What happens if…

- local_offerPlan PocketSmith Free

- buildTask type Moderate

- listSteps 3

- timelapseTime required 30 minutes

- favoriteGrab a... Box of cookies

With an understanding of your money and a picture of your future in front of you, you can begin to plan meaningful changes. Here's how we can help.

What happens when your income or spending changes? Let’s say you earn less, or you finish paying off a debt. How does that change your future? We call that a ‘what-if scenario’ and you can use it to see what your new balance will look like over the next six months.

Testing these scenarios will help you see where you can make meaningful changes with your money. So take a moment to think about a few possible scenarios. These could be anything from receiving a one-off sum of money, to a 20% drop in your income or adding a new, recurring payment over the next few months.

In this guide you will see how to build a picture of the impact ‘what-ifs scenarios’ can have on your money.

Step 1. Add your what-if scenario

To build your what-if, you first add the scenario and then you can make the changes to your scenario by adding budgets to it. So let’s create that scenario.

Click on the instructions to change the picture.

Click on the instructions to change the picture.

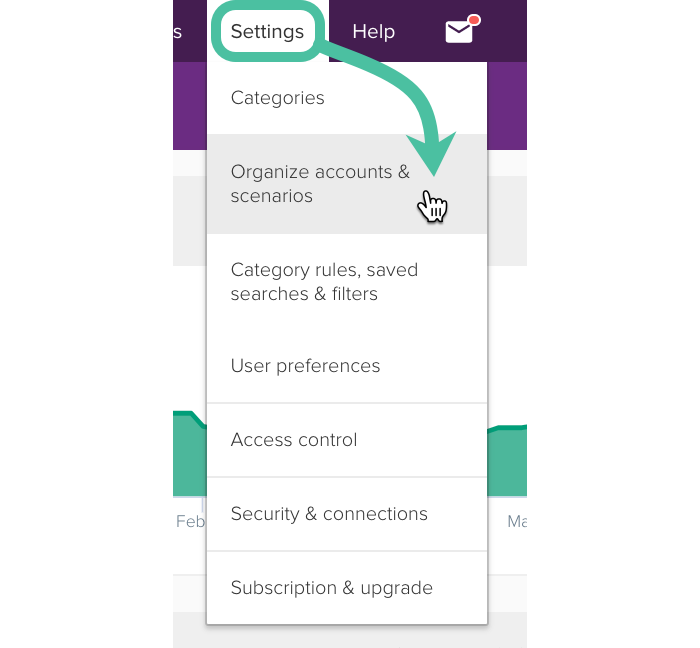

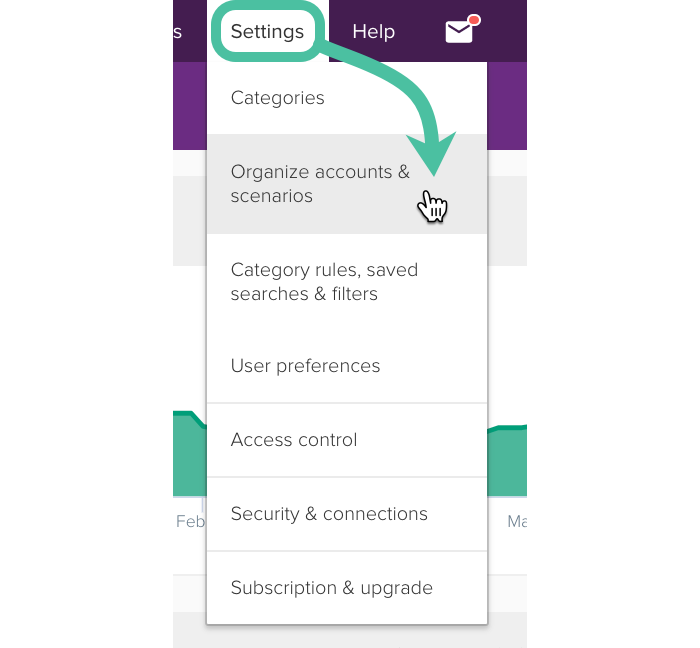

- In PocketSmith head over to Settings > Organize accounts & scenarios.

