When it comes to managing your money, most of the best-known methods are grounded in numbers. Some of our favorite budgeting techniques come down to number crunching — from the 50/30/20 budget, to Reverse Budgeting, to Zero-Based Budgeting. But there’s one money management style that places mindfulness at its core. Enter: Kakeibo. Pronounced kah-keh-boh, Kakeibo is a Japanese approach to managing money that dates back more than 100 years and loosely translates to mean ‘household ledger’. Let’s dive into what Kakeibo is and how it can help you hit your financial goals.

What is Kakeibo?

Kakeibo was first introduced in Japan in the early 1900s in a women’s magazine founded by journalist Hani Motoko. Originally designed as a tool to help women to manage the household budgets, Kakeibo continues to be used today. It has seen a resurgence in recent years as it was embraced by the personal finance movement across mainstream and social media. The book, Kakeibo: The Japanese Art of Budgeting & Saving Money, written by Fumiko Chiba, was released in 2017, and further popularised the method.

Kakeibo isn’t so much of a budgeting strategy as it is a philosophy. While it does have its own money management principles, Kakeibo is about embracing mindfulness and intentionality around your money.

With Kakeibo, you have the freedom to continue refining your finances over time and making gradual shifts until your spending routine is where you want it to be.

How Kakeibo works

The crux of Kakeibo is tracking your spending and reflecting on where your money has gone. It’s a practice, more than a structure. Kakeibo prompts you to ask yourself key questions about your money, like:

- How much income do you make a month? Looking at your income first grounds you in your own reality and gets you up close and personal with the money that’s passing through your hands each month.

- How much would you like to save? This offers you the chance to look ahead to the future and set some broader goals, like an emergency fund or a specific big ticket purchase.

- How much are you currently spending? This prompts you to get clear on how much is going out and forces you to confront that number head on.

- Where would you like to improve? This might be a certain area of spending, like money leaks or impulse purchases, or it might be the way in which you use money to improve your life. You might want to make room for more wellness spending, or increase the amount you’re able to save towards a big goal.

With Kakeibo, you track all of your spending in real time, usually manually in a notebook or journal that you assign as your Kakeibo journal. For each transaction, you assign it a category. The four Kakeibo categories are:

- Needs. These are your essential expenses that are basically non-negotiable, like your rent, mortgage, childcare, insurances, etc.

- Wants (also called Leisure). These are your discretionary expenses, like eating out, movies, entertainment, socializing, clothing, and other material items.

- Culture. These expenses are also non-essential, but contribute to the overall improvement of your life or your wellbeing. That might include a quarterly haircut, a gym membership, hobbies, alternative therapies, and relaxation modalities. You may even move certain things from the ‘wants’ category into culture if you strongly feel that they’re aligned to your values.

- Unexpected. These are the expenses that you weren’t planning to pay, like car repairs, gifting money to a friend or family member in need, or medical bills. Usually these are essential expenses.

This information is then used to apply Kakeibo principles to the way you manage your money. You use your spending ‘data’ to inform how you’ll spend and save next month. The idea is that you reflect on your spending and look for areas to improve, tweak or change next month. What’s really great about reflecting on your spending this way is that it gets you to think about how you’d categorize the transaction, and keeps you connected to the things you believe enrich your life or honor your values.

Our priorities and values can change over time, but if we’re not connected to what those things are, we can keep spending in a way that we think makes us happy, but in actual fact, is taking away from an opportunity we crave.

Example: Ella has always maintained that she wants to keep her morning coffee in her budget. She knows that cutting out her morning latte won’t make her wealthy, and she found joy in getting that hot coffee each morning on her way to work at her favorite coffee shop. After embracing the Kakeibo philosophy, Ella realized that she wasn’t enjoying her morning coffee as much as she used to. She’s in a new job now and goes to a different coffee shop out of habit. The coffee isn’t that great, the staff don’t remember her order or recognize her as a regular, and it’s usually a long wait. What used to add value to her life just wasn’t cutting it anymore. After realizing this, she started making her coffee for free at her office, and instead used her coffee spend to go out for brunch on Sunday mornings with her friend.

