Envelope budgeting, cash stuffing, cash envelopes — call it what you want, envelope budgeting is hot right now. This cash-based budgeting system has been around for decades, but in an age of digital everything, we’re developing a fondness for doing things the old-fashioned way. And so envelope budgeting is back, baby. Here’s everything you need to know about managing money with cold hard cashola and a stack of envelopes.

What is Envelope Budgeting?

Envelope Budgeting (also called cash stuffing, cash envelopes, and the envelope system) is a method of managing your money using cash organized into different envelopes by category. For example, if you earn $1,000 per week post-tax, you withdraw that amount and organize it into your different envelopes by allocating an amount to each envelope. You might have envelopes for all kinds of categories, like:

| Rent |

Bills |

Utilities |

| Misc expenses |

Emergencies |

Pet expenses |

| Coffees |

Beauty |

Clothes |

| Gaming |

Crafts |

Petrol |

| Groceries |

Dining/takeout |

Alcohol |

| Entertainment |

Travel |

Car maintenance |

| Home decor |

Gifts |

Sinking funds |

Some people start with much broader categories and niche down from there as they get clearer on what they like to spend their cash on. You can start with a split as simple as needs, wants and savings, like the 50/30/20 budget and build out from there.

Envelope Budgeting has been around for decades. It was a popular way of managing money before the digitization of currency and evolution of budgeting apps and intelligent online banking dashboards. But the nostalgic money management method has grown in popularity online in recent years, with many attributing the method to helping them pay off debt and build large pots of savings.

Pros and cons of Envelope Budgeting

Pros and cons

Just like all budgeting methods, there are pros and cons. Let’s take a look at some of the upsides and downsides to cash stuffing and envelope budgeting.

Pros

- Visualizing your budget can help you stick to it. Having a physical representation of your income and where you’re allocating it can help you stick to your budget more easily. Digital banking can mean money is more of an abstract concept. Many cash stuffers report finding it easier to stick to their budget when they have a visual understanding of the money they’ve earned and where they’re allocating it.

- It can hold you accountable to good money habits. Facing the music of your money management in such a hands-on way can help hold you accountable to your good money habits and get you to your goals faster. For example, if you’ve set aside $50 for one category, you’d have to physically take money from another envelope in order to go over that category. It’s a lot more confronting than simply tapping your card.

- It adds friction to your purchase decisions. Speaking of tapping your card, cash envelope budgeting adds substantial friction to your money decisions — and this can be a great thing. Adding the step of having to go to your envelopes, count the cash out, go back to make the purchase, and then return the change back to the envelope can help you slow down and make better decisions in the long run.

- It could help you cut back on online shopping. A lot of our big money splurges happen online. It’s easier than ever to make large payments very quickly, with things like Apple Pay and Google Pay, and websites saving our card details for one click checkout — but while convenient, it can mean we spend more than we plan to. Using cash envelopes can help you reduce your reliance on online consumption and save you money in the process.

- It’s fun and gamifies money management. One of the best benefits of cash stuffing is that it’s fun! There are lots of creative ways to customize your cash envelopes, including wallet books specifically made for cash stuffing. Some cash stuffers like to cross off charts when they add cash to their savings envelopes, or take on challenges to fill a board with certain notes to reach a certain amount. It adds a level of gamification to your money that can help keep people engaged.

- It builds a ritual around managing your money. Falling off the budget wagon or failing to check in with our finances is a slippery slope to financial avoidance. You may find that cash stuffing helps you build a ritual around checking in with your finances and makes you more likely to be across where your money is going.

- It helps you stay connected to your money. Money in a bank account can feel abstract — which can make holding it harder, and spending it easier. Many find that using cash means they’re less likely to want to spend their money due to the physicality of seeing the savings increase. Handing over a physical note can feel like a bigger deal than a number going down on a screen.

- It can help heal your relationship with money and spending. We all have our own unique relationship with money that influences how we spend, save and invest it. Using cash envelopes can help you improve your relationship with money by creating a safe, fun and simple environment in which to face up to your finances.

- It can save you paying card surcharges. More and more vendors are now adding a card surcharge to digital payments, that can be anything from 0.5% up to 3%. While these seem small at the time, it really adds up. Using cash saves you from paying these surcharges.

- You might get a cash discount. Some small businesses offer a discount to those using cash, which might mean you score a lower price and avoid card surcharges!

- You’re protected from scams and fraud. With scams on the rise, using cash may reduce the risk of having your card details cloned, or your accounts compromised.