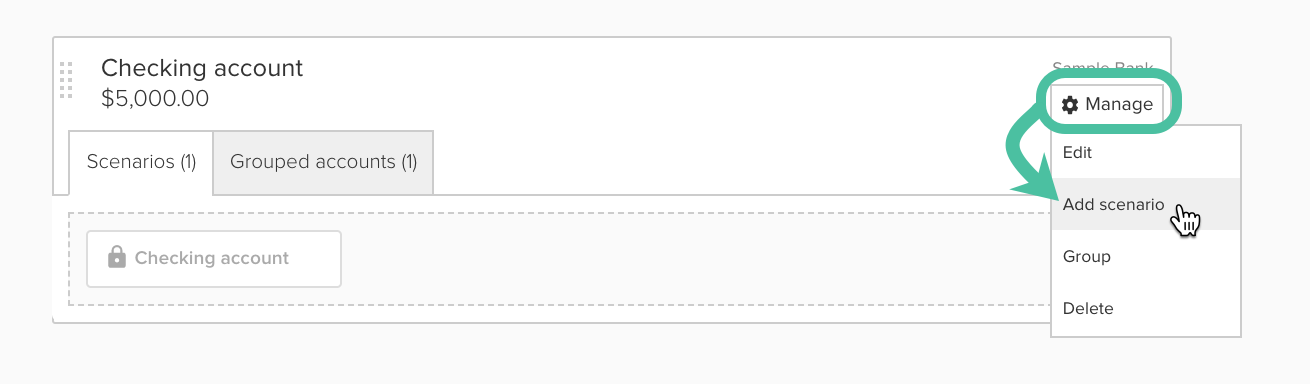

- In the right hand top corner of your chosen account, hover over ‘Manage’ and select ‘Add scenario’.

