Zero-based budgeting, sometimes referred to as ZBB, is a budgeting technique that has grown in popularity in recent years on social media. Interestingly, the technique actually has origins in business and government spending, but the principles have now become mainstream in personal finance. Want a piece of this business-approved budgeting pie? This guide will teach you everything you need to know about zero-based budgeting and whether or not it’s the strategy for you.

What is Zero-Based Budgeting?

Put simply, zero-based budgeting is a method of managing your money that gives every single dollar a job. The idea is that your spending, saving and investing should all add up to the exact number you bring home. No dollar left behind, no dollar left unassigned. Some people use a zero-based budget as part of their envelope budgeting system but you can use it digitally too.

The method of budgeting was first coined (pun intended) by Pete Pyhrr, an employee of Texas Instruments in the 1970s. However, Jimmy Carter, the Governor of Georgia, was credited with popularizing it, after using the system to manage the state’s budgeting process. Well, if it’s good enough for the budget of an entire US state, it’s good enough for us!

How is Zero-Based Budgeting different from any other budget?

How it's different

The key difference between zero-based budgeting is that every pay period is essentially a fresh budget. You don’t base your spending allocations on what you spent last month, or carry forward any assigned category limits or allocations. Rather, you reprioritize your money each month.

Think of your budget like a trip to the grocery store. Traditional budgeting is like going to the store, grabbing all your usual items, and only scrutinizing the addition of anything outside of the ordinary. Like, you know, that tub of Biscoff spread that you totally don’t need but absolutely do need. With zero-based budgeting, you consider each addition to your cart carefully, as though it were a delicious tub of Biscoff spread, and effectively create an entirely new grocery list based on only what you truly need.

Pros and cons of Zero-Based Budgeting

Pros and cons

Just like all budgeting methods, there are pros and cons. Let’s take a look at some of the upsides and downsides to zero-based budgeting.

Pros

- You’re forced to reevaluate every expense every month. Unlike more hands-off budgets where you may repeat the same behaviors each month, or roll over the same category allocations as the month prior, zero-based budgeting forces you to start a fresh budget for every budget period. While some expenses may remain unchanged, like rent for example, you still need to face up to that expense and allocate that money to that category. For expenses that can change, you’re reminded to reevaluate whether or not you want to spend money on that again in the next budget period. As a result, you’re much more aware of how much of your money is going to various different aspects of your lifestyle. Even though you can’t just stop paying your rent, it might help you become more aware of how much you’re spending, and consider moving somewhere cheaper if you decide that amount doesn’t align with your goals anymore.

- It reminds you to allocate your money in accordance with your goals and values. Reevaluating your budget each month allows you to be much more aware of where your money goes, and what your spending and saving split looks like. Justifying every expense every month can help you identify where your money is best spent and what you value, and it may remind you to allocate some money to the things you enjoy. You’re also able to be more strategic when pursuing money goals, as you’re more in touch with how you’re allocating your money. As a result, you can make cut backs to increase savings capacity or to allocate a certain amount of money to something that’s important to you.

- It can prevent money leaks. Subscriptions, expensive grocery items (Biscoff who?), those random in-app add-ons, or introductory periods that roll onto full price payments — all of these things can cause money to leak out of your budget without you even realizing. With traditional budgets, these items can get missed because you get used to parting with that money each month. Zero-based budgeting can help you catch these unused and unnecessary expenses much quicker.

- You can be more strategic with money. Every dollar spent today is a dollar you don’t have tomorrow. Zero-based budgeting allows you to be much more strategic with how you’re allocating your money by empowering you to change it up regularly. If you know you’ve got a busy month of work coming up, you might choose to set up a lean zero-based budget and maximise your savings opportunities while you know you’re going to be head-down-bum-up with work. Likewise, if you have a period of time where you want to allocate more money to immediate joy, like around the holidays, your zero-based budget allows you to plan for that intentionally.

- It helps you be intentional with your money. Being mindful of where your money goes can help you make better use of your financial capacity. Slowing down and creating a fresh budget every month helps you build a strong connection to your financial behaviour.

- It reminds you to factor in savings before spending. Most budgeting methods are designed to get you to set aside some money for savings, but the zero-based budget method helps you visualise where your money is going, and reminds you to prioritise setting money aside for savings upfront.

- It treats your personal finances like a business. There’s a lot to be said about the way businesses manage their finances. They do regular reviews, they respond to external and internal changes, they aim to be profitable, and they increase spending to seize opportunity, and make cuts when they need to. A zero-based budget approach forces you to treat your personal finances like a business, and can therefore see you create better outcomes for your money.