Without Kakeibo, Ella might not have reflected on her spending enough to recognize that it wasn’t adding value anymore. In a purely mathematical approach to budgeting, that category may have remained static and unchanged simply because it was a habit, and because giving it up wouldn’t make a huge mathematical difference to her financial position. But because Kakeibo evaluates the transaction holistically, Ella was able to redeploy the (albeit small) amount she was spending on her morning coffee into something that did bring her joy.

Pros and Cons of Kakeibo

Pros and cons

Just like all budgeting methods, there are pros and cons. Let’s take a look at some of the upsides and downsides to reverse budgeting.

Pros

- Helps you reconnect to your spending. In a world of automation, AI and conveniences at every turn, it’s easy to feel disconnected from many areas of our lives — and our spending is no different. Kakeibo helps you reconnect to where your money is going and what that means for your overall wellbeing.

- Reveals your values and priorities. How you spend your time and money says a lot about what’s important to you and what you value. Getting into the habit of building awareness around where your money goes is a great way to understand where you might be living out of alignment with your values, and where money can be better used to enrich your life.

- Fosters mindfulness and financial wellbeing. Mindfulness is all about slowing down and doing things with intention, rather than living life on autopilot. Kakeibo helps you practise mindfulness with your finances, and boosts your overall financial wellbeing at the same time.

- Holds you accountable. At its core, Kakeibo requires you to keep your finger on the pulse of your spending, which can help keep you accountable and aware of your financial decisions.

- Gives you freedom and autonomy. Kakeibo doesn’t force you to limit your spending or stick to hard and fast rules. You actually get a lot of autonomy with the Kakeibo method, as it’s all about learning from your behavior and tweaking it over time.

- It’s simple and cheap. All you need is a notebook and a pen!

- Trains you to spend mindfully and live below your means. Engaging with where your money goes every month exposes you to the difference between what you save and what you spend. Over time this teaches you to live below your means and gradually increase the gap between your income and your expenses.

- May prevent lifestyle creep. Lifestyle creep happens when we increase our lifestyle spending at the same pace (or faster) than our income. Kakeibo keeps you engaged with your money and can help you identify lifestyle creep before it becomes a habit.

- Helps build long-term change. There’s a big difference between knowing something and understanding it. Kakeibo doesn’t just tell you what to do, it teaches you to know what to do intuitively, which builds real change in your attitude and behaviour towards money over the long term.

Cons

- Can be time-consuming. Tracking your spending does require you to engage with your money often, which some find too time-consuming. Kakeibo isn’t a set-and-forget type of approach. You need to set aside time to not only write down your expenses, but reflect on them in a meaningful way.

- Possibility for things to get missed. Tracking with your journal and pen can be cathartic, but there’s also a risk you’ll miss something, which could then throw off your budget.

- No digital back up. If you lose your Kakeibo notebook, you might miss out on the cumulative behavioral benefits of the practice. Unlike spreadsheets or apps, there’s no digital back up.

- Less granular than other budgets. The upsides of Kakeibo can also be the downsides. You get a lot of freedom to spend your money how you like with Kakeibo, but some people like having rigid rules to follow. Kakeibo isn’t as granular as other budgets, so it might not work for rule-lovers.

- Manual tracking isn’t for everyone. Tracking your money the old fashioned way has its perks, but it’s not for everyone. That’s not to say you can’t digitize your Kakeibo method, though.

The brain bit: The Kakeibo mindset

The Kakeibo mindset

Kakeibo works by bringing together mindfulness and money to connect you to your finances. Money is complicated for us humans. On the one hand, we’re extremely emotionally entangled with it. On the other hand, we avoid it and can feel extremely disconnected from it, especially when we don’t feel like we have a natural capability for managing it. Kakeibo solves this complexity by gradually increasing our awareness of and connection to our finances over time.