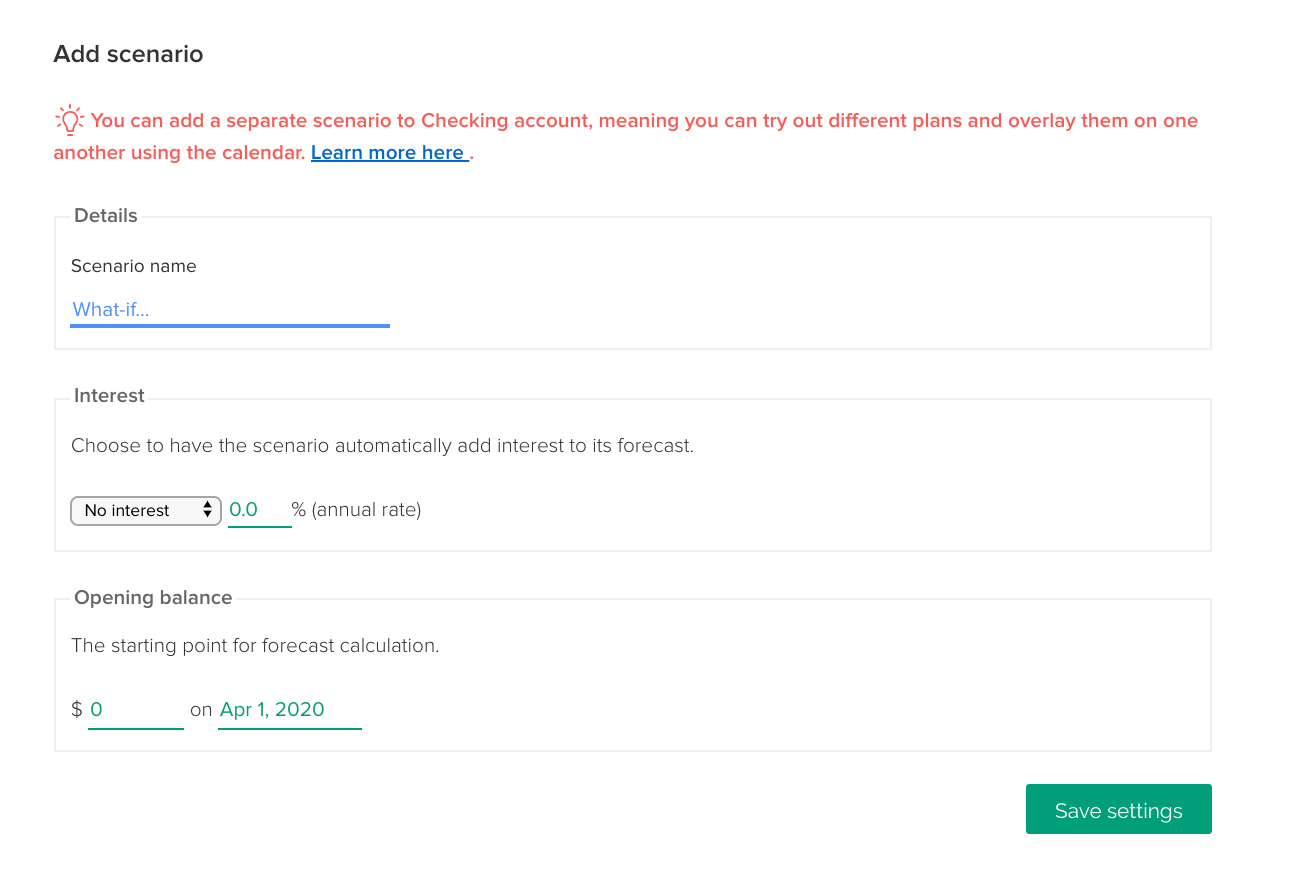

- Give your scenario a name and click ‘Save’. You’ve just added your first scenario and, currently, it’s empty. We’ll add your details to the scenario in the next step.

Step 2. Add budgets to your scenario

With your scenario set up, we can now make changes to your future by adding budgets to it. Budgets can cover a raise or drop in income, such as if you work less. Or, they can be changes to your expenses, such as a drop in transport costs.

Click on the instructions to change the picture.

Click on the instructions to change the picture.

