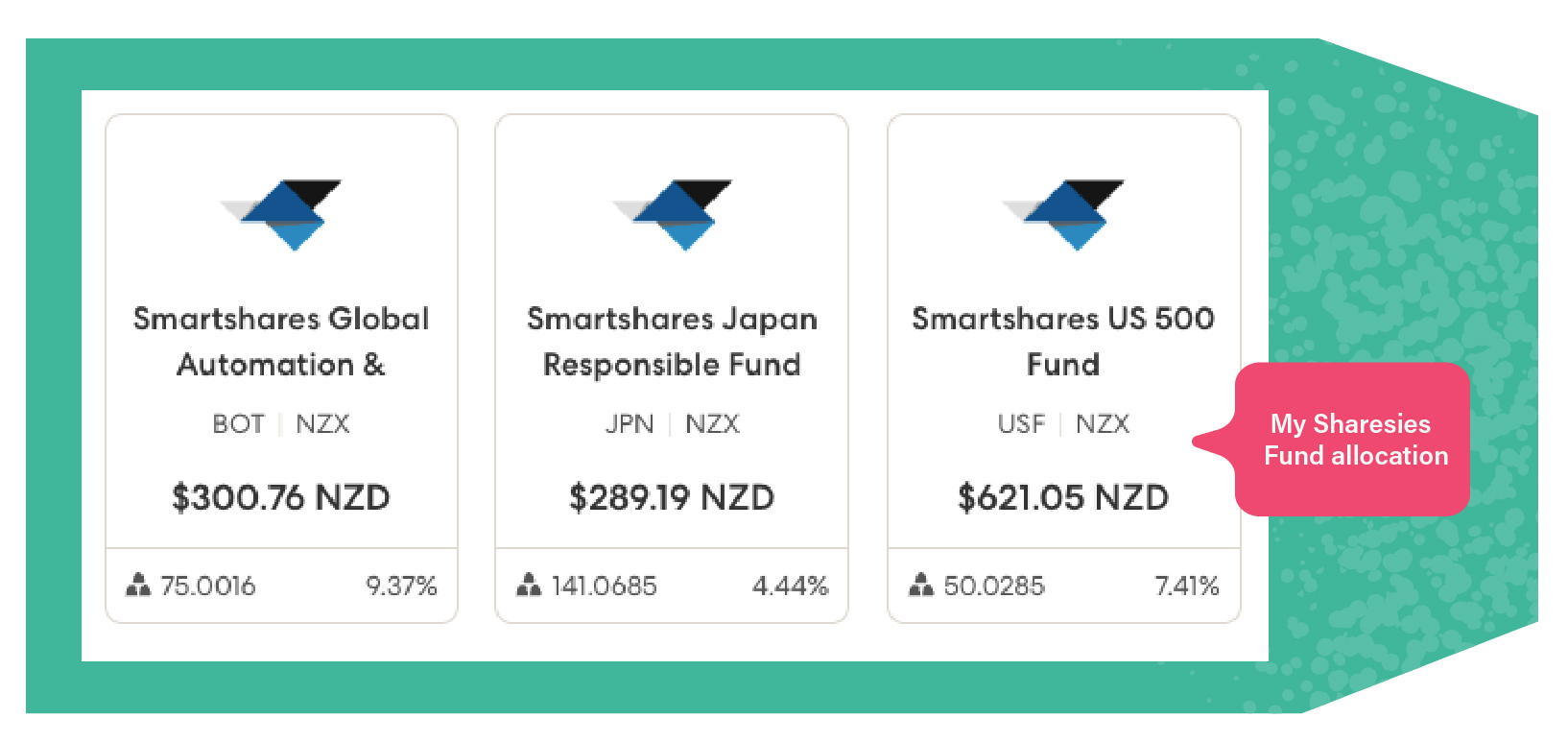

As you can see, I have invested in three different funds: the Smartshares Global Automation & Robotics Fund, the Smartshares Japan Responsible Fund, and the Smartshares US 500 fund.

Since I have diversified my portfolio by putting my money into three different funds, it lowers the risk of me losing money. This is because if one fund crashes, I still have another two to fall back on. The numbers at the bottom of each fund are the amount of shares I have and returns I have made from each fund. Even though the Automation & Robotics fund has a higher percentage in return than the US 500, I have made more from the US 500 fund because I have invested more money into it, therefore gaining a more significant return.

What has all this taught me? I suppose I could boil it down to three main lessons:

The first thing I learned from that experience is to stay calm, not panic, and remember that I am in this for the long term. When I first saw that I had lost around 8% of my investments, I thought, “Oh no,” but I quickly moved on. I guess it did help that I am still in the early stages of my investing journey, and I had not invested a huge amount. If it was 8% of $100,000, I don’t know if I would have remained as calm, but I still don’t think I would have taken any drastic action.

Another thing that I have learned is to make a habit of investing the same amount of money regularly. This is called dollar-cost averaging. It’s when you frequently invest the same amount into a specific investment, ignoring the share price. This means that if prices are high, you will purchase fewer shares, and when prices are low, you will purchase more shares. Over time your cost per share will average out, meaning you don’t need to time your investing during a particular high or low point.

One of the most important things I have learned is not to dwell on how my investments are faring. This is because I would definitely rather spend my time without worry rather than constantly thinking about my investments. In my case, since the money is transferred straight from my pocket money into my investments, I’ve automated things so that weekly investing has become a habit, and I don’t have to think about it proactively.

Overall, I’m still enjoying the journey of investing, and I look forward to reviewing my experience again in a few months. With inflation going the way it is, I’m glad I’ve started investing now rather than later.

Jordan is a high school student in Dunedin, New Zealand. He loves writing across a range of genres, from zombie fiction to articles about financial literacy. Outside of school, Jordan is happiest on a cricket field, in a forest photographing fungi or playing video games with his friends and younger brother.