Cons

- Withdrawing cash can be time-consuming. Having to go out and withdraw your income is easier for some of us than others. Depending on your routine and proximity to an ATM, this extra step might put you off taking on cash stuffing — especially if you’re paid weekly.

- Bill payments may only be able to be done digitally. Withdrawing cash to add to your bills envelope may mean you end up double handling your financial admin if those bills end up needing to be paid digitally anyway. You can always opt to leave your bill payments in your bank account, but it can mean you lose the visual connection to that part of your budget.

- Some ATMs charge a fee. Regularly withdrawing cash might get expensive if the ATM is charging a fee each time. Make sure to find a free one!

- You actually might overspend. Some people love cash stuffing because it means they’re less likely to spend, but others, the opposite is true. Cash can feel a bit like ‘free money’ or faux currency because the numbers on your bank balance don’t go down, and there’s no trace of where the money was spent, or when.

- Managing coins and change can be annoying. Organizing a fistful of notes is great fun. Organizing handfuls of coins, however — not so fun. Depending on what currency you’re using and the types of things you buy, you may end up with a lot of heavy coins that are hard to attribute to a specific category, especially if you’re spending money from multiple envelopes in one day.

- Not everywhere accepts cash. Ever since the COVID-19 pandemic accelerated our use of contactless transactions, cash is becoming less and less customary. In some regions, you may find places don’t readily accept cash, or don’t have the correct change when you need it.

- You don’t have an automatic record of your transactions. Using cash means you can’t rely on your bank statement for a record of where your money has gone. You’ll need to remember to write down your transactions manually if you want to be able to look back and review your spending, which adds another layer of admin.

- It requires regular effort. Envelope budgeting is far from a set and forget strategy, so only take this on if you’re willing and able to regularly organise your envelopes.

- You need to remember to take your envelopes with you. Forgetful people — you might need to swerve this one. Effective use of cash envelopes means spending from the right envelopes at the right times. Borrowing from other categories can get confusing, so you need to be able to remember to take your cash categories out with you.

- Keeping your cash secure is critical. Depending on how much you’re budgeting, you might have thousands of dollars in cash in your home at any given time. It’s important to keep this secure and out of sight to reduce the risk of theft. It’s also worth checking whether your home insurance covers any cash theft in the case of a break-in.

- You miss out on bank interest. When you’re holding your savings in cash, you’re missing out on interest payments from a bank or financial institution. Taking into account inflation, which is the rising cost of goods and services each year, your money will be worth less over time.

The brain bit: The Envelope Budgeting mindset

The Envelope Budgeting mindset

The idea of envelope budgeting is that by using cash, we’re less likely to spend recklessly and more likely to consider where our money is going. Several studies have explored the behavioral differences between paying with card and using cash. Particularly where credit cards are concerned, we are far more likely to spend more when using card compared to when using cash.

The Pain of Paying

The behavioral disparity has been attributed to the human behavioral principle known as The Pain of Paying. When we hand over money, we experience negative emotions that are similar to that of feeling pain. Why? Because humans have a natural loss-aversion bias, which means we react to losses more strongly than we react to gains of equal value.

Example: Sally is out with friends and drops a $20 note on the street. When she realizes, she’s upset and frustrated. She thinks about how much work she had to do to earn that $20, everything she was going to spend it on with her friends that night, and the fact that someone else has now got her hard-earned money purely through a stroke of her own misfortune. Sally’s friend Martin arrives at dinner and says he found $20 in his coat pocket that he’d forgotten was there from last winter. While he’s chuffed that his found money will cover one of his cocktails tonight, Sally’s emotions relating to her loss are a lot stronger than Martin’s relating to his gain — even though the value is the same.

Okay, so it sounds like using cash is a sure winner, right? It’ll activate your sense of loss aversion, you’ll spend less and become more aware of where your money is going. How good!

Well, not exactly. It turns out, despite some people feeling greater physical pain from parting with cash, for others, it’s the exact opposite.

Where some of us are more connected to parting with our cash than we are to parting with a number on the screen, some of us actually feel less ‘pain’ at handing over cash. When we spend cash, our bank balance doesn’t go down. That means all of our spending can exist without any of our digital numbers being messed with. We won’t log in to our bank and find we’ve got less money left than we thought, and we won’t have to look at that transaction later and feel guilty about it. For this group, spending cash feels like free money.

20%: The percentage of surveyed Gen Z budgeters who felt they spent more with cash because it feels like free money.

Source: Credit Karma

Who Envelope Budgeting is best suited to

Unsurprisingly, cash envelope budgeting is best suited to people who do feel that additional pain when using cash, and who benefit from getting hands on and practical with their money.