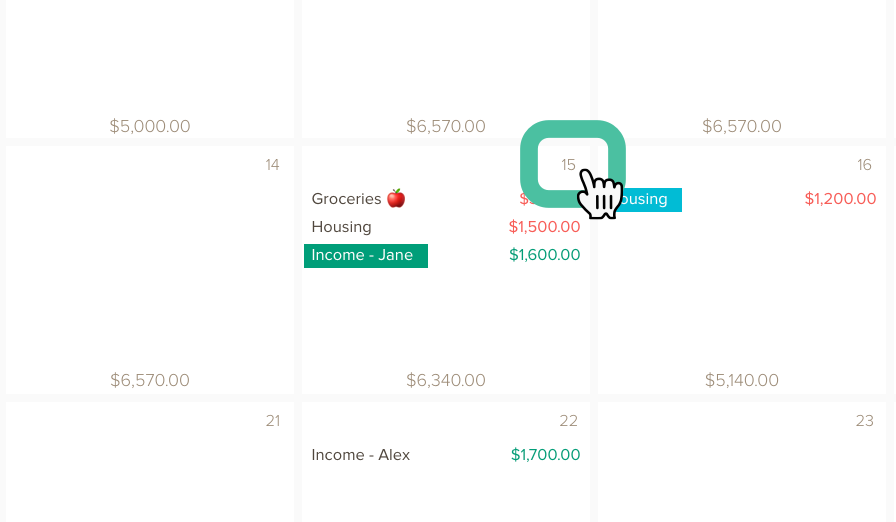

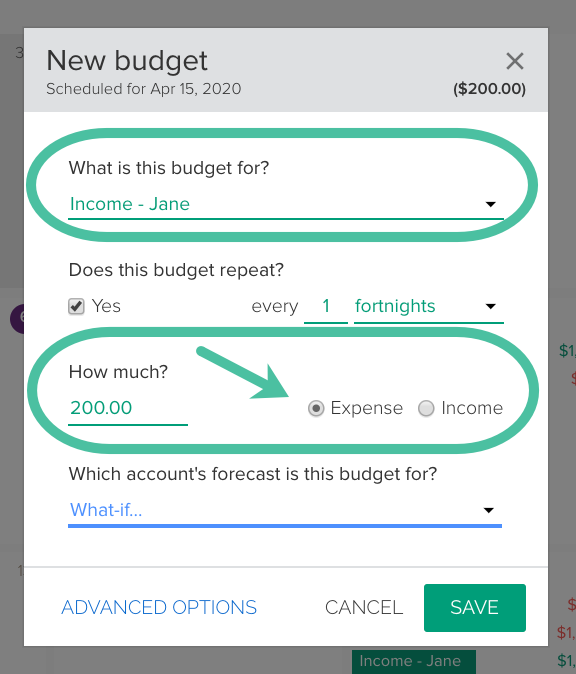

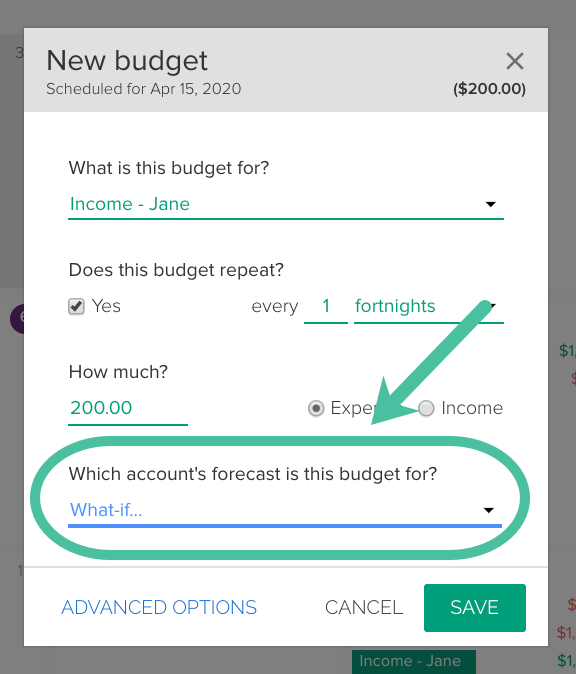

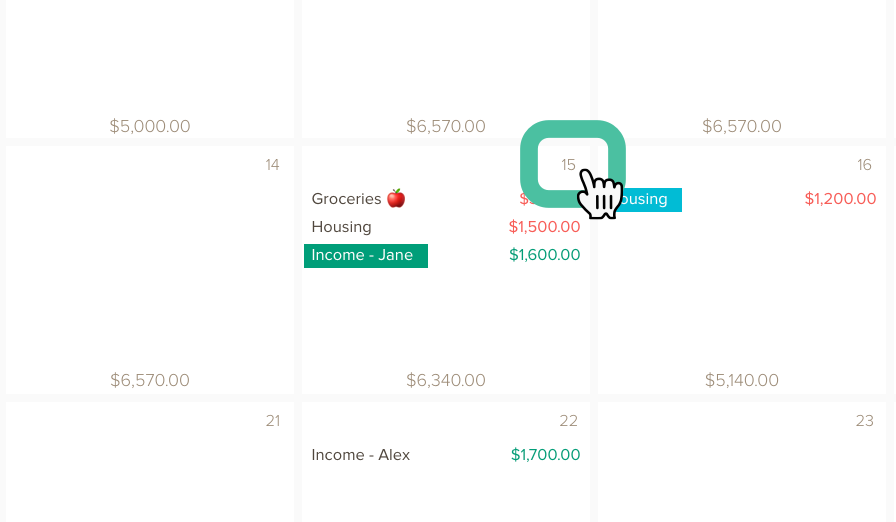

- To Add a budget to your scenario, head to Forecast > Calendar and click on the date that the change to your budget would happen on, or start from. You’ll see the familiar new budget window.

-

Set your changes for each of the categories in your budget.

For example, if you work one day less that drop in income is added to your 'Salary' as an ‘Expense’. If you work an extra day, that is added to your 'Salary' as ‘Income’.

Expenses are the same. To reduce the amount you spend on something, mark it as ‘Income’. Say you decide to work from home instead of traveling every day - add that extra money as ‘Income’ to your transport budget. - Finally, check that you have your new scenario selected under ‘Which account’s forecast is this budget for?’ Click ‘Save’ to add this budget to your scenario.

- Keep adding separate budgets for each change you’d like to test. You get a visual glance of their effect from your forecast graph above your Calendar.