- You can respond to changes to your situation in real time. When we get too comfortable with repeating the same budget month in, month out, it can be hard to make cutbacks when things get tight because we’re used to the status quo. A zero-based budget makes you more aware of when you might need to trim some expenses, either proactively or reactively.

- It can work well for fluctuating incomes. Organising your money each month into its own zero-based budget can work well if you earn different amounts each week, as it can ensure you spend less when you earn less, and save more when you have more capacity. However, this relies on you always earning enough to cover your regular expenses.

- It can prevent lifestyle creep. As we earn more, we spend more. It’s a common quirk in our financial behaviour – our lifestyle expands to the capacity of our income. We start buying nicer groceries (hello again, Biscoff), dining at more expensive restaurants, driving a nicer car, etc. A zero-based budget makes you more proactive with where you’re choosing to allocate your money. You’re able to see much more clearly how much discretionary income you’re working with, allowing you to divert surplus income to saving before you get caught up in the throes of lifestyle creep.

Cons

- It’s time-consuming. Among the cons of zero-based budgeting is quite simply the time investment. Starting a fresh budget for each budget period might have its benefits — that’s a juicy pro list right there — but it does mean you need to be disciplined enough to sit down and do this every month. If you’re more of a set-and-forget type of person, this might not be for you.

- Unexpected expenses can throw things off. This can be true for all budgets, but particularly for the zero-based budget. Giving every single dollar a job doesn’t leave much wiggle room for anything you didn’t expect, whether that’s a gift, a flat tire or an emergency wine and snacks run when your friend has had a rough week.

- You have to actually stick to it. Ah, that small factor. As with all best-laid plans, they work on paper, but do they work in reality? For a zero-based budget to be most effective, you do need to stick to it as best you can, and that means tracking your spending and comparing your real expenditure with your budgeted numbers.

- It can become restrictive or overly granular. A zero-based budget can limit you to very short-term thinking, or leave you scrutinizing the smallest of expenses. Nailing your personal finances shouldn’t be miserable. We want to allow ourselves some money for enjoying life and honoring what matters to us, but a zero-based budget can make spending feel like failing for some people.

- It relies on strong surveillance of your spending behavior. You do need to be tracking your numbers to make a zero-based budget work, which isn’t for everyone. Plus, if your tracking habit slips, it can be hard to get back on top of things, and that can leave you wanting to throw the towel in.

The brain bit: The Zero-Based Budgeting mindset

The Zero-Based Budgeting mindset

What is it about the zero-based budgeting method that makes so many people tick?

The idea of zero-based budgeting is that you’re proactive with your budget and keep your finger on the pulse. Reevaluating every expense in real time should ensure that your finances don’t run away from you, and reduce the likelihood of avoidance and burying your head in the sand. Despite criticisms of zero-based budgeting suggesting that you can be too optimistic and set yourself up for failure, research actually suggests that even if you expect your spending to be less than it actually is, the presence of the budget and the act of tracking your spending can still benefit your finances. In fact, researchers discovered that even if you go over your budgeted amount in a certain category, the presence of the budget is still likely to moderate behavior more so than if it weren’t there at all, and more so than if you’d been overly conservative.

However, while the numbers might stack up in terms of moderating your spending, it’s important to check in with how a budgeting style feels for you. While research suggests that it’s better to budget $100 in a category but end up spending $150, than it is to budget $200 and end up spending $200, it might not be helpful for your mindset to continually feel like you’re going over budget.

Zero-based budgeting can also help you with motivation and follow-through. It requires you to engage with your budget and spending regularly, which keeps it top of mind and means you’re much more aware of your financial behavior.

Plus, setting up your new budget each month may prompt you to visualize the behaviors you’d need to engage with to stay within budget. Visualizing the process steps towards a goal has been proven to increase success. For example, if you’re setting your zero-based budget for the month ahead and you decide to reduce your eating out budget to $50, your mind might start to visualize the lunch you’ll need to pack for work to avoid grabbing something on the go, which supports your chances of following through.

Who Zero-Based Budgeting is best suited to

Zero-based budgeting is best suited to people who work well with structure and boundaries, and who are able to follow through with plans they set for their spending. Some people find the zero-based budget too strict and specific, while others thrive on having a clear plan set out in front of them.

It also helps to be comfortable and confident in your spending habits — but not in the way you might think. People who are very, very frugal and vigilant with their money may actually find a zero-based budget makes it harder to enjoy their money due to the high-touch nature of the budgeting system. If, however, you’re good at being able to spend and save simultaneously, the zero-based budget can help you enjoy a portion of your money for intentional discretionary categories.

