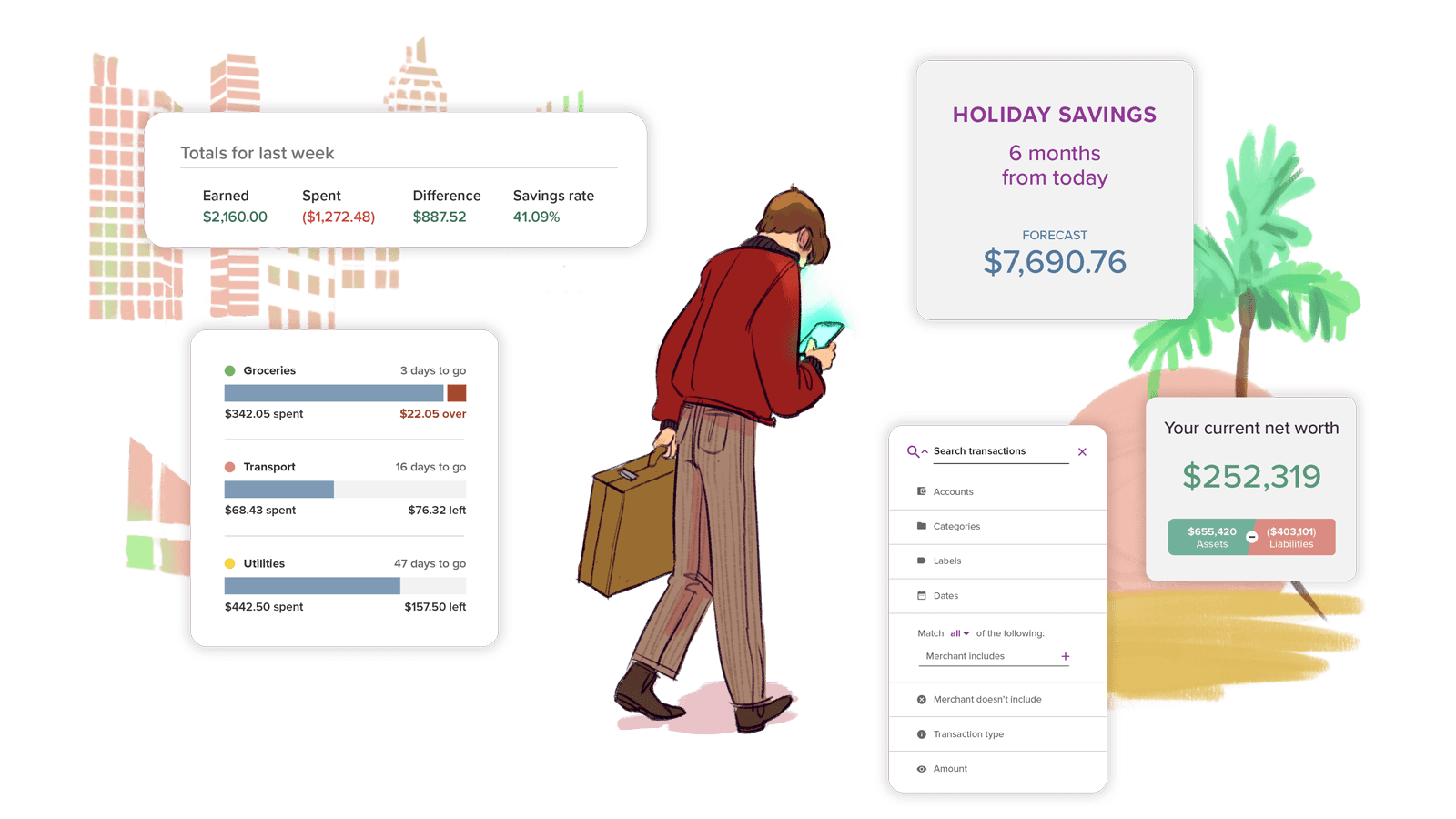

PocketSmith is the alternative to WeMoney that can help you take your finances to a new level. Elevate your budgeting and financial planning to new heights with our versatile dashboards and a suite of reporting tools. Dive into detailed spending trends, manage your income and expenses with precision, and explore the convenience of calendar budgeting. Keep an eye on your net worth and effortlessly track multiple currencies. PocketSmith also serves as your secure digital vault for important household documents like insurance papers, warranties, and receipts – a comprehensive money dashboard at your fingertips.

We’re a team of people just like you, and we're dedicated to supporting every WeMoney user transitioning to PocketSmith. We invite you to join us and advance your money management journey with a budgeting app that's more than just an alternative — it's a significant upgrade!

We've partnered with Australian CDR data provider Basiq to give you open banking access. This means you'll get access to open banking feeds for all banks in Australia as they come online, and alternate traditional feeds in the interim.

See your forecast bank balances by scheduling future budgets. Our budget calendar makes it easy to see balances on any given date which allows for detailed financial planning.

We're highly responsive and care about getting you in control of your money. If you need a little help or just want to learn more, please get in touch — we’ll get right back to you.

Your data is safe with us. It's encrypted in transit and at rest, and you're not required to share personally-identifying information with us. Read more about our security practices.

Since 2008, we've been working on creating the world's best personal finance tool. We pride ourselves on constant improvement and iteration. You won't see any stagnation around here. Check out our product history.

Some free personal finance apps in Australia advertise to you, making you their product. The PocketSmith experience is about you and your money, you will not be sold other products along the way.

See more...

See more...