The perfect cash stuffing candidate

- Lives close to a free ATM

- Likes to get hands-on and crafty with organizing their money

- Doesn’t feel like spending cash is ‘free money’

- Benefits from seeing their savings build up physically

- Likes to follow rules and guidelines, and won’t rebel against structure

- Disciplined and focused enough to balance envelopes regularly

- Driven by external motivation like a savings chart

The best way to work out whether you’re a good candidate for envelope budgeting is to try it. Withdraw some cash and see how you spend it. Track what you buy with your cash, and compare it to a period of card-only spending.

If you find you can’t wait to spend the cash and almost feel the hole it’s burning in your pocket, cash stuffing might not be for you. If, however, you feel a connection to that cash, a desire not to break big notes, and a feeling of wanting to watch that cash accumulate and cross off a new achievement on your progress chart, you’re probably a stellar cash stuffing candidate.

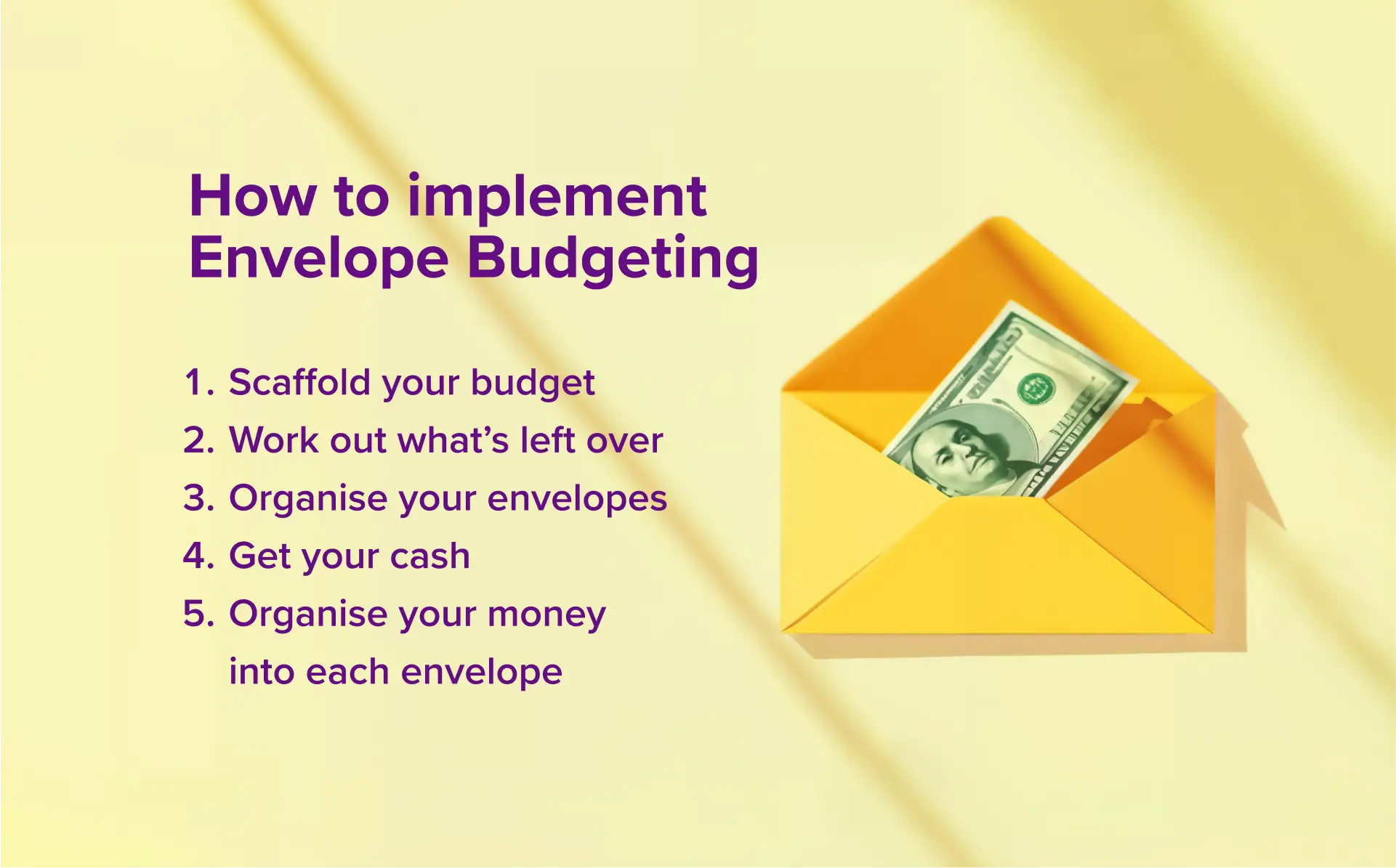

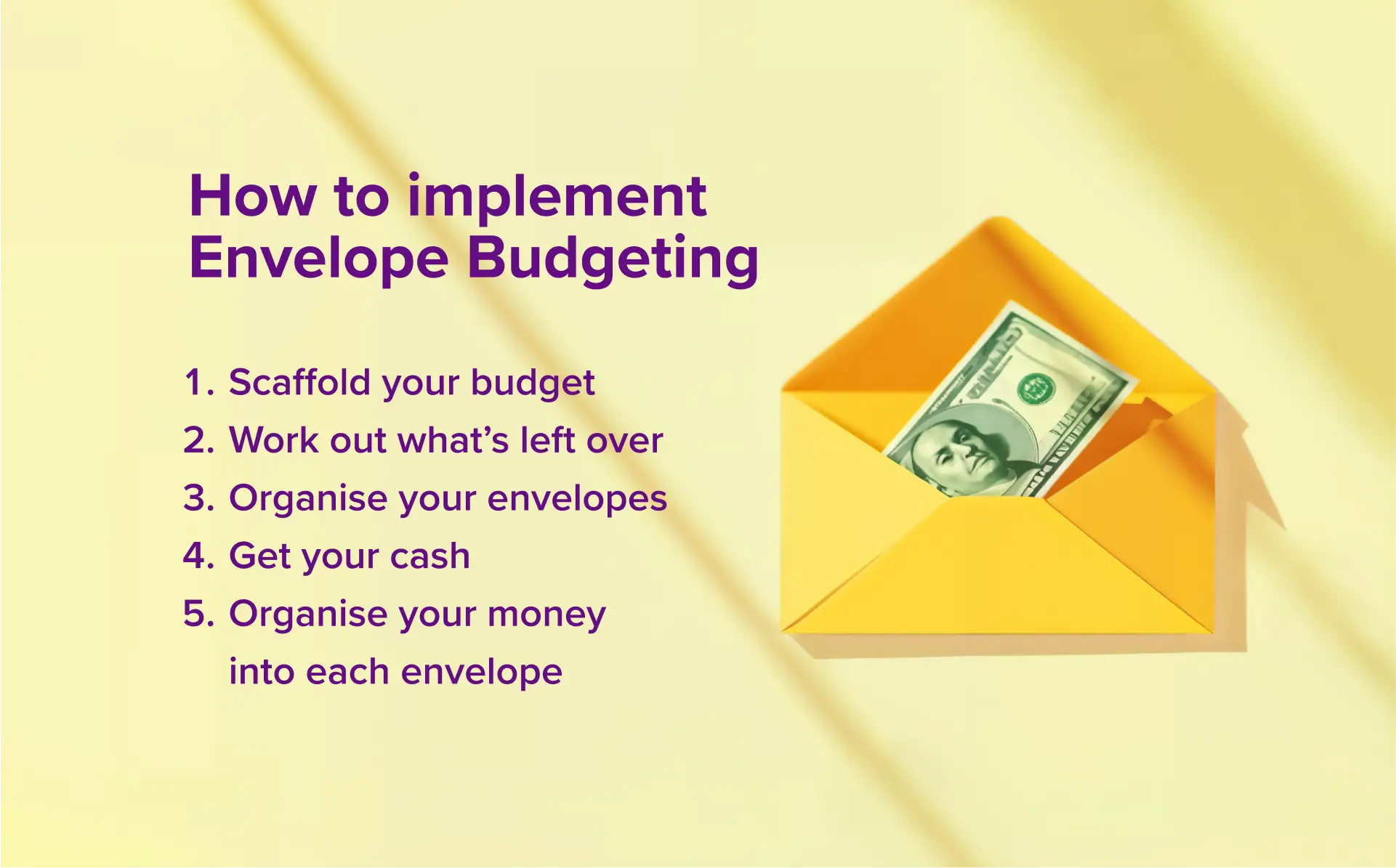

How to get started with Envelope Budgeting

How to get started

Ready to give this a try? Let’s get you set up.

Step 1: Scaffold your budget, needs-first. Implementing cash envelope budgeting starts before you withdraw any money. First, we need to nail your allocations and decide on your frequency. Most people find cash envelope budgeting works best on a monthly basis.

Look at your fixed, necessary expenses and total them up — we have to meet our needs first before we can look at organizing our money into other fun categories. Note down how much needs to go to each category of your necessary expenses, for example, rent, bills, insurances, petrol, etc.