Kakeibo supports behavior change

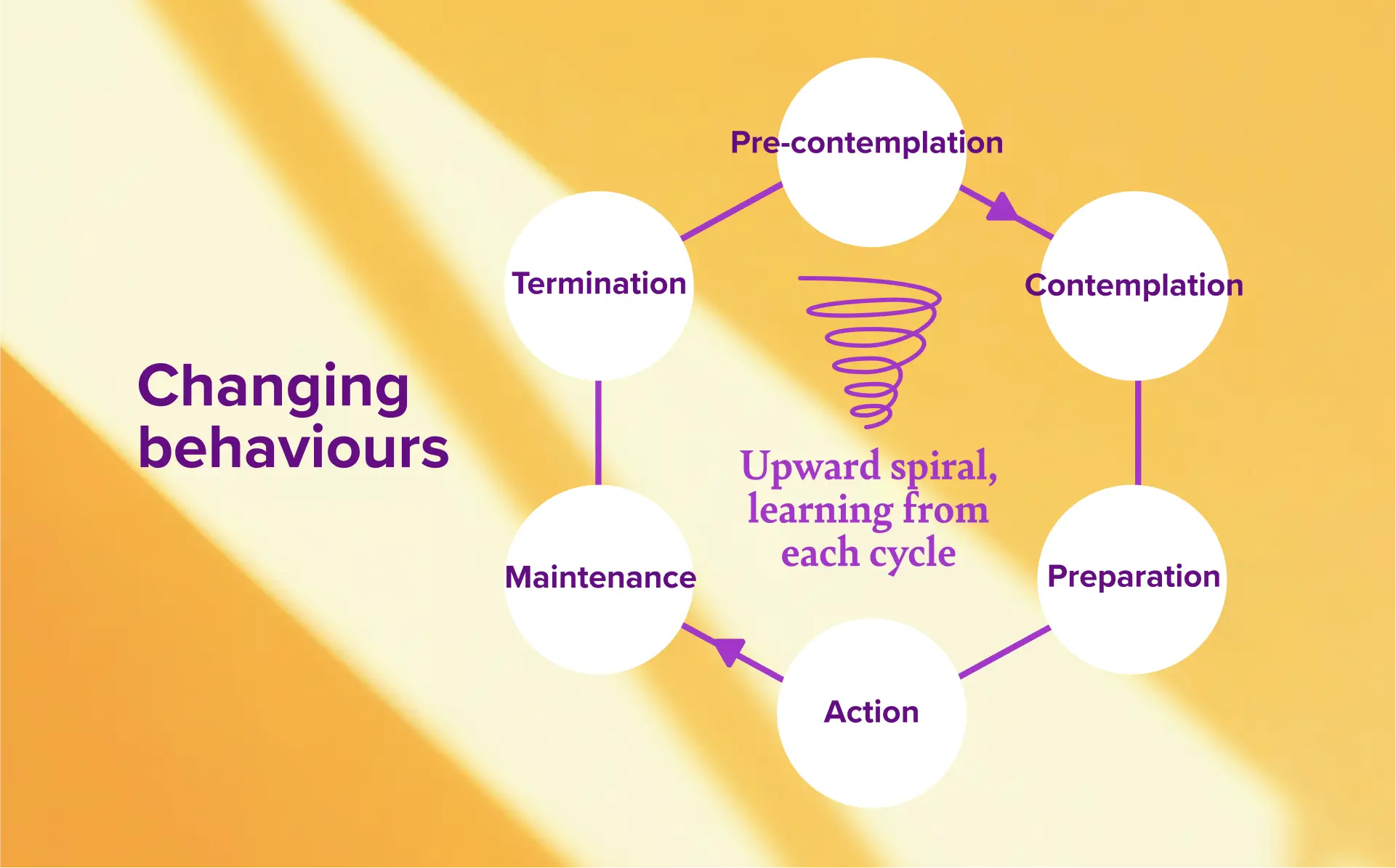

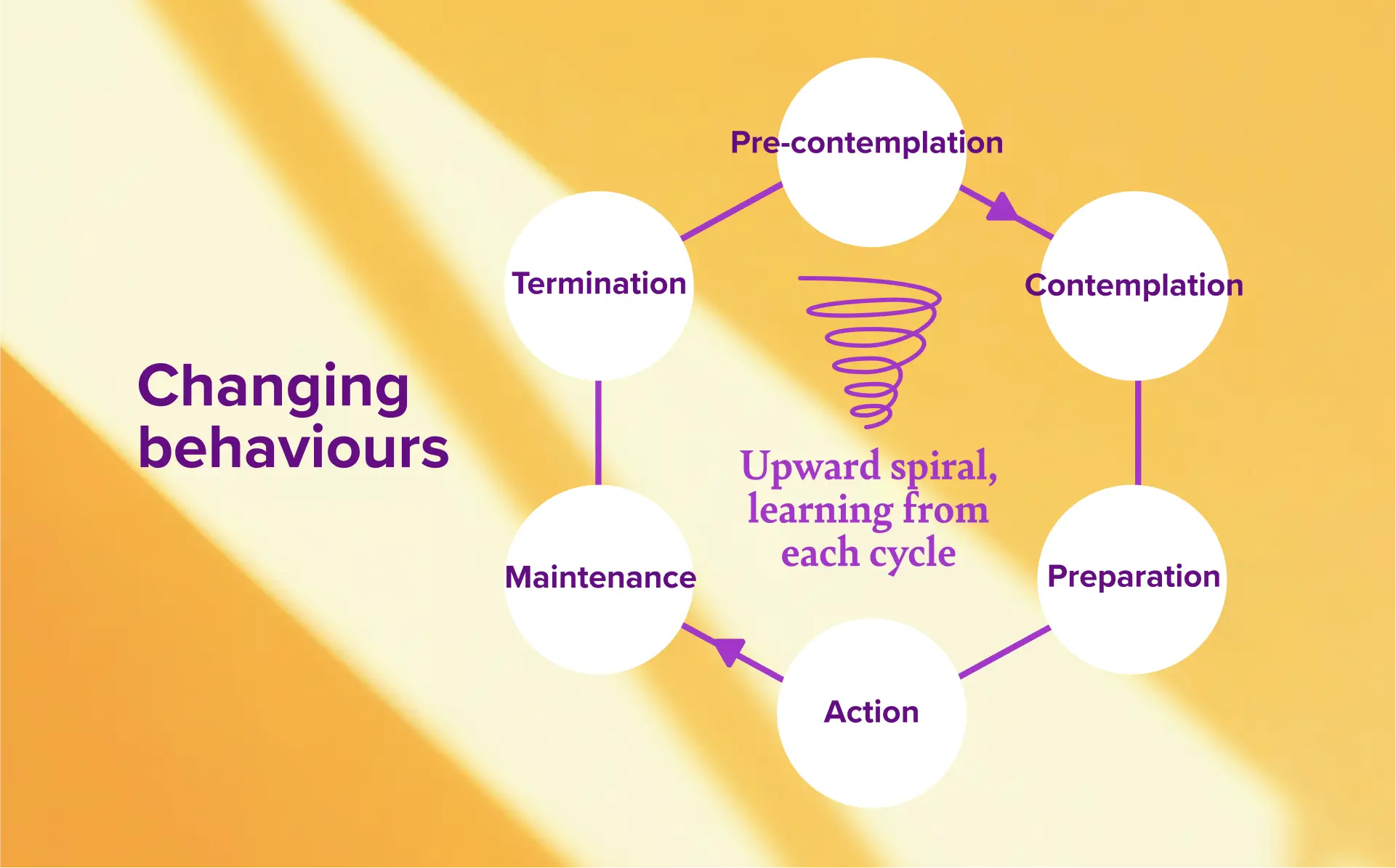

Kakeibo can help us build long-term, lasting change by helping us move through the stages of behavior change at a pace we feel comfortable with. The transtheoretical model of behaviour change says that in order to change, we need to be at a certain stage of readiness, and that when we try to change and fail, we’re simply not appropriately ready to make that change.

