Dave Ramsey is a prominent figure in the personal finance world famed for his “7 Baby Steps” process for achieving financial freedom. His most famous book, Total Money Makeover, gained popularity for sharing the Baby Steps that thousands of people attribute to fixing their finances. However, despite praise for the Baby Steps, Ramsey has attracted widespread controversy surrounding his overall financial ideology. In this guide, we’ll walk you through the principles of the Baby Steps, including the pros, cons, criticisms and alternatives, to help you find a method that works for you.

What are Dave Ramsey’s Baby Steps?

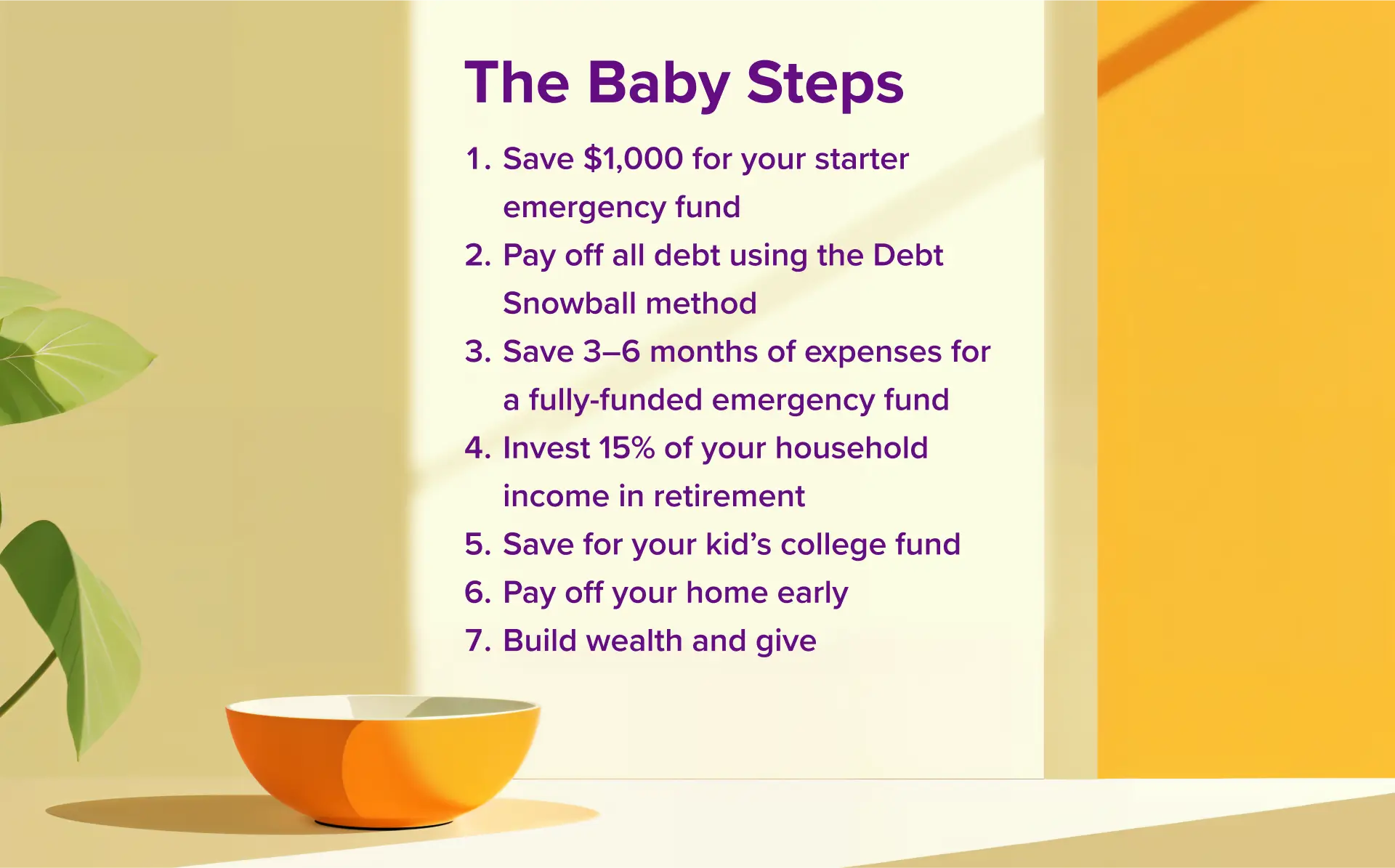

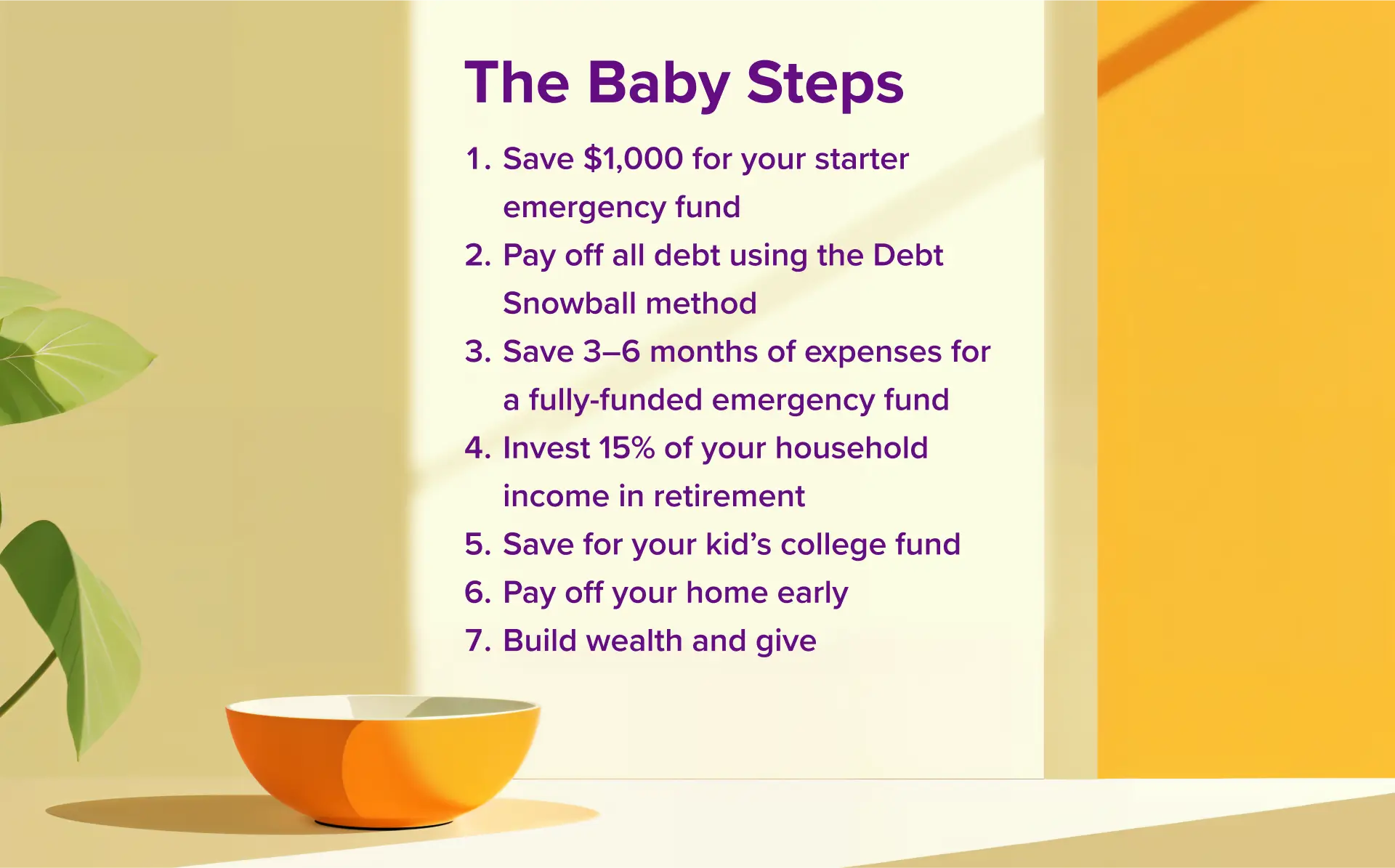

Dave Ramsey’s Baby Steps are seven distinct steps to follow to fix your finances. The steps are as follows:

