Hi Ruth,

My partner and I are looking to move to one of the major cities soon for work opportunities. We bought our first home a few years ago, and we’re looking to hold onto it and rent it out. However, we need to do some remodeling to make it fit for renting. Renovations are pretty new to us, and the finance side of it is the thing that’s stressing us out the most. How do we incorporate renovations into our budget? And what renovation costs should we be prioritizing?

This question prompted a few questions for me: Why hold onto your house? Why not sell it and buy a home in the city you are moving? Do you want to return to your original city at some point? Or can you not afford to buy in your new city?

When you rent out your home, you are inviting a lot of drama into your life, both personal and financial, so I would encourage you to think deeply about the ‘why’ of becoming a landlord. I can’t guide you toward your reasons for renting your property, but I can certainly help you budget and pay for your renovations before you offer it to a tenant.

Find out what needs fixing

The priority would be to find exactly what your home needs to bring it up to a rentable standard. Approach a couple of property managers and ask them to view your property and advise you on what you need to do to appeal to future tenants, as they will know the market better than you. Don’t just take their word for it though, you should also research the government requirements for providing a rental home.

If you are about to become tenants yourself, you can also think about what you are looking for in a property and seek to provide that to your future tenants.

Once you know what your home requires:

- Write out a comprehensive list of the jobs required, and then set about costing out each repair and upgrade in as much detail as possible. Request quotes for work from honest tradies and suppliers and find out their timeframes too.

- Create a timeline for repairs, prioritizing the most essential maintenance and working towards a handover date.

This will now give you a firm foundation, instead of guesswork. For example, if you wanted your tenants to start leasing in June:

Consider the impact to your mortgage

It would be easy to consider just extending your mortgage by $20,000 or so to cover those costs, but I think you are kicking the can down the road by adding years and extra interest payments onto your mortgage.

Also, your bank has given you lending on this property as your primary home; they may need to be consulted about its use change and may or may not want to extend your lending.

Keep your financial planning tidy

I’m much more in favor of keeping your financial life tidy and paying your way as you go because plans change. This is proved by the fact you have bought a home in one city, yet are now moving to another. So, leave a tidy trail in your wake. Leave a home in one city that is fit for purpose as a rental property, where the repairs are up-to-date and paid for, and future rent can now pay for the mortgage on this home. This will better prepare you for your future so that you can easily pay your own rent.

By researching the costs, these become known costs, and given enough time, you can budget them. When you commit to saving up and paying with cash, you will feel the pain of each expense, which will mean you’re more likely to negotiate better rates with tradies and take on work yourself to lower those costs.

Decide on your timeframe for moving

The next question to ask yourselves is how much time do you have to raise the money required to cover the cost of your repairs? If you have six months before work begins, you will need to set aside up to $3,333 per month to have the total amount of $20,000 saved before work begins. If you have 12 months to prepare, you need to save $1,666 per month. Or you could ease back your saving and create a timeline to have the right amount of money saved up by the time each component of the work is completed.

Setting up a budget is the easy part. You find out how much you need and you set a timeline for saving it, only booking in the work once you know the money is there to pay the bill.

Create visual reminders

That timeline of repairs you created, with the associated costs listed out? It should be prominently displayed and a visual reminder of your goals: To create a property fit for renting, with all repairs paid in cash by a specific day, so that you can move to your new city knowing everything is taken care of.

Make more money and then ring-fence it

Raising the money to complete the repairs is the hardest part. I don’t know your income, but I’d imagine saving $3,333 per month would strain your monthly take-home pay. I’d encourage you, during this period of change, to focus on making more money. Get creative! Whether you borrow the money or save it up yourself, at some point, you are going to need to find the money. It might as well be now.

