Hold onto your hats! We’re about to blow your mind. What if we told you that you could become financially independent, which would then give you the opportunity to step back from paid work and have an early retirement before the age of 65? Like really early — we’re talking about in your 30s or 40s.

Welcome to the FIRE, or ‘Financial Independence, Retire Early’ movement, which has made major waves over social media in the past few years.

Are you interested?

Those who aim to FIRE earn as much income as they can, as soon as they can. They have extremely aggressive savings and investment plans for achieving financial independence as soon as possible. They invest as much of their income as possible, in the shortest time frame possible.

The goal? To create a large nest egg, usually 25 to 30 times their annual expenses, that will produce an income of its own, and let them step away from paid work.

Many in the community have aggressive savings rates — 60 to 70% is not unheard of. Many FIRE adherents strive to increase their income, often through side hustles, while saving as much of the extra money as possible. Frugal living can become somewhat of a mantra, as they follow strict budgets they have set for themselves.

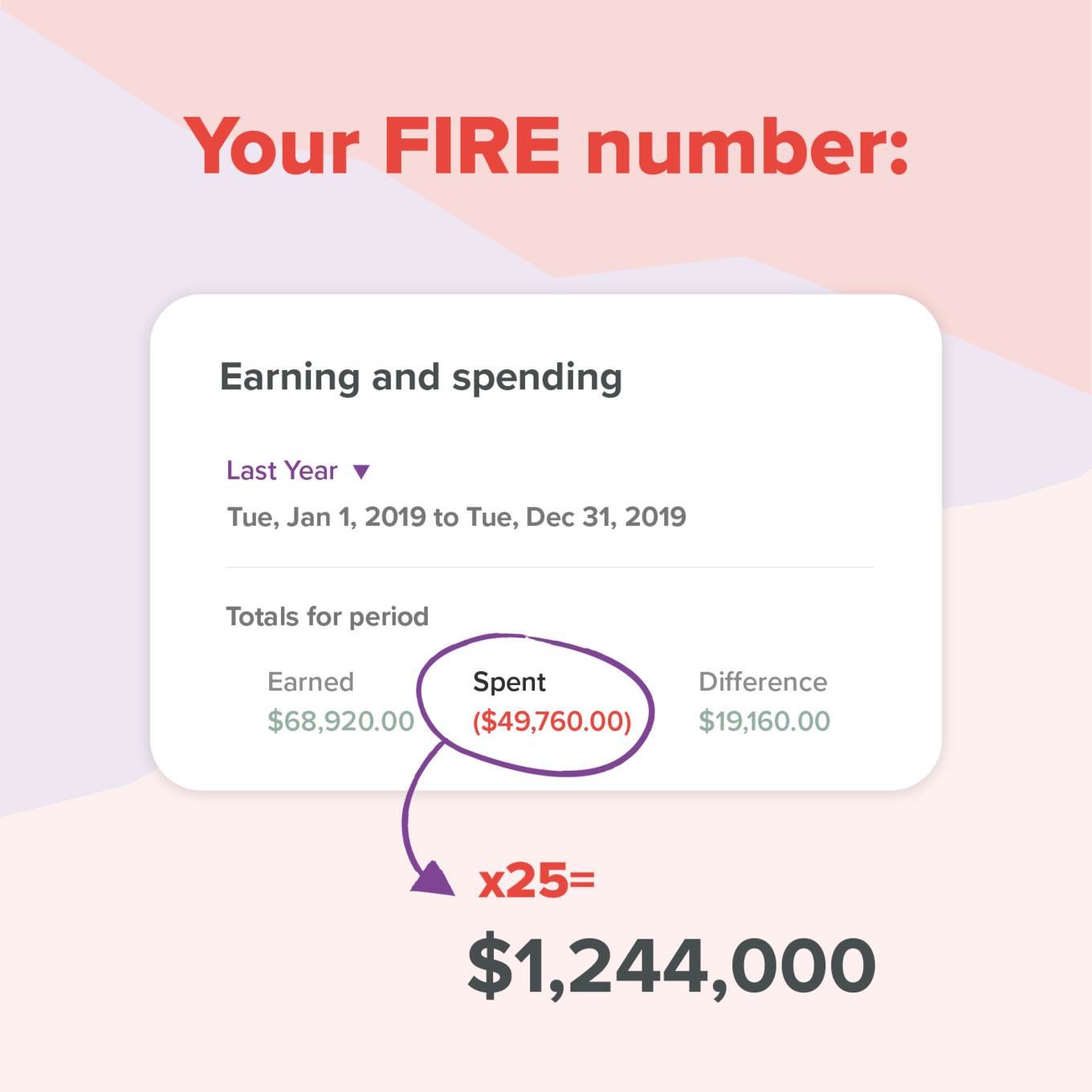

Start by working out your FIRE number. For you to even dream of kicking back and going mountain biking on a summer’s day when everyone else is at work, you need to know what your financial goal is.

The calculation uses just the most simple math: Annual Expenses x 25 = FIRE number

Say your annual expenses are $50,000, then your FIRE number is 25 times that, or $1,250,000.

That sum is then invested in assets that return you an income in order for you to FIRE!

There are a few variations on the FIRE concept, depending on the standard of living you’d like to maintain in retirement:

Once you have a specific amount of money in mind, you can work towards achieving it by:

So far, it’s all sounding pretty straightforward. However, be warned: FIRE is not for the faint of heart. If it was, everyone would be doing it.

Deciding to aim for FIRE takes commitment, focus and, if you are in a relationship, teamwork to steadfastly work towards your FIRE date.

You need to remember why you are aiming for FIRE in the first place. What makes this a goal worth aiming for? You will rigorously look at any debt you have and consider the implications it has on your retirement date. No stone is left unturned in order to find the most financially optimal route that will get you to your goal faster.

You should make sure that you’re still maintaining an emergency fund — the last thing you want to be doing in an emergency is dipping into the retirement savings that you’ve worked so hard for.

Most people take a lifetime of working to ensure they have enough to get them through their retirement years once they have stopped work. Those pursuing FIRE are fast-tracking this process by 20 to 40 years. That does not happen by accident, but instead by a lot of dogged determination and going without today, for the benefit of tomorrow.