There are six stages of behavior change under the transtheoretical model: Pre-contemplation, contemplation, preparation, action, maintenance, and relapse (or termination). What’s great about Kakeibo is that it doesn’t require users of the method to change everything right away. In fact, it doesn’t really require you to change anything. You can use Kakeibo without changing anything about your finances at first, and still benefit from the awareness and learnings it provides you. Arguably, as you learn more about your money (and yourself) in the process, you gradually increase your readiness to change and have greater success long term than if you’d had short-term success with a more pass-or-fail budgeting method.

Writing things down on paper

Kakeibo also embraces the art of writing things down on paper. Multiple studies have shown that goals written down are more likely to be achieved, and so writing down your financial goals and tracking your spending using a pen and paper could have the same positive effects. It’s also been found that the use of manual pen and paper can also help with learning and memory in ways that using a keyboard can’t.

Kakeibo boosts financial wellbeing

From a wellbeing perspective, Kakeibo allows you to gain a sense of control over your finances by increasing your awareness. It gives you the space and permission to look at your money from a holistic lens, and learn about yourself in the process. Not only can it improve your financial wellbeing, it could also improve your happiness and self-concept, too.

Who Kakeibo is best suited to

- Journalers. If you already journal regularly, you’ll probably love the mindful nature of Kakeibo. Plus, your brain is already on board with the art of getting things down on a page.

- Minimalists. Kakeibo helps you get the most out of your money and be more intentional, which may work well for you if you’re pursuing intention in other areas of your life.

- Routine-lovers. If you love a routine and a ritual, you might get a lot of joy from setting aside time to add to your Kakeibo journal and reflect on your finances.

- Goal-setters. If you love a vision board and working towards a goal that matters to you, Kakeibo is a really great way to bring together personal finances and mindfulness and help you achieve your goals in a really meaningful way.

“You can have anything you want, just not everything you want.”

Kakeibo really embraces this mindset that you can have anything you want, just not everything you want. It forces you to reflect on how you spend your money and where it’s adding value to your life. It takes the rapid impulsiveness out of money and makes it something you spend and save with intention. By building the mindset that you can work towards anything you want simply by aligning your financial behavior to that goal, you can feel more empowered by your finances and therefore more in control.

How to get started with Kakeibo

How to get started

Ready to give Kakeibo a try? Here’s how to get started.