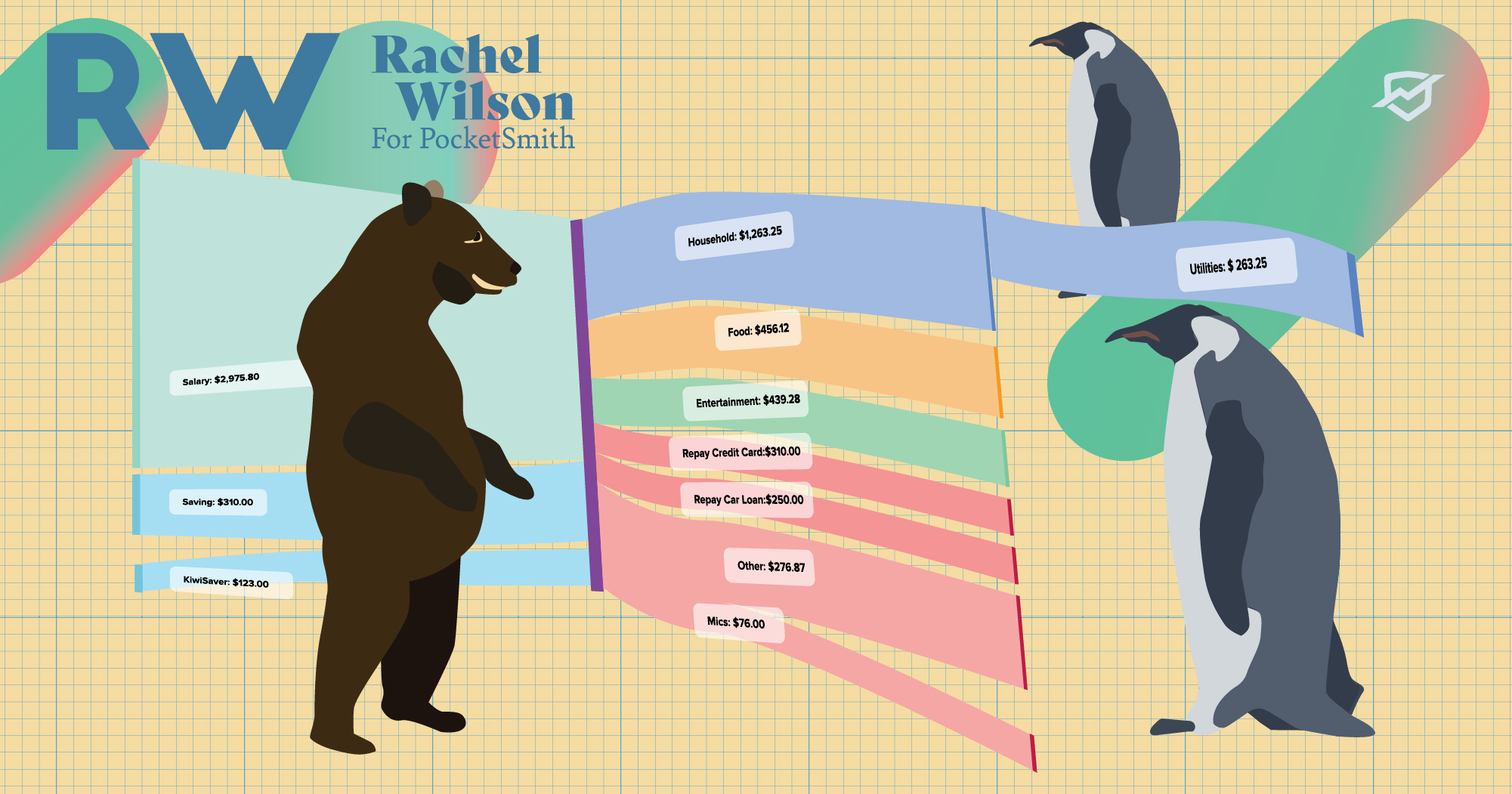

Then create a specific bank account called “Rental Property Renovations”. Every time you sell something, put that money in here. Every time you earn a little bit extra, put that money in there. You can also set up a direct transfer in line with your pay cheque to push money automatically into this account.

Within PocketSmith you can create a “Rental Property Renovation” budget and watch your account balance grow there. Once bills start to come in you can categorize them to this budget and keep yourself on the right track. This can also be where you manage all the future costs associated with being a landlord.

Look to the future

The first step of the process is preparing your property for sale and paying cash for all repair costs, and then you’ll have to manage the ongoing repairs once the home is rented. Just as you have set aside a portion of your salary to pay for the repairs you have made, you will also need to continue to set aside an amount of your rental income/salary for all future repairs and property-associated costs.

The final step where I would encourage you to keep checking in with the economics of your rental property and asking yourselves if it still fits within your family goals. Tracking all the money you have spent and will continue to spend, the income it generates, and the capital gain on your property will give you the information you need to make an objective decision about how worthwhile this investment is to you, and whether it is helping you grow your wealth, or preventing you from living your best life in your new city. Only you can know the answer to that.

Got a burning money question for Ruth? Send them through to [email protected]!

Ruth blogs at thehappysaver.com all about how she and her family handle money. What’s the secret? Spend less than you earn, invest the difference, avoid debt and budget each dollar that flows through your hands. She firmly believes that if you can just get the basics right, life becomes easier from there on in.