“Best personal finance software I’ve ever used! It’s even better than the old Microsoft Money. I highly recommned it!”

“PocketSmith is the best to help you track, budget and forecast every single area of your finances.”

“Simply the BEST budgeting app there is. It can do everything all the other apps can do and so much more they cannot do, like calendar view of available balances”

Most personal finance software solutions only track your expenses. We go further by helping you plan for the future. Our personal accounting software gives you detailed features that will help you record your finances just the way you want them.

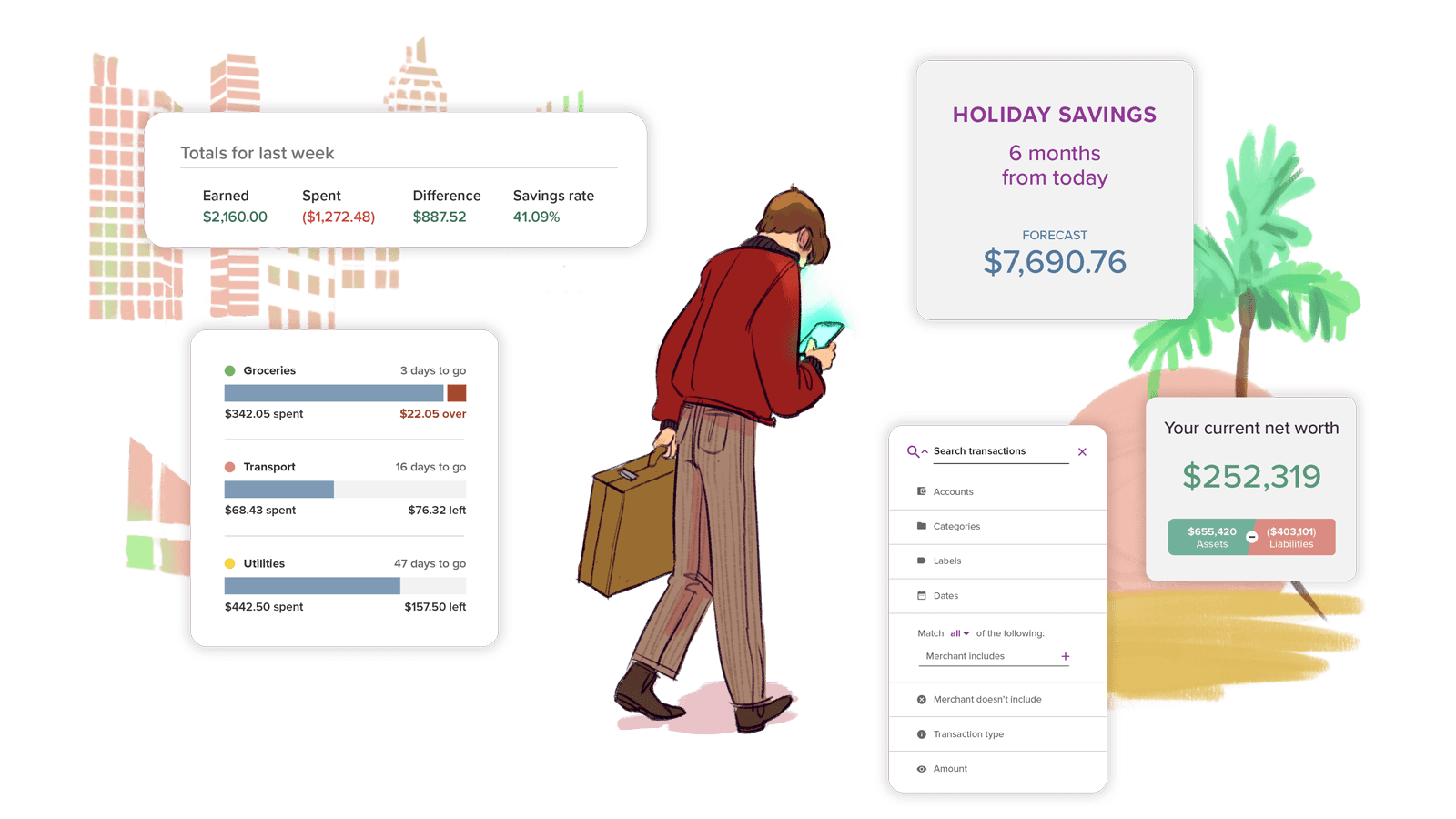

Elevate your budgeting and financial planning to new heights with our versatile dashboards and a suite of reporting tools. Dive into detailed spending trends, manage your income and expenses with precision, and explore the convenience of calendar budgeting. Keep an eye on your net worth and effortlessly track multiple currencies. PocketSmith also serves as your secure digital vault for important household documents like insurance papers, warranties, and receipts – a comprehensive money dashboard at your fingertips.

