Our Product History

We're committed to delivering excellent software for exceptional value. The price of a PocketSmith subscription in July 2023 is the same as it was back in 2011, where it reflected the value of our subscription at that point in time.

We've since continued to evolve our product to meet our users' growing needs as well as innovations in personal finance.

As we launch new plans this year, come take a look at how PocketSmith has changed since then. Here are some of our highlights from each year. You may spot a feature or two you didn't know about!

2011

Introducing Bank Feeds with v2

We make the leap from being file upload-only to offering Bank Feeds for users on paid plans from November 2011, with them entering public beta early in 2012. This is momentous for us and our users as it creates a much easier user experience importing data from banks.

We also departed from the first version of the product in 2011. With a complete visual overhaul and leaving the static 1024-pixel wide layout of the late 2000s behind, the application was proudly emblazoned with a v2 logo with an sepia-toned eye toward the future.

2012

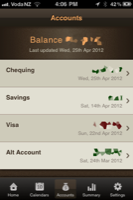

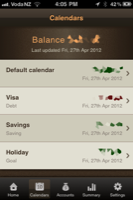

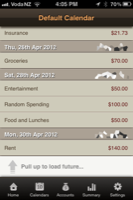

Pocketsmith Mobile and Filters

The first version of PocketSmith Mobile is launched as a web application designed for smartphone browsers. It's designed to look like a wallet, and brings with it some quality stitching.

We introduce Filters, a powerful feature that automatically runs a repeated search on all newly-imported transactions, and then automatically does things like categorize and rename them for you.

You're now able to customize and schedule PocketSmith Account Update emails to be sent to you, so you can keep tabs on your finances from your inbox.

2013

Accounts and Forecasting

We launch a new version of PocketSmith that brings a cleaner interface, drag-and-drop sub-categorization, and a speed boost of up to 40%.

Projected bank balances are now linked to account balances, making it possible to create accurate rolling forecasts. Every account now comes with a Scenario that contains its cash projections, and an account can have multiple Scenarios to model multiple "what-if" outcomes.

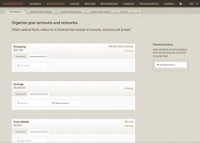

Accounts are now managed on the Account Summary page, which gives easy access to account balances, preferences, and Bank Feed settings.

2014

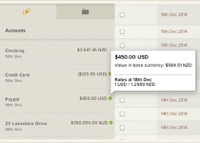

Multi-currency and Search Engine

Following years of planning, we introduce the ability for PocketSmith to manage accounts in up to 166 currencies (including Bitcoin!), and you can start to see foreign currency balances converted into your home currency.

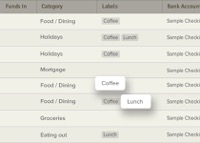

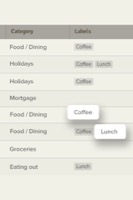

We also launch the first version of the Transactions page and its powerful search engine, which looks into all transaction attributes (e.g. merchant, amount, category, date) and returns results as you type. It comes with another time-saving innovation, Saved Searches. You can now also add labels to your transactions as an additional way to organize and find them.

We're one of the first financial products to introduce two-factor authentication (2FA) alongside additional security measures, including a login history for your account.

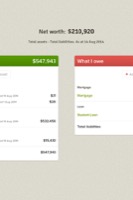

Two new reports are added: Net Worth and the Income & Expense report.

2015

New Interface, Graphs, and Advisor Access

After a year of work, we unveil a major upgrade to PocketSmith's form and function, featuring a new logo, color palette, and a UI framework based on Google's Material Design. We make the interface cleaner and easier to use, and we update all of our features with the new style.

We introduce the now-ubiquitous quick-look transactions pop-up, which quickly shows you the transactions comprising a chart element, or total, or budget, along with a link to jump off into the full Transactions view for more detail.

PocketSmith's back end also gets an upgrade, delivering a big speed boost that we first test with our users at the aptly-named https://faster.pocketsmith.com.

We release Advisor Access, which allows you to invite an advisor, friend, or family member to access and manage your account without requiring your password.