- Step 1: Save $1,000 for your starter emergency fund. Straight out of the gate this step teaches you to stash $1,000 as fast as you can for the foundations of your emergency fund, to minimize reliance on debt for unexpected expenses.

- Step 2: Pay off all debt using the Debt Snowball method This step is all about clearing consumer debt like credit cards, car loans and in some cases, student loans, as quickly as possible. Ramsey endorses the Debt Snowball method of starting with the smallest balance debt first.

- Step 3: Save 3-6 months of expenses for a fully-funded emergency fund. This step prioritizes building a stable foundation and extending your emergency fund from $1,000 to 3-6 months of expenses. You can decide the total amount to strive for here.

- Step 4: Invest 15% of your household income in retirement. This step moves you from paying off consumer debt into growing your retirement savings, ideally with 15% of your total income.

- Step 5: Save for your children’s college fund. Now it’s time to save for your children’s education. In some countries this can be done through specific education accounts or college savings plans. This step only applies if you have children or plan to later in life.

- Step 6: Pay off your home early. This step prompts you to clear your mortgage so you’re completely debt-free and have very few fixed monthly outgoings.

- Step 7: Build wealth and give. This step is focused on growing your net worth by investing. Now you’re debt free and mortgage-free, you can build your wealth and give generously.

How the Baby Steps work

The Baby Steps form a series of priorities, from becoming debt-free to investing for your retirement and your future. While the steps guide your priorities, you’ll need to execute on each of the steps by following a budget, paying down debt and managing your spending. Here’s what the Baby Steps recommend.

- Zero-Based Budget: Ramsey advocates for a Zero-Based Budget in order to give every dollar a job and maximize the amount you’re able to allocate to your Baby Steps.

- Debt Snowball: Baby Step 2 focuses on paying down consumer debt using the Debt Snowball method. Your Zero-Based Budget will help you work out how much you can allocate to paying off your debts.

- Manage your spending: Ramsey is famous for his incredibly strict attitude towards non-essential spending, and is of the opinion that you should sacrifice almost all non-essentials in order to complete the first three Baby Steps as soon as possible. He famously once said, “the only time you should see the inside of a restaurant is if you’re working there”, referring to those still in the early Baby Step stages.

- Side hustle extra income: In the spirit of achieving the Baby Steps as fast as possible, Ramsey also advocates for taking on a second (or third) job or starting a side hustle in order to maximize your debt repayments and get your emergency fund fully funded.

Pros and cons of Dave Ramsey’s Baby Steps

Pros and cons

Just like all personal finance philosophies, there are pros and cons. Let’s take a look at some of the upsides and downsides to Dave Ramsey’s Baby Steps.

Pros

- Offers a clear, standardized path to financial security. The biggest appeal of the Baby Steps is the progressive list of steps to work towards. With so many questions and complexities within personal finances, people respond well to knowing which order to do things in and when.

- Builds discipline and respect for your financial future. The Baby Steps force you to take a hard look at your financial future, and may help create behavior change by exposing people to the reality of an unstable financial future if they don’t make changes now.

- Reduces reliance on credit. The Baby Steps begin with an emergency fund, which is then topped up after debt has been paid off. This helps reduce your reliance on credit when unexpected expenses pop up, which can help to break down the revolving cycle of debt.

- Endorses the debt snowball method. Behaviorally, the Debt Snowball method of becoming debt-free works well for lots of people. Rather than forcing people to do what’s mathematically best, for example the Debt Avalanche method that prioritizes high interest debt first, the second Baby Step is designed to help you build momentum and stay the course on your debt-free journey.