Lastly, if you earn a fluctuating income, perhaps as a freelancer or a contractor, a zero-based budget may help you maximize higher earning months and cut back during lower earning months.

How to implement Zero-Based Budgeting

How to get started

Getting started with a zero-based budget is simple. You’ll just need to define what your set budgeting period will be, and when you’ll begin.

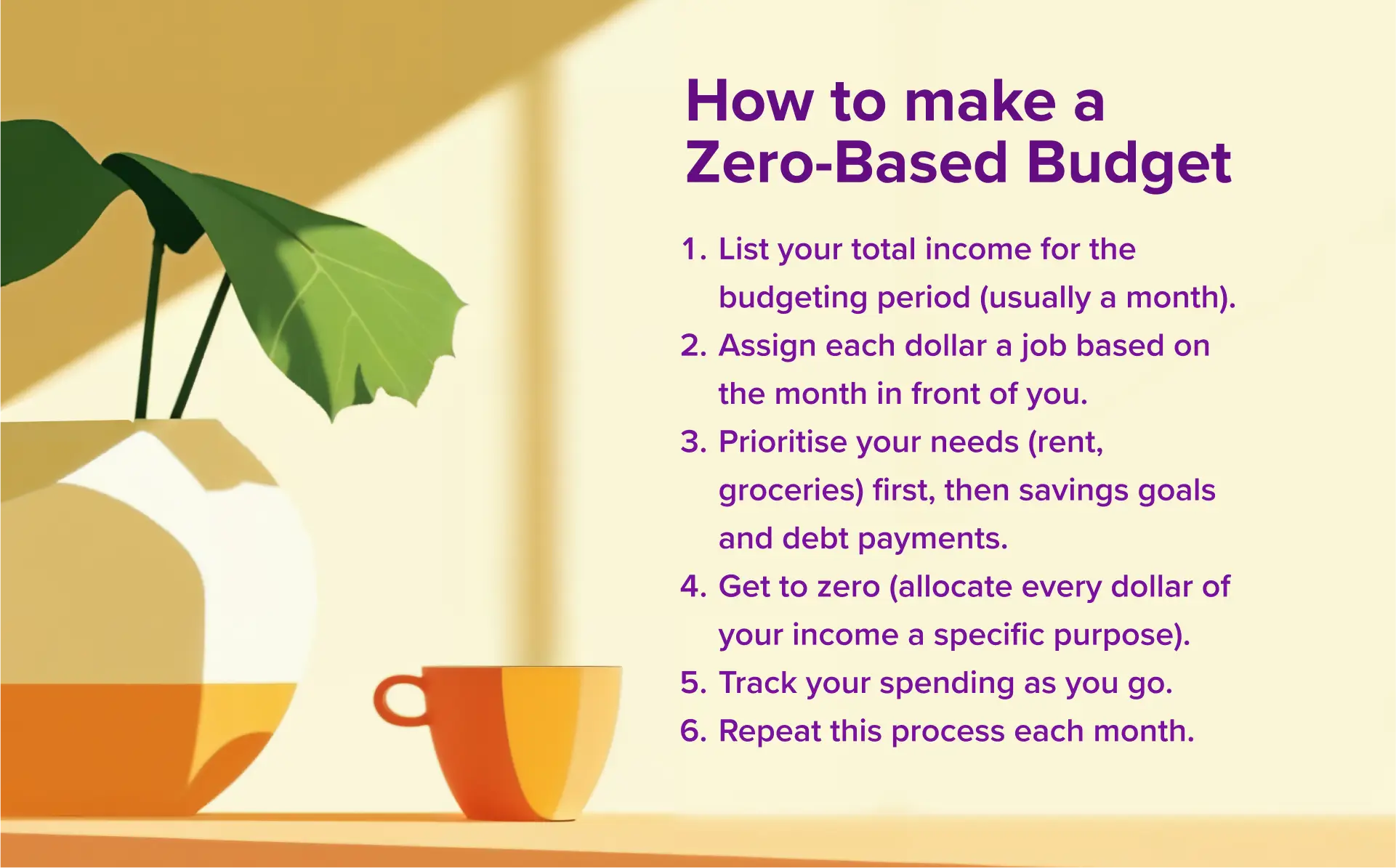

- Step 1: List your total income for the budgeting period (usually a month).

- Step 2: Instead of allocating funds based on how much you spent in the past, you assign each dollar a job based on the month in front of you. Every expense needs justification and allocation.