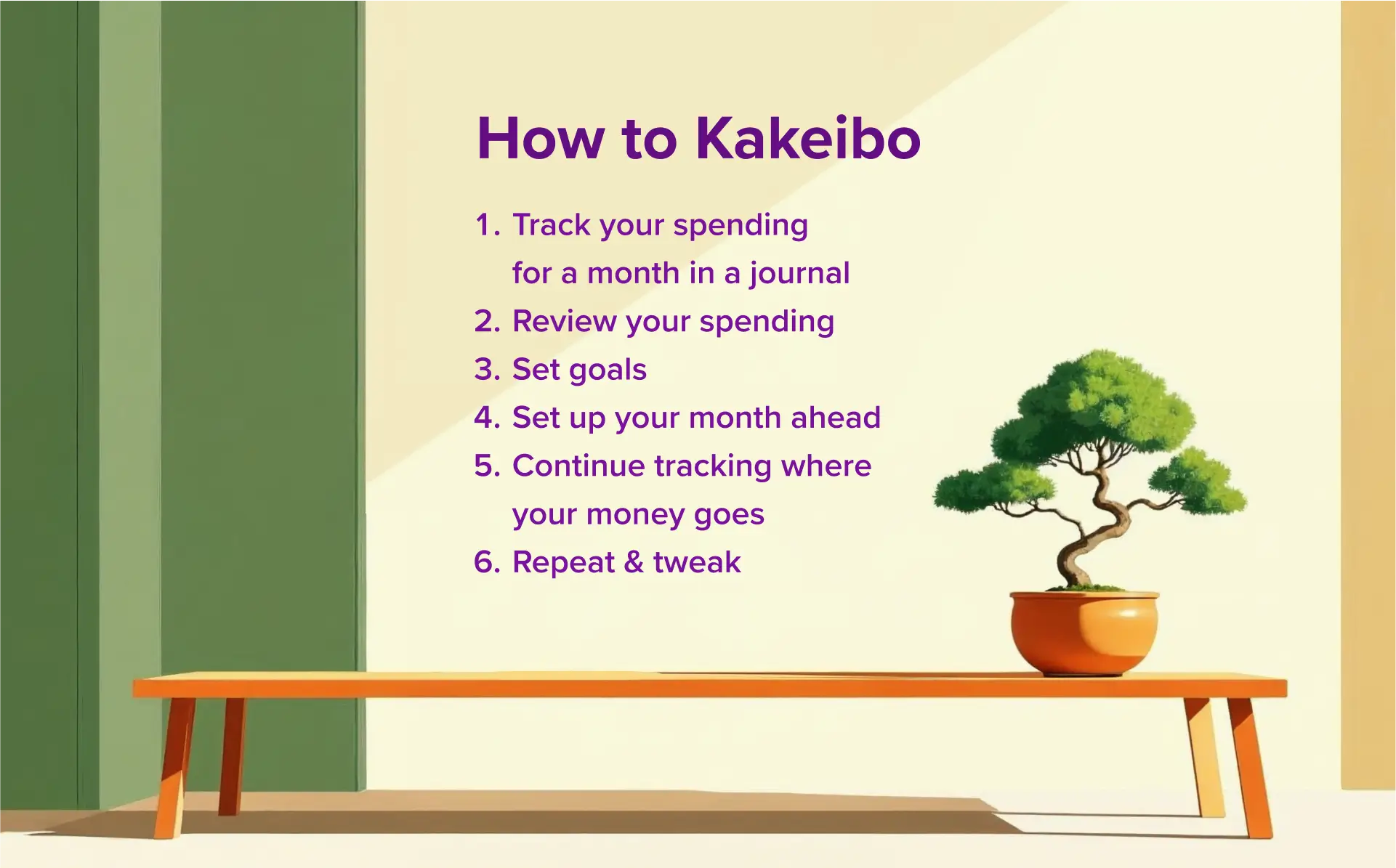

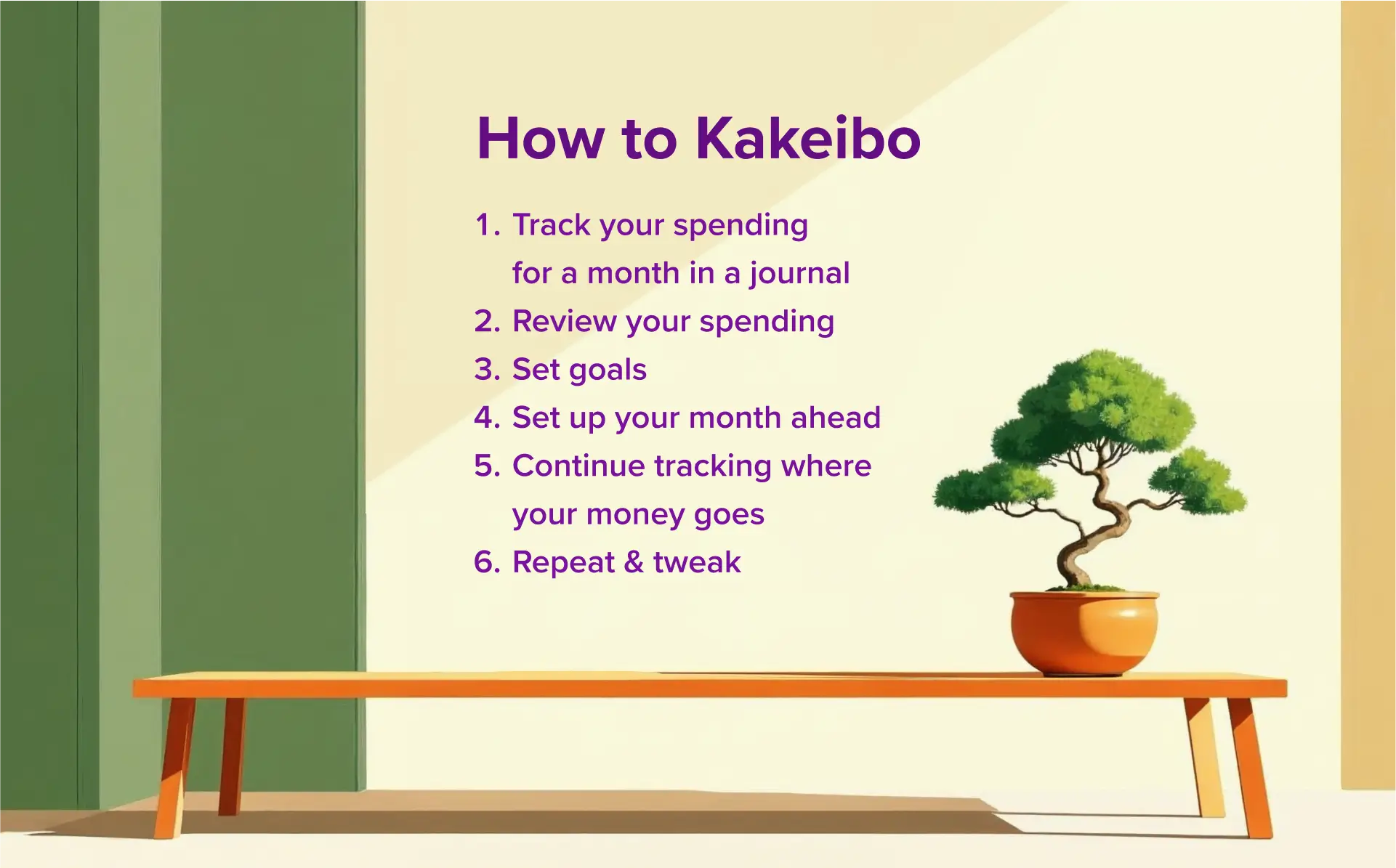

- Step 1: Track your spending for a month in a journal. Write down what the expense was, how much it was for, and which of the four Kakeibo categories it relates to.

- Step 2: Review your spending in real time, and then collectively at the end of the month. Each time you note down an expense, sit with that for a moment and allow any feelings or emotions to come up. Jot down anything you notice. Then, do a full review at the end of the month. Total up each of your four categories, compare them to how much money is coming in, and reflect on how that aligns with what you really want out of your money. Are there any opportunities to make changes? Do you feel like you have anything to show for your money? Where is your money mostly being spent?

- Step 3: Set goals. Now is your chance to set long and short-term goals for your money. You might want to work towards a bigger goal like an emergency fund, travel fund or house deposit, or you might want to save up for something that’s just a month or two away. Write these goals down in your Kakeibo notebook, and consider creating a vision board to go with your goals to enhance your emotional connection to them.

- Step 4: Set up your month ahead. Write down what’s coming in, how much you’ll set aside towards your goals — embracing the Pay Yourself First mentality — and then how much is left for spending.

- Step 5: Continue tracking where your money goes by writing it in your Kakeibo notebook, and at the end of each period, reflect on what you can change or improve. Consider ranking your transactions out of 10 for how much value they added to your life, and look to eliminate the lower ranking spends to make way for higher ranking spends.

- Step 6: Repeat! With Kakeibo, you have the freedom to continue refining your finances over time and making gradual shifts until your spending routine is where you want it to be.

Questions to ask yourself when doing your Kakeibo reflections

Unsure how to reflect on your spending? Here are some prompts to get you started.

- How did I feel before spending this money, and how do I feel now? Is there a difference?

- Why did I spend this money on this thing?

- Is this expense higher than I’d like it to be, and is there anything I can do about that, even if it would mean a big change? (Great for more fixed expenses like rent)

- Did I get value from my money this month?

- What would have made this month more enjoyable?

- If I’m being honest with myself, which of these expenses could I have lived without?

- Are there any regrets coming up?

- Is there something I wish I could afford in my budget?

- Do I feel I’ve made progress this month? If not, how do I feel about that?

- Based on this month’s spending, what season of money am I in right now? Do I need to shift seasons?