- Teaches you to live below your means. The Baby Steps and the associated financial ideology are grounded in very minimal non-essential spending, particularly while you are in consumer debt. This teaches you to live below your means and may help curb patterns of overspending — however, Ramsey’s attitude towards debt is very negative, and can create unnecessary shame for people simply trying to better their family’s finances.

Cons

- Limitations based on region. Despite being popular in many countries, the Baby Steps speak primarily to an American audience, by focusing on college savings methodologies and employer-matched 401k retirement funds. Forums like Reddit speak about people’s experiences with the Steps outside of the US, but you’ll need to do your own research.

- Many dispute the sequence of the steps. Critics of the Baby Steps believe that step 5 is far too late in one’s financial journey to introduce the concept of investing. Due to the power of compounding returns, some recommend investing as early as step 2, or suggesting that some of the steps should happen at the same time as one another. This is particularly true for those with the opportunity to take advantage of employer-matched retirement contributions.

- Requires a lot of sacrifice. The Baby Steps aren’t designed to be a gradual process. Ramsey advocates for becoming debt-free and saving your emergency fund as quickly as possible, sacrificing almost all of your discretionary expenses and leisure time in favor of saving and earning more money. This simply isn’t enjoyable or viable for many people.

- Donating 10% of income. In Baby Step 7, Ramsey recommends donating 10% of your income, since many of his teachings are rooted in his Christian faith. This may not be affordable, achievable or desirable for different cultures.

- Can cause a negative relationship with money. In principle, the Baby Steps may seem like nothing more than a roadmap to financial success. But the narrative surrounding Ramsey’s advice is one of shame and restriction. This risks further damaging your relationship with money and creating more financial problems down the line.

Don’t be afraid to change up the process, rules or the Steps to suit your own finances. Personal finances aren’t one size fits all.

Alternatives to Dave Ramsey’s Baby Steps

Alternatives to Baby Steps

There are many valid criticisms of the Baby Steps and Ramsey’s approach as a whole, but the concept of a step-by-step roadmap to wealth remains valuable. Here are some alternatives to Dave Ramsey’s Baby Steps and ways to modify them.

Modifying the Baby Steps

You can modify the Baby Steps as necessary to suit your own personal situation. Some followers of the Steps suggest these changes:

- Tackle steps 4-6 simultaneously.

- Move investing from Baby Step 5 to Baby Step 2, to maximize the benefit of compounding returns and potential employer-matches (location dependent).

- Take a holiday after Baby Step 3 to celebrate your debt freedom and relax a little.