Step 2: Work out what’s left over after those things are accounted for, and start chunking up that money into as many different categories as you like. You can be as broad or as niche as you like. You might have one entertainment envelope, or four envelopes for different types of entertainment.

Step 3: Organize your savings envelopes. This is any money you’re going to stuff into envelopes that you’ll keep, rather than spend. You may also want to start some sinking funds for larger, long term expenses and assign envelopes to those.

Step 4: Get your cash! It’s time to head to the ATM and withdraw your money.

Step 5: Get stuffing! Organize your money into each envelope, and find somewhere safe to store them. Then, you’re good to go. When the month is up, any money left in your envelopes can either be rolled over to the next month, or swept into a savings envelope.

Envelope Budgeting 🤝 PocketSmith

Well, this is awkward, isn’t it. We’ve just waxed lyrical about budgeting with cash and shunning digital payments, and yet, we run one of the best personal finance platforms in the world. Yikes.

If we’re being real with you, cash envelope budgeting and PocketSmith aren’t the best pairing in the world. PocketSmith relies on bank feeds to whip up our fabulous reports, budgets, dashboards, forecasts and categorization tools, so we might have to stay in the friend zone on this one.

That said, if you’re wanting to combine elements of cash envelope budgeting without fully going off the digital grid, this resource shows you how PocketSmith’s repeating budgets can help you scaffold out the bones of your cash budget. Alternatively, you can categorize your cash withdrawals by the corresponding envelope you’re using offline.

Envelope Budgeting: How to nail it

How to nail it

We want you to crush this new budget of yours, so here are our top tips on how to nail it.

- Decide when and where you’ll withdraw your cash, and find out whether your bank or a local store can give you the denominations you need to make your budget work.

- Nail the numbers before you stuff your envelopes.

- Keep a record of your transactions. This will help you review where your money is going and make changes accordingly.

- Add in challenges or progress charts to your savings envelopes. Coloring in a new square each time you stuff your savings envelope can help you sustain your motivation to keep going.

- Rebalance your envelopes regularly. Make sure you’re putting change back into the correct envelopes rather than letting it stay in your wallet.

- Consider stashing loose change to boost savings. Cash stuffers often accumulate a lot of small coins or low denomination notes. To streamline your numbers, you could round each transaction up to the nearest whole number or nearest multiple of 5, and sweep the difference into a separate pot. Then, every 3-6 months, take your miscellaneous change to the bank and get a boost to your savings.

- Make sure you’re able to carry your cash around with you safely.

- Have a buffer or a miscellaneous envelope, especially when getting started. You don’t want to go and throw off your whole system because of one forgotten cost!

- Get creative with your categories. The fun of envelope budgeting is that you can have an envelope for literally anything you like. Love collecting cat stickers? You can have an envelope for that.

Design note: unsure on legalities of using GIFs but the Oprah ‘you get a car, you get a car’ gif would be funny here!

Envelope Budgeting: How not to fail it

How not to fail it

The opposite of nailing it? Failing it. Here are some potential pitfalls to avoid.

- Check you’ve remembered and accounted for all your expenses. Missing something can throw off the whole budget.

- Avoid pulling money from different envelopes. Not only can this get confusing and admin-heavy to rebalance, it can take the fun out of it. If you find you’re overspending in one envelope, recalibrate your allocation next month.

- Don’t forget about direct debits and automatic payments. Withdrawing all of your money in cash can mean automated payments bounce.

- Don’t set yourself up to fail. While spending cash can help you taper your spending habits, telling yourself you’ll only spend $20 on coffee for the month when you’re currently having a daily iced latte from the Starbucks drive-thru isn’t going to be easy. Base your envelope allocations on your real spending data to start with, and then taper it back over time to foster long term behaviour change.

The PocketSmith verdict

This was a hard one to score because of how personal it is to everyone! For some, it’s an easy 5/5. For others, it’s a hard no. We’re sitting somewhere in the middle. We get the science, but we’re digital dollar tinkerers through and through.

This was a hard one to score because of how personal it is to everyone! For some, it’s an easy 5/5. For others, it’s a hard no. We’re sitting somewhere in the middle. We get the science, but we’re digital dollar tinkerers through and through.

This was a hard one to score because of how personal it is to everyone! For some, it’s an easy 5/5. For others, it’s a hard no. We’re sitting somewhere in the middle. We get the science, but we’re digital dollar tinkerers through and through.

This was a hard one to score because of how personal it is to everyone! For some, it’s an easy 5/5. For others, it’s a hard no. We’re sitting somewhere in the middle. We get the science, but we’re digital dollar tinkerers through and through.