Use PocketSmith as your budgeting app to help you make day-to-day decisions or to plan for your future.

We've partnered with data provider Salt Edge to connect you with PSD2-compliant open banking feeds for all major institutions across England, Scotland, Wales, Northern Ireland and the EU.

Find what you're looking for, within seconds of needing it. Need to check when your TV license was last paid? That information is right at your fingertips with PocketSmith.

Want a home accounting software with the features of Mint.com in the UK? Get live bank feeds, budgeting, and all your accounts showing in one place - along with our unique cash flow forecasting features that leaves Mint in the dust.

Want to dive in to your data a bit more? Grab your transactions in XLSX or CSV files for Excel and dive in. No more PDF files downloaded from your bank!

Since 2008, we've been working on creating the world's best personal finance tool. We pride ourselves on constant improvement and iteration. You won't see any stagnation around here.

Some free personal finance apps in the UK advertise to you, making you their product. The PocketSmith experience is about you and your money, you will not be sold other products along the way.

PocketSmith is the best personal finance software in the UK for people from all walks of life. Whether you’re a first home buyer looking for easy-to-use budgeting software or the CFO of your household searching for personal accounting software to give you next-level insights, PocketSmith has the tools that fit.

Connect to all the major banks across the UK and around the world for access to live bank feeds. Say goodbye to tracking your money across multiple apps. With PocketSmith, you’ll get the full financial picture in one place.

Tailored Financial Visualisation:

PocketSmith transforms the way you see your finances. Build bespoke dashboards that match your financial goals. Utilise a variety of visual aids, including dynamic graphs and our unique calendar-based planning, to illuminate crucial financial insights. This surpasses the capabilities of standard money management apps in the UK, providing unparalleled clarity and emphasis on your financial well-being.

In-depth Financial Reporting:

Enhance your understanding of your financial situation with PocketSmith. Access comprehensive income and expense statements, offering more detail than typical UK budgeting apps such as Emma or Money Dashboard. Keep abreast of your net worth and effortlessly manage accounts across borders with instant currency conversion.

Detailed Transaction Management:

Organise your transactions more intuitively than ever. PocketSmith introduces customisable, nestable categories, along with handy labels, notes, and attachments for meticulous tracking. Our advanced Transactions page boasts a powerful search function, simplifying finding and filtering. For those in the UK looking for a superior alternative to traditional finance apps, PocketSmith delivers unmatched organisation and precision.

Adaptable, Effective Budgeting:

Discover a budgeting experience that molds to your lifestyle with PocketSmith. Opt for your preferred budgeting timeframe and take advantage of rollover budgeting flexibility. Enhance your financial journey by sharing progress with a partner or advisor via, Advisor Access, a feature designed for dynamic financial collaboration in the UK.

Have a picture of your finances at the tip of your fingers, wherever you go, with PocketSmith Sidekick, our mobile companion budgeting app. Adjust your financial management to your lifestyle and categorise transactions, create budgets, manage household documents whilst you’re on the go!

PocketSmith has been an innovator in the fintech world since 2008 and is still proudly independent and self-funded. Our only source of revenue is our customer subscriptions, and we are a stable, profitable company with no investors telling us what to do — our customers are at the centre of everything we do.

At PocketSmith, we make money from your subscription, not your data. We will never sell your data or advertise to you.

“I can do everything on PocketSmith and no longer need to use spreadsheets. Just takes five minutes a day.” Read more reviews.

Why is PocketSmith the best personal finance software in the UK?

PocketSmith is world-class personal finance software that lets you take control of your finances. Made in New Zealand for a global audience, PocketSmith is tailored towards customers from all walks of life, both in the UK and abroad. Track your income, expenses, assets, and net worth, customise your budgets, forecast your cash flow up to 60 years into the future, and see it all in a nifty calendar view.