Financial Order of Operations

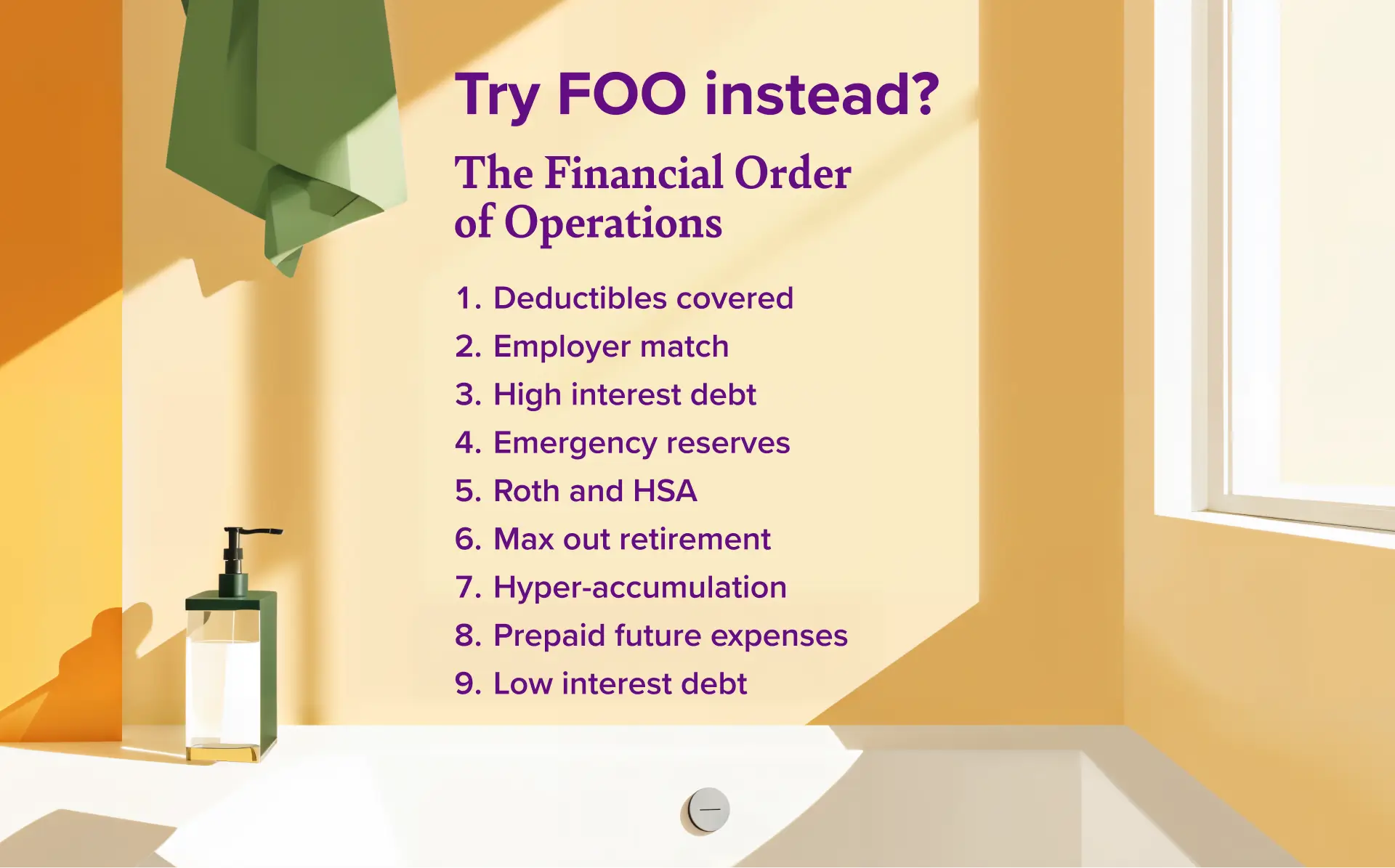

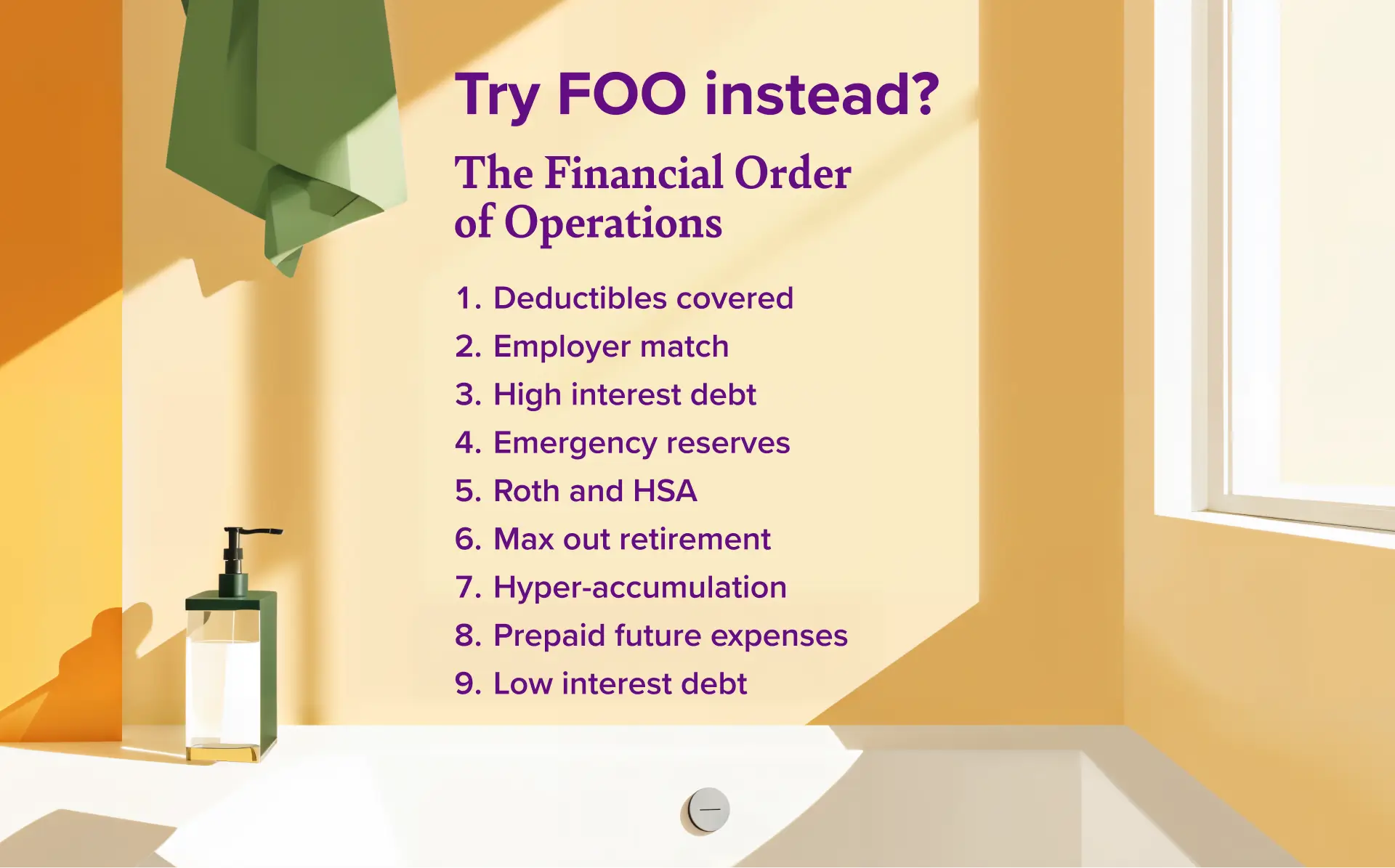

Many who were turned off by the Baby Steps prefer the Financial Order of Operations (FOO) method by Brian Preston, aka The Money Guy.

Preston’s nine steps follow a similar structure to Ramsey’s, but with a few key differences, including investing earlier, leaving your mortgage until last, and allowing room to enjoy life.

The nine steps are:

-

Deductibles covered: Similar to emergency savings, Preston first recommends saving enough to cover your highest insurance deductible (known in some countries as ‘excess’) so that you can claim if you run into financial difficulty.

- Employer match: Next up is getting your employer match on retirement contributions due to the potential to gain a higher return than your higher interest debt is costing you.

- High interest debt: Then we move onto paying off high interest consumer debt.

- Emergency reserves: Once you’re debt-free, Preston recommends building an emergency fund of 3-6 months worth of expenses.

- Roth and HSA: These are US-specific terms, but step 5 of the FOO involves making use of tax-efficient investment strategies.

- Max out retirement: Now it gets a little more complicated. Step 6 in the FOO is to max out all employer-sponsored retirement accounts.

- Hyper-accumulation: Step 7 requires you to invest 25% of your gross income into your retirement savings. Preston notes that you can complete step 6 and 7 simultaneously, due to step 6 being extremely difficult to complete.

- Prepaid future expenses: Again, this is very geared towards a US market, but step 8 suggests saving for your children’s education using tax-efficient strategies.