- Step 3: You prioritize your needs (rent, groceries) first, then savings goals and debt payments. Finally, you allocate funds for “wants” (entertainment, dining out) after covering necessities and savings goals.

- Step 4: Ideally, by the end of this allocation process, you should have assigned every dollar of your income a specific purpose, hence reaching zero.

- Step 5: Track your spending as you go, and compare your real spending with your budgeted numbers.

- Step 6: Repeat this process each month, starting fresh each time and critically deciding where your money is going to go and why, remembering not to just replicate your behaviour from the last month.

Zero-Based Budgeting 🤝 PocketSmith

PocketSmith isn’t built on the basis of a zero-based budgeting approach. Instead, the platform uses repeating budgets to keep track of your spending. However, the automatic bank feeds can provide insightful tracking data about where your money has gone. You might choose to operate your zero-based budgeting manually in a spreadsheet, while using PocketSmith’s transaction records to consolidate all of your accounts into one easy review destination. Intelligent categories and tags can help you assign what transactions relate to which part of your zero-based budget, and you can keep all of your transaction data from all your accounts in one place.

Zero-Based Budgeting: How to nail it

How to nail it

We want you to crush this new budget of yours, so here are our top tips on how to nail it.

- Set aside time each month to adjust your budget for the month ahead. Zero-based budgeting can be time consuming, but ritualizing and romanticizing (R&R, baby) your budgeting process can keep you coming back for more.

- Track your spending against your budget in real time. Find a way to track your budget categories against your real spending as you go, so you know when you’re nearing your limits.

- Use last month’s spending as a guide — but don’t forget to rationalize each expense. Zero-based budgeting requires you to start from zero every month, but that doesn’t mean you can’t use last month’s expenditure to inform the starting point of your budget decisions.

- Use sinking funds. Sinking funds help you park money that you’ll later need for a big bill or expense, like your annual car insurance payment. Building sinking funds into your zero-based budget can help you ensure you’re prepared for those larger bills.

- Set money aside for unexpected expenses. The biggest threat to any budget is an unexpected expense. Consider allowing a buffer for overages so that you don’t throw your entire budget out of whack.

- Hold yourself accountable. Ah, the all-important follow through. Find your own rhythm with sticking to your budget and holding yourself accountable to the amounts you plan to spend.

- Visualize what you’d need to do in order to hit the budgeted numbers you set out. This can mean you’re more likely to stick to your budget and achieve your financial goals.

Zero-Based Budgeting: How not to fail it

How not to fail it

The opposite of nailing it? Failing it. Here are some potential pitfalls to avoid.

- Don’t obsess about being perfect. Your budget is supposed to be a help, not a hindrance, so don’t get too granular and make it a miserable experience. Instead, get into the habit of adjusting and tweaking your budget to meet yourself where you’re at.

- Beware of “legacy expenses”. These are the expenses that regularly repeat in each monthly budget, like your rent, or ongoing bills. Even in a zero-based budget where you’re redeploying your income fresh each month, you may risk overlooking opportunities to reduce regular expenses.

- Don’t get stuck in short-term thinking. Keep your longer term goals in mind, and remember the importance of investing in yourself and your growth when it comes to your overall wellbeing.

The PocketSmith verdict

While the zero-based budgeting is a popular method for organizing your money, it’s a little bit too labor-intensive for us. We reckon there’s a lot to say about automating and simplifying your finances and using an app (ahem, like PocketSmith) to keep your budget ticking over for you. Plus, you can leverage things like forecasts and budget predictions to look several months ahead, rather than only ever thinking about the budget period in front of you.

While the zero-based budgeting is a popular method for organizing your money, it’s a little bit too labor-intensive for us. We reckon there’s a lot to say about automating and simplifying your finances and using an app (ahem, like PocketSmith) to keep your budget ticking over for you. Plus, you can leverage things like forecasts and budget predictions to look several months ahead, rather than only ever thinking about the budget period in front of you.

While the zero-based budgeting is a popular method for organizing your money, it’s a little bit too labor-intensive for us. We reckon there’s a lot to say about automating and simplifying your finances and using an app (ahem, like PocketSmith) to keep your budget ticking over for you. Plus, you can leverage things like forecasts and budget predictions to look several months ahead, rather than only ever thinking about the budget period in front of you.

While the zero-based budgeting is a popular method for organizing your money, it’s a little bit too labor-intensive for us. We reckon there’s a lot to say about automating and simplifying your finances and using an app (ahem, like PocketSmith) to keep your budget ticking over for you. Plus, you can leverage things like forecasts and budget predictions to look several months ahead, rather than only ever thinking about the budget period in front of you.