See how our diverse group of customers in the UK and around the world use PocketSmith to sort out their personal finances. From UK-based Kevin, who uses PocketSmith to track his expenses, freelance work and taxes, to Oliver who tracks his UK and AU bank accounts with PocketSmith.

Does PocketSmith have a mobile app?

Yes! PocketSmith is a web-based desktop personal finance app. Our iOS and Android mobile app is designed as a companion budgeting app, giving you access to the core features of PocketSmith right there in your pocket! We know our customers lead busy lives, so take control of your finances wherever you are - whether that’s on the desktop, or on your phone whilst you’re on the go.

Can I integrate my investment accounts for a better picture of my net worth?

Yes! We have Data Connections that allow us to connect to other financial aggregators for different regions. Link your investment accounts and see them in our net worth tracker. Add all your other investments and liabilities (i.e. real estate and mortgages) to see an even better picture of your net worth.

Can I use PocketSmith to create custom budgets?

We pride ourselves on creating leading budgeting software that allows customers in the UK to create budgets unique to their situation. Budgets aren’t one size fits all - the best are fitted to your needs - so whatever stage of life you’re at, we’ll help you get control over your money.

Does PocketSmith work as a substitute for accounting software such as Xero Personal?

PocketSmith acts as a perfect alternative to traditional home accounting software such as the now sunset Xero Personal. In fact, we’re the only personal finance software that is recommended by Xero as an alternative! Keen to find out more about how PocketSmith can help your personal accounting and finances? Check out why Sam the Comic Accountant says home accounting software is the best thing for personal budgeting!

Do I have to use bank feeds with PocketSmith?

If you prefer not to use automatic bank feeds, you can use our convenient bank file uploader. PocketSmith supports the following file types: OFX, QFX, QIF, and CSV. Export your bank files from your online banking website, then import them straight into PocketSmith! Read our guide to importing bank files.

Can I share PocketSmith with my financial advisor or family member?

Yes, PocketSmith has a shared access feature where you can choose to share access to your PocketSmith account with a trusted partner, financial advisor, or other financial services of your choice, such as a mortgage broker.

What is PocketSmith?

PocketSmith is world-class personal finance software that lets you manage your money, your way. Track your income, expenses, assets and net worth, customise your budgets, forecast your cash flow up to 60 years into the future, and see it all in a nifty calendar view.

How can PocketSmith help me save for my future goals?

PocketSmith helps you save for future goals by providing powerful forecasting tools to visualise long-term financial scenarios, customisable budgeting to allocate funds towards your objectives, and detailed tracking to monitor progress, ensuring you stay on track to achieve your financial dreams.

How does PocketSmith cater to the needs of freelancers and independent contractors?

PocketSmith caters to freelancers and independent contractors by offering flexible budgeting and forecasting tools tailored to fluctuating incomes, customisable categories for easy expense tracking and tax preparation, and secure storage for important financial documents. Its multi-currency support and collaborative features also make managing international clients and working with financial advisors seamless.

Is PocketSmith the best alternative to Emma?

Don’t take it from us, hear what our lovely user community has to say. See how diverse households around the world use PocketSmith to get financial peace of mind. From self-employed expat mental health nurse Nicole, who uses PocketSmith to conquer her taxes, to London-based Kevin, who uses our app to track his everyday expenses and pay off his debts, and to Jimmy, a Kiwi who fast-tracked his way to a house deposit with PocketSmith.

What is the best Personal Capital alternative in the UK?

Look no further! PocketSmith is the best alternative to Personal Capital, now Empower, in the UK. PocketSmith is connected to open banking via Salt Edge, our UK open banking provider. PocketSmith has all the features to help you take your finances to the next level.

How is PocketSmith the best alternative to Money Dashboard?

PocketSmith stands out as the premier alternative to Money Dashboard by offering more than just a comprehensive view of your finances. With PocketSmith, you can craft custom dashboards tailored to your personal or family financial goals, project your cash flow up to 60 years into the future, and effortlessly manage international accounts with live currency conversion. Flexible budgeting options allow for period adjustments and envelope budgeting, while net worth tracking gives a complete picture of your wealth. Advanced transaction tools offer detailed categorisation with custom labels, notes, and the ability to set smart rules for transactions. Combined with a strong commitment to privacy and a user-first design approach, PocketSmith clearly differentiates itself as a top choice for those seeking a robust financial management tool.

Try risk free with a 14-day money back guarantee

GET STARTED