Kakeibo 🤝 PocketSmith

Okay, we’ve been caught with our pants down a little bit here. Kakeibo is very much a pen-to-paper methodology, and we’re, well, a digital budgeting software for personal finance nerds across the globe. However, we love Kakeibo and think there’s room to embrace many parts of the philosophy in tandem with a budgeting app.

PocketSmith’s transaction feeds are the perfect way to consolidate all of your transactions in one place, making it easy to review and reflect on your expenses without missing anything. You can manage your own categories, too, allowing you to organize your transactions in line with the Kakeibo four-category method. But, best of all: the PocketSmith timeline feature. Timeline is like a digital journal for your finances. You can add attachments, notes, images and text to your transaction record, and then view it as a continuous timeline. Perfect for your Kakeibo-inspired reflective practice.

Kakeibo: How to nail it

How to nail it

We want you to crush this new budget of yours, so here are our top tips on how to nail it.

- Habit stack with other mindfulness activities. If you do journaling, meditation or other mindfulness practices, habit stack these with your Kakeibo entries to help make it part of your routine.

- Find a reflective rhythm. Reflection is meaningless if you’re not truly connected to it. Try different reflective practices to find what helps motivate you to improve your finances.

- Always get a receipt. Many Kakeibo devotees recommend always asking for a receipt so you have physical evidence of where your money has gone! Not only does it help with accuracy, it helps you connect to the fact you’ve spent money.

- Romanticize the process. Ritualizing your Kakeibo practice and making it enjoyable is what’s going to keep you coming back for more. Pour a hot tea, get comfortable and carve out some ‘me time’ to make the most of it, knowing you’re taking steps towards a better financial future.

- Create a vision board. Visualizing your goals helps you build an emotional connection to them, which in turn helps you engage in the behaviors that will move you closer to that goal.

What is habit stacking? Habit stacking was popularized by James Clear’s book, Atomic Habits, as a way to help with habit follow through. The idea is that you ‘stack’ your habits on top of things you’re already doing. If you need to take a pill, stack it onto something you do every morning by default — like brushing your teeth. Try stacking Kakeibo with another habit you do regularly to hold yourself accountable.

Kakeibo: How not to fail it

How not to fail it

The opposite of nailing it? Failing it. Here are some potential pitfalls to avoid.

- Don’t go it alone. Consider finding a Kakeibo buddy by getting a friend or family member to commit to the practice with you. You can then deepen your experience by talking about your financial goals together.

- Be open to making adjustments. As with all money management methods, it has to work for you. Be open to changing things as you see fit — you don’t have to follow things 100% by the book to get the benefits.

- Don’t try to over-save. Kakeibo requires you to let go and trust the process. Don’t confuse it with fad diet-style budgeting that restricts all spending and then ends up with a big rebound spend. Take it slow and steady if you want to win the race.

The PocketSmith verdict

We love the reflective, holistic nature of the Kakeibo practice, and strongly recommend encompassing aspects of it into whatever budgeting method you swear by. However, we’re of course a little biased when it comes to digital personal finance software, so we reckon a combination of PocketSmith functionality and Kakeibo intentionality could be the ultimate sweet spot!

We love the reflective, holistic nature of the Kakeibo practice, and strongly recommend encompassing aspects of it into whatever budgeting method you swear by. However, we’re of course a little biased when it comes to digital personal finance software, so we reckon a combination of PocketSmith functionality and Kakeibo intentionality could be the ultimate sweet spot!

We love the reflective, holistic nature of the Kakeibo practice, and strongly recommend encompassing aspects of it into whatever budgeting method you swear by. However, we’re of course a little biased when it comes to digital personal finance software, so we reckon a combination of PocketSmith functionality and Kakeibo intentionality could be the ultimate sweet spot!

We love the reflective, holistic nature of the Kakeibo practice, and strongly recommend encompassing aspects of it into whatever budgeting method you swear by. However, we’re of course a little biased when it comes to digital personal finance software, so we reckon a combination of PocketSmith functionality and Kakeibo intentionality could be the ultimate sweet spot!