- Low interest debt: Preston’s final step in the FOO is low interest debt like your mortgage. Unlike Ramsey’s Baby Steps, the FOO leaves your mortgage until last, allowing you to take advantage of compounding returns by investing earlier.

Baby Steps: How to nail it

How to nail it

We want you to crush your finances, so here are our top tips on how to nail the Baby Steps and make them work for you.

- Make it your own. Don’t be afraid to change up the process, rules or the Steps to suit your own finances. Personal finances aren’t one size fits all.

- Increase your income. As with many wealth roadmaps, extra income can help you move through the Baby Steps faster.

- Talk to other people following the steps. People all around the world follow Ramsey’s Baby Steps, so check out forums like Reddit, or Facebook groups to connect with people in your region following the Steps.

- Chat to a financial advisor. If you have access to a financial advisor, consider getting tailored advice on how to make the Baby Steps work for you. They may be able to support you to tweak them to suit your own circumstances and goals.

- Be wary of feelings of shame and restriction. If any type of budget makes you feel shameful or too restricted, it’s a good sign it’s not the right fit for you.

Baby Steps: How not to fail it

How not to fail it

The opposite of nailing it? Failing it. Here are some potential pitfalls to avoid.

- Don’t force it. If the system isn’t working for you, that’s okay. Look to another option, like the Barefoot Investor Buckets, or a simple Zero-Based Budget to start off with.

- Don’t make your life miserable. It’s okay to enjoy life while planning for your financial future — you don’t have to give up everything you love, we promise!

The PocketSmith verdict

This was a tough one to score due to the widespread controversy around Ramsey’s attitude towards people experiencing financial difficulty and high debts. The Baby Steps do offer a step-by-step plan to getting out of debt and working towards financial freedom. But the overall approach employs a lot of shame and restriction around money and spending, and takes a very rigid view on what someone’s priorities should be. The flow of the steps won’t necessarily work for you if you’re outside of the US, and in fact, may result in lost financial opportunity depending on your own financial situation. Ultimately, we recommend approaching the Ramsey world with caution. If it clicks with you, take what’s helpful. If it makes you feel worse about your finances rather than better, run for the hills.

This was a tough one to score due to the widespread controversy around Ramsey’s attitude towards people experiencing financial difficulty and high debts. The Baby Steps do offer a step-by-step plan to getting out of debt and working towards financial freedom. But the overall approach employs a lot of shame and restriction around money and spending, and takes a very rigid view on what someone’s priorities should be. The flow of the steps won’t necessarily work for you if you’re outside of the US, and in fact, may result in lost financial opportunity depending on your own financial situation. Ultimately, we recommend approaching the Ramsey world with caution. If it clicks with you, take what’s helpful. If it makes you feel worse about your finances rather than better, run for the hills.

This was a tough one to score due to the widespread controversy around Ramsey’s attitude towards people experiencing financial difficulty and high debts. The Baby Steps do offer a step-by-step plan to getting out of debt and working towards financial freedom. But the overall approach employs a lot of shame and restriction around money and spending, and takes a very rigid view on what someone’s priorities should be. The flow of the steps won’t necessarily work for you if you’re outside of the US, and in fact, may result in lost financial opportunity depending on your own financial situation. Ultimately, we recommend approaching the Ramsey world with caution. If it clicks with you, take what’s helpful. If it makes you feel worse about your finances rather than better, run for the hills.

This was a tough one to score due to the widespread controversy around Ramsey’s attitude towards people experiencing financial difficulty and high debts. The Baby Steps do offer a step-by-step plan to getting out of debt and working towards financial freedom. But the overall approach employs a lot of shame and restriction around money and spending, and takes a very rigid view on what someone’s priorities should be. The flow of the steps won’t necessarily work for you if you’re outside of the US, and in fact, may result in lost financial opportunity depending on your own financial situation. Ultimately, we recommend approaching the Ramsey world with caution. If it clicks with you, take what’s helpful. If it makes you feel worse about your finances rather than better, run for the hills.