I love PocketSmith because you can tailor it in a way that makes sense to you. It caters to both the 'numbers geeks' and the 'just tell me if I'm winning or losing' crowd.

Ruth, thehappysaver.com

New Zealand

Great product, been using it for years. The best feature is the forecast calendar.

Nick Mann

UK

Embark on your new financial journey with PocketSmith, offering more than what you admired in apps like MoneyBrilliant and WeMoney.

Customised visualisation for your financial path: At PocketSmith, we redefine financial visualisation. Create custom dashboards perfectly aligned with your financial objectives. Embrace a range of visual tools, from dynamic graphs to innovative calendar-based planning, designed to spotlight the insights crucial to you. This goes beyond traditional money management apps, offering clarity and focus on your financial health.

Comprehensive reporting for in-depth understanding: Gain a clearer picture of your finances with PocketSmith. Receive a detailed personal income and expense statement, a feature extending beyond what you've found in budgeting apps like WeMoney. Stay updated on your net worth and manage international accounts effortlessly with real-time currency conversions. PocketSmith steps up where others like MoneyBrilliant or WeMoney leave off, providing you with a more complete financial overview.

Detailed transaction management: Organise your transactions more intuitively than ever. PocketSmith introduces customisable, nestable categories, along with handy labels, notes, and attachments for meticulous tracking. Our advanced Transactions page boasts a powerful search function, simplifying finding and filtering. If you're seeking an alternative to WeMoney or MoneyBrilliant, PocketSmith offers unparalleled control and efficiency.

Flexible, empowering budgeting: Experience budgeting that adapts to your life with PocketSmith. Choose from various budgeting periods and enjoy the convenience of rollover budgeting. Share your financial progress with a partner or advisor through Advisor Access. PocketSmith isn’t just another money app; it’s a collaborative platform for effective financial management, a step above competitors like WeMoney and MoneyBrilliant.

PocketSmith has been an innovator in the fintech world since 2008 and is still proudly independent and self-funded. Our only source of revenue is our customer subscriptions, and we are a stable, profitable company with no investors telling us what to do — our customers are at the centre of everything we do.

At PocketSmith, we make money from your subscription, not your data. We will never sell your data or advertise to you.

Free apps like MoneyBrilliant have made the user their product, selling real-time information to their market research clients. That doesn't vibe with our values — our users' data is sacred to us.

Does PocketSmith connect to all WeMoney supported banks?

PocketSmith connects securely to all major banks in Australia with open banking data feeds, and you can search for your bank below. PocketSmith is a money management and budgeting app that grows with you. You can start simply by just tracking your budgets and enjoy our automatic categorisation and custom labelling. But you can also plan your whole financial future up to 30 years into the future with our cash flow and net worth forecasting features. Check out our complete list of supported banks to see if your specific bank is included.

What sets PocketSmith apart as the best alternative to WeMoney?

Don’t take it from us, hear what our lovely user community has to say. See how diverse households around the world use PocketSmith to get financial peace of mind. From retired Australian Chris, who uses PocketSmith for His Short, Medium, and Long-Term Money Goals, to Western Australian based Dave, who uses our app to have flexible budgeting and to Jimmy, a Kiwi who fast-tracked his way to a house deposit with PocketSmith.

How does WeMoney vs. PocketSmith stack up?

PocketSmith has all the functionality, plus so much more, compared to apps like WeMoney. With its vast number of financial institutions, PocketSmith is a powerful tool for users who want detailed insights into their daily transactions and financial forecasting. Of all the alternatives to WeMoney in Australia, you will not find one more comprehensive than PocketSmith. Take the Tour to explore.

Do I have to use bank feeds with PocketSmith?

If you prefer not to use automatic bank feeds, you can use our convenient bank file uploader. PocketSmith supports the following file types: OFX, QFX, QIF, and CSV. Export your bank files from your online banking website, then import them straight into PocketSmith! Read our guide to importing bank files.

Can I share PocketSmith with my financial advisor or family member?

Yes, PocketSmith has a shared access feature where you can choose to share access to your PocketSmith account with a trusted partner, financial advisor, or other financial services of your choice, such as a mortgage broker.

WeMoney is a mobile app. Is PocketSmith a web app, mobile app or both?

Both! PocketSmith can be used at your desk or on your phone so you can manage your money wherever you are! PocketSmith is cloud-based desktop personal finance software with a mobile companion app. Our iOS and Android budgeting app is designed to provide you with the key elements of PocketSmith right there in your pocket. So you can achieve your money goals while you do what you do best — live your life!

What is PocketSmith?

PocketSmith is world-class personal finance software that lets you manage your money, your way. Track your income, expenses, assets and net worth, customise your budgets, forecast your cash flow up to 60 years into the future, and see it all in a nifty calendar view.

How can PocketSmith help me save for my future goals?

PocketSmith helps you save for future goals by providing powerful forecasting tools to visualise long-term financial scenarios, customisable budgeting to allocate funds towards your objectives, and detailed tracking to monitor progress, ensuring you stay on track to achieve your financial dreams.

How does PocketSmith cater to the needs of freelancers and independent contractors?

PocketSmith caters to freelancers and independent contractors by offering flexible budgeting and forecasting tools tailored to fluctuating incomes, customisable categories for easy expense tracking and tax preparation, and secure storage for important financial documents. See how Rachel uses PocketSmith to manage her money as a freelancer. PocketSmith's multi-currency support and collaborative features also make managing international clients and working with financial advisors seamless.

Money Under 30 | Advice On Credit Cards, Investing, Student Loans, Mortgages & More