I love PocketSmith. Love, love, love. I’ve been using it for about three years now, and, quite honestly, I can’t imagine tracking my finances without it. How do I love thee? Let me count the ways… okay, not all of them, that would make for a very long article. Let me sum up.

Multi-currency support. Color-coded nesting categories. Custom dashboards. Sankey diagrams. And, of course, the all-important “X spent of Y allocated budget.”

But even as much as I love it, and even with PocketSmith’s multitude of far-reaching functionalities, there are still things I don’t use it for. Why, you ask? Read on, Macduff!

I lump these under the same heading because they’re what beginner Smithers often ask about. It’s an easy mistake to make. After all, PocketSmith does so much it would be natural to think it also does invoicing for your business clients. Or files your taxes for you. Or you can move money between accounts within the PocketSmith portal.

Nope. Sorry to burst the bubble, but that isn’t what it’s designed for. PocketSmith offers live-feed banking integrations, not a bank in itself. When I need to move money around, I use my banking portal. Aside from that, my money train stops at three stations. There’s the blue one, Hnry, for my invoicing and self-employed tax needs. The green one, Kernel, for Kiwisaver, index funds, and high-yield savings. Then there’s the purple one. PocketSmith.

Purple is as purple does, and what purple does is make money management easy for everyday peeps like you and me.

Just a week ago, I hit a situation where I had to decide: Stump up for a one-off cost and then pay less going forward? Or pay nothing up-front, spread the cost over time, and risk paying more overall? In my case, the one-off cost was for a pair of ice skates I spotted at a secondhand shop.

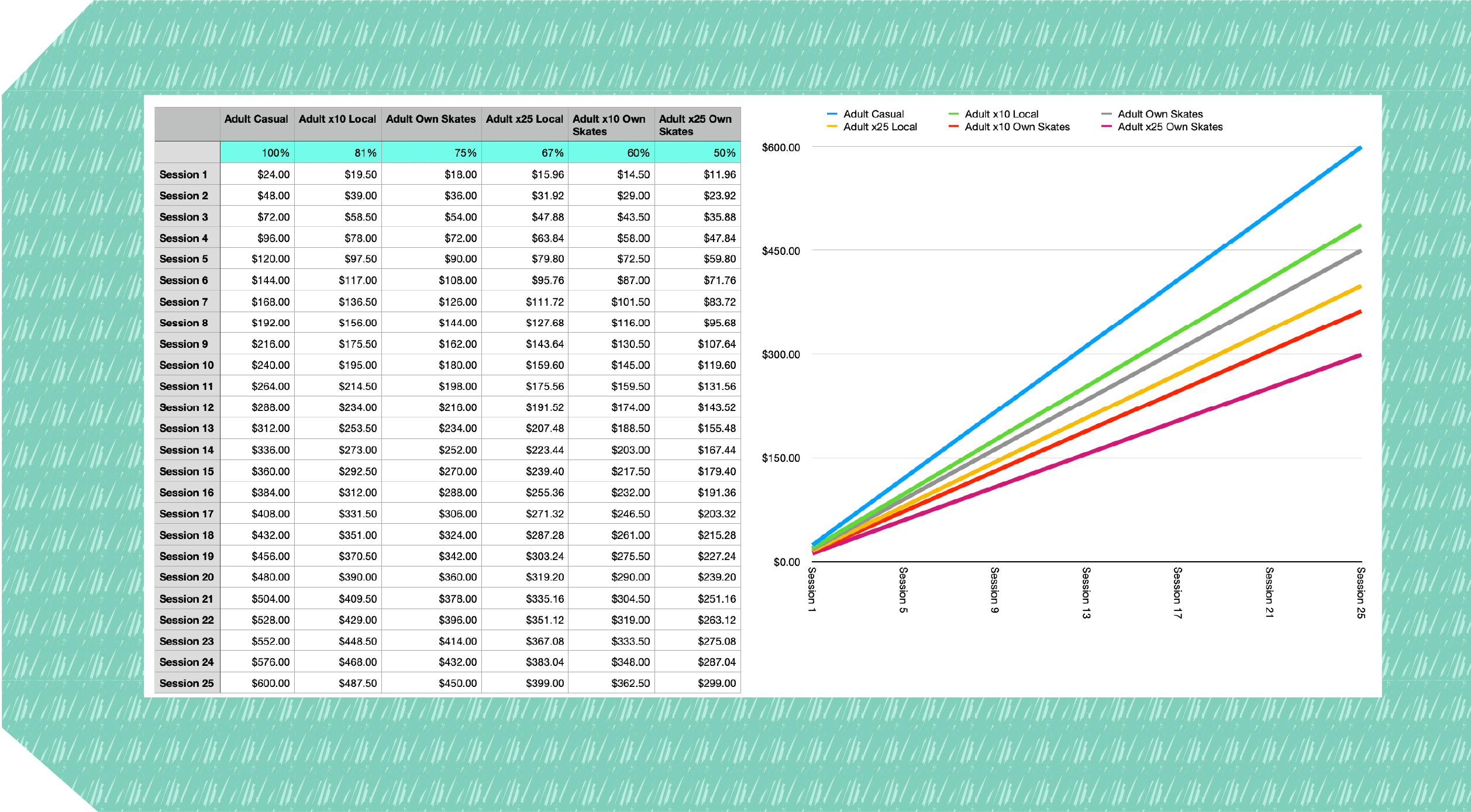

There were no less than six different scenarios to weigh up:

What’s a gal to do? Plug a few numbers into a spreadsheet, obviously. Ten minutes later, I had entry costs for all six scenarios extrapolated out to a full 25 sessions and could check the percentage savings. The contrasts were stark. My conclusion?