Some people deprive themselves greatly in the pursuit of FIRE, others don’t see it as a deprivation at all and see the build-up to financial independence as an easier goal, even an enjoyable one.

It’s true that having a very large income will get you there much faster, but if you have a smaller income and even smaller expenses, FIRE is still perfectly attainable for you. It boils down to your grit and determination.

Many who pursue FIRE love a good spreadsheet. Many also use budgeting software like PocketSmith to chart their progress. These are essential tools of the trade because measuring your progress towards FIRE comes down to tracking your money. You need detailed records of your earnings, spending and investments.

Check in regularly to make sure they are tracking towards your end goal. If they aren’t, then you need to adjust accordingly. By looking at your historic rates of return you can start to project forward as to when you will have enough money to FIRE, taking into account all the nuances like a bull or bear share market, a rise or fall in house prices or a change in your level of income.

In the FIRE community, a house isn’t generally considered an asset, because once you’ve retired, it typically does not return you an income, unless you have filled it with tenants or boarders. It may increase in value, but this value goes unrealized until it’s sold. In the meantime, you still need a place to live. So, when working out your FIRE number, remember that it may not include the value of your home.

The numbers don’t lie!

If your annual expenses were $50,000 as in the example above, then, when you have a net worth of $1,250,000 invested in assets that return you an income, you can FIRE!

These assets might include such things as:

Your investments, whether they’re active or passive funds, will produce a range of returns over time and the general rule of thumb is that you can safely withdraw 4% each year (no matter the annual rate of return) for you to live on, leaving the entire investment intact and producing an income for you in perpetuity.

Even if you’re not planning on going full FIRE, just saving and investing more than you currently do will build your wealth and bring your retirement date closer. That’s worth considering because it will give you options in your later years.

For those of you reading whose spark has been ignited, know that stopping paid work early in life is entirely possible. It may take you some years of grit and frugality to get there, but if you’re focussed, organised and committed to achieving your goal, you just might get there!

Ruth blogs at thehappysaver.com all about how she and her family handle money. What’s the secret? Spend less than you earn, invest the difference, avoid debt and budget each dollar that flows through your hands. She firmly believes that if you can just get the basics right, life becomes easier from there on in.