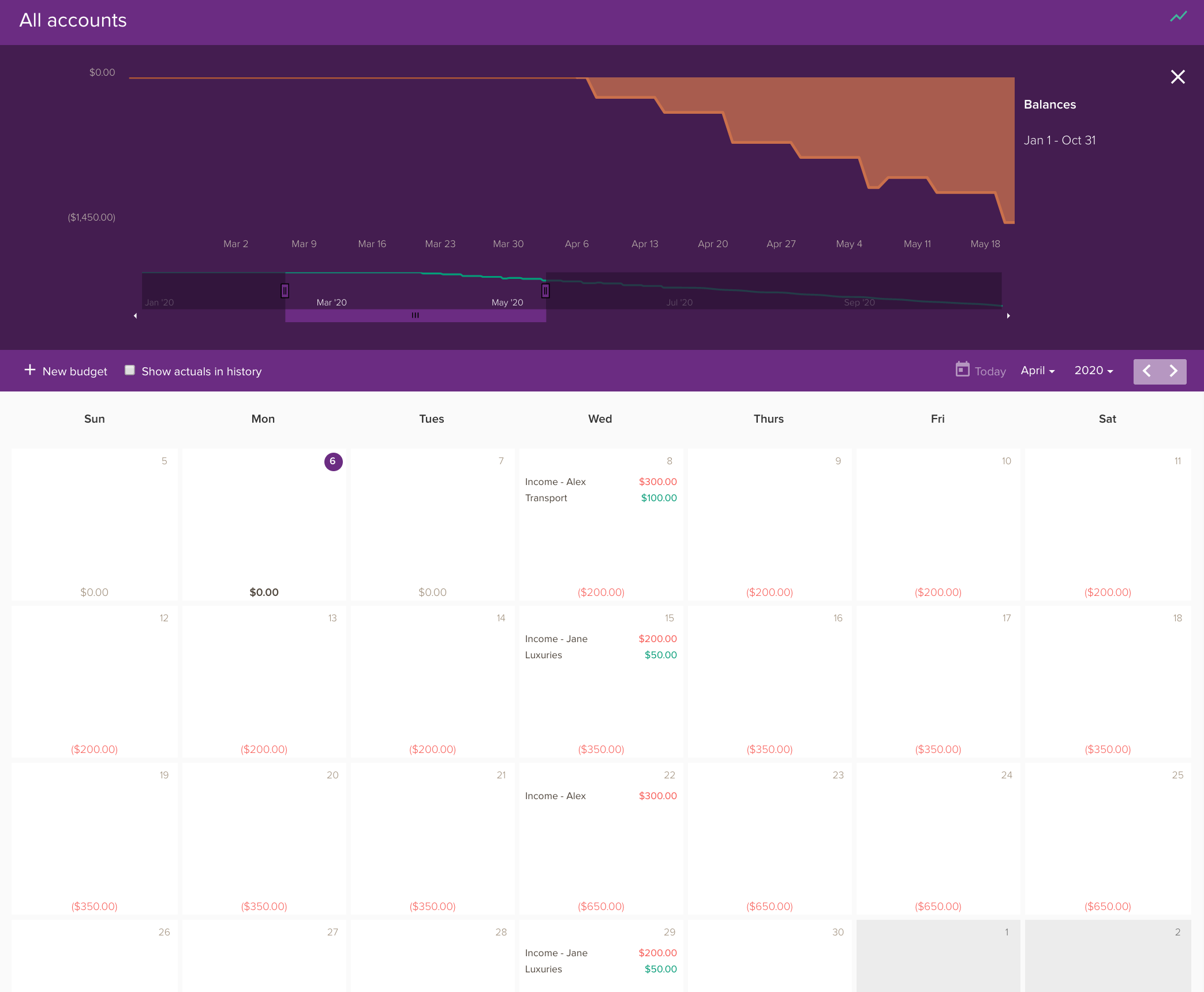

Step 3. Go see what happens in your scenarios

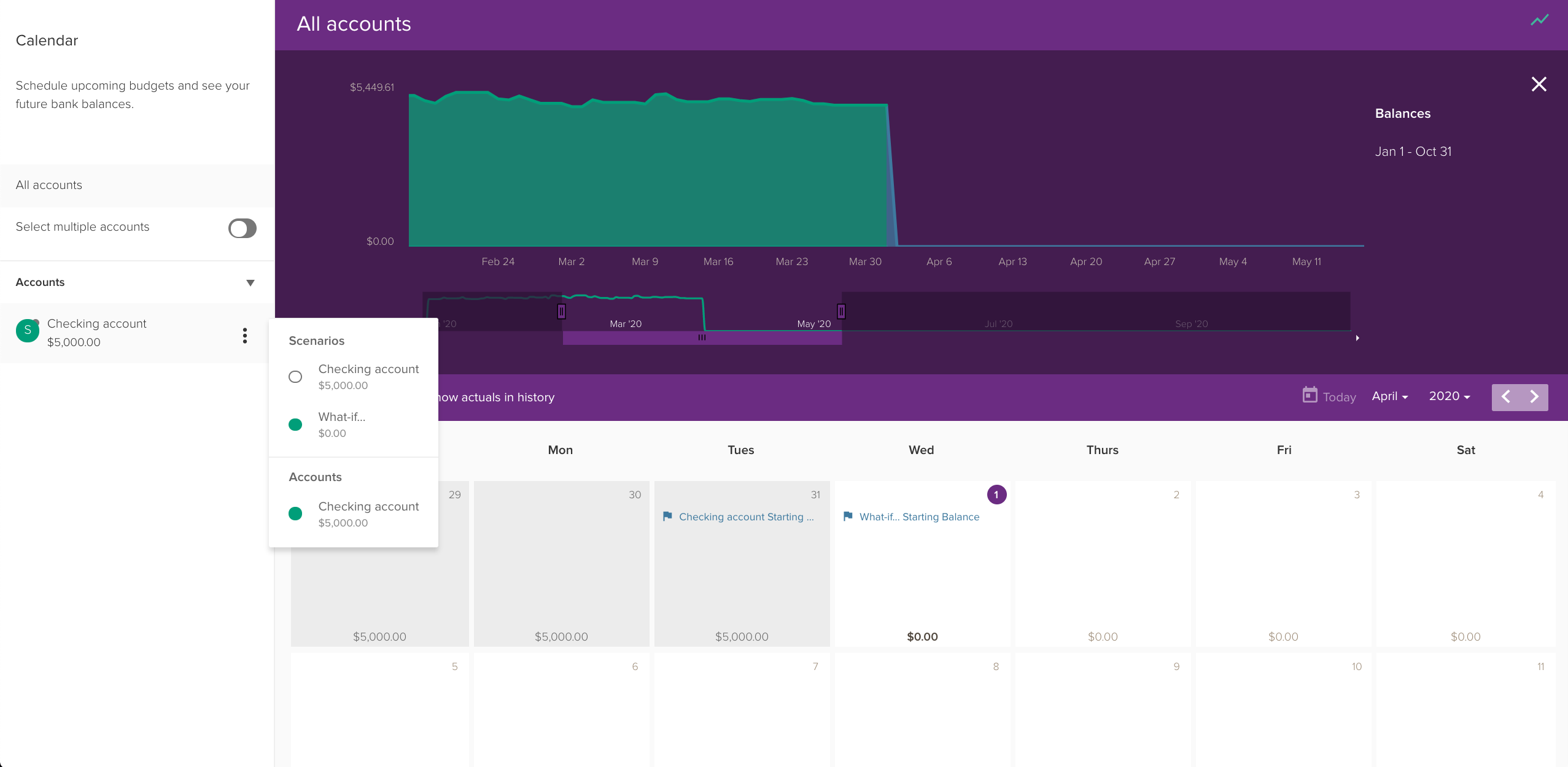

Now it’s time to see the impact of your changes on your future. All your scenarios live in the calendar sidebar next to “All Accounts”. Click on the three-dot menu beside your account to see a list of your scenarios.

Click on the instructions to change the picture.

Click on the instructions to change the picture.

- To see the overall impact of your changes, toggle the scenario on and off in the sidebar by clicking on the dot beside the what-if scenario.

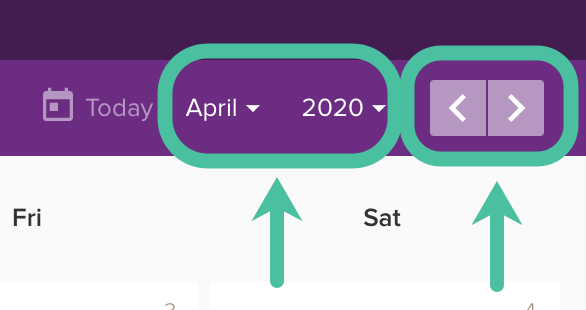

- If you want to get a sense of the changes on a particular date, you’ll just need to adjust the date on the Calendar. Use the Date selector on the right hand top corner of the calendar.

- If you want to remove a scenario completely, you can park it, or you can delete it entirely.

Here’s to your future

Building scenarios is a fast way to find where you can make meaningful changes with your money. It’s not always the huge changes that have the biggest impact - so keep exploring until you find all the areas that work for you.

You've just scratched the surface of what you can do with PocketSmith. To learn more, please visit our website, or check out our Learn Center.