Buying the skates costs me $15 up front and it saves me a full 50% on every entry ticket. That’s a whopping $300 over 25 entries (or $285 factoring in the cost of the skates.)

Worth it? I should think so!

Life can be bumpy, especially when it comes to income and lifestyle changes as a freelancer. The self-employment rollercoaster is a stereotype for a reason. Sometimes I need to weigh up whether to take on an extra client, or if a contract offer I’ve had is worth accepting, or some other hypothetical. It’s only a what-if at this stage. PocketSmith offers a ‘Scenarios’ section. I could use that.

Do I log in to PocketSmith? No. I pull out my quick-and-dirty spreadsheet.

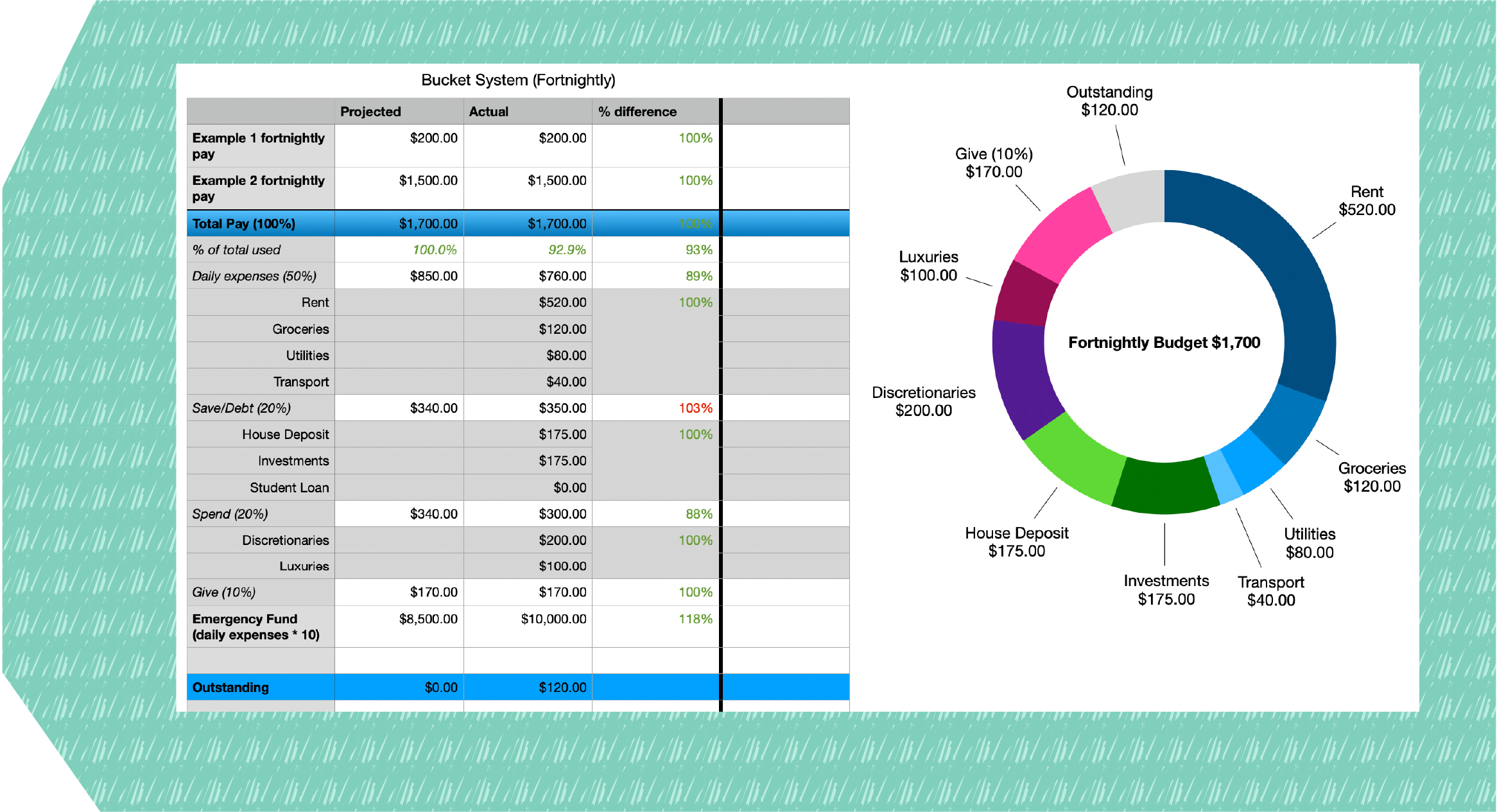

I’ve had this thing for years, since well before I joined PocketSmith. It takes me all of 30 seconds to plug in my inputs in the form of projected income sources. Loosely based on The Barefoot Investor’s ‘bucket’ system, it then tots up this income and splits it out into separate buckets:

It’s basic, but that’s the beauty of it. I don’t need all the granular details that PocketSmith offers, not at this stage. All I need is the 30-second, 30,000-foot overview.

So that’s it. Three times I, as a passionate advocate of PocketSmith, as a daily user and daily dashboard-checker, didn’t actually use PocketSmith. And that’s okay! Use the right tool for the job, I say. For self-employed taxes and invoicing, I use Hnry. For banking, I use my bank. For a hypothetical 30-second income projection, I use a spreadsheet template that I’ve customized to sleek, streamlined perfection.

For all the other stuff, there’s PocketSmith.

Rachel E. Wilson is an author and freelance writer based in New Zealand. She has been, variously, administrator at an ESOL non-profit, transcriber for a historian, and technical document controller at a french fry factory. She has a keen interest in financial literacy and design, and a growing collection of houseplants (pun intended).