Our graphs get major upgrades too, from the addition of a drill-down pie chart on the Transactions page to the ability to zoom in on date periods on the area charts.

2016

Files and Photos, Budgets, Trends, Reminders

You can now store files and photos against your transactions in PocketSmith, which is handy for receipts and utility bills for historical records, or pictures of a purchase or an event. We also release Timeline, your personal social-media-esque wall of photos, files, and notes which turns your transactions into a diary.

The Budget page gets a major upgrade, with a redesign that shows your overall budget at a glance with the ability to view, drill down, and nest sub-category budgets. This comes in alongside Trends, which lets you compare historical performance across your categories.

We add a few more financial guardrails with the ability for PocketSmith to send you a scheduled reminder about your overdue and upcoming bills, and we introduce Safe Balance so you can see how much you have available after planned income and expenses.

Feature refinements continue, with an option to export your Income & Expense statement with each category's transactions, a button for a filtered transaction that lets you quickly edit its rule, and a new categorization interface that lets you focus on the job one card at a time.

2017

Emojis, Attachment Inbox, Auto-Budgeting

PocketSmith undergoes a massive infrastructure upgrade to futureproof it for growth. We upgrade the database along the way, and one of the outcomes that we're most excited about is support for emojis! PocketSmith accounts everywhere start to look more vibrant as they’re introduced to categories, budgets, merchants, notes, and more, as users 🏷️ their 💵 🗒️ 🏦 💱 🎠 👕 👠 🍔 💃 and 🎉.

You can now email photos and bills directly to your PocketSmith account with the Attachment Inbox feature. Forwarded files are stored in your account, ready for you to assign them to transactions.

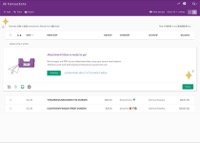

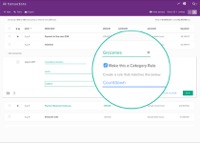

We make improvements to the category rule management screen that, amongst other things, gives you the ability to see hit rates that show how well a rule is performing. You can now also make a category rule directly from a transaction.

To give you a head start in setting up your budgets, we introduce the auto-budget tool — a feature that makes budgets for you based on your categorized transaction data. This lets you build a budget and forecast in one click, and then adjust from there.

2018

PocketSmith Companion mobile app

Our app on iOS and Android gets a big facelift and usability boost this year, cementing it as the one app for all of your banking information.

We introduce a new mobile dashboard that features a long vertical scroll, giving you the ability to add and sort as many widgets that matter to you. Each widget shows you a summary of your finances — like your Net Worth, spending breakdown, your favorite budgets — and tapping it expands its functionality.

Here are some of our favorite widgets and features.

- The transaction search widget brings in an ease of use from PocketSmith on the web — just tap it and start typing, and your results continue to be refined as you go.

- The spending pie chart shows a breakdown of your activity by category by week or month, and tapping on a category segment on the pie reveals the relevant transactions.

- The top accounts widget lets you keep tabs on the account balances that are top of mind for you. Tapping on an account shows you its transactions, with a tab that filters only incomes.

- The net worth widget shows you the big number along with the values of your total assets and liabilities. Tap on this to see your asset and liability allocations in pie charts and lists.

- To build better habits around categorizing your transactions, you can set reminders to be sent to your mobile (and email) from PocketSmith via the User Preferences pane.

2019

UK/EU Open Banking and Multi-currency updates

We add Salt Edge as a second data aggregator to PocketSmith in order to connect our UK and EU customers with Open Banking-compliant bank feeds. Seven years after first launching the bank feeds feature, this heralds a new era for connectivity in PocketSmith as the financial world begins to adopt standards to ultimately give consumers better access to their data.

Alongside this, we streamline the process for connecting bank feeds by simplifying each step, from picking your bank, to setting automatic categorization, to validating your credentials.

Multi-currency support is extended to budgets now, with each budget adopting the currency of the account it belongs to, and its values are converted to base currency at the current exchange rate.

Other features now also work with multi-currency, including Transactions and Timeline, auto-budget, "Recent activity" and "Your next 7 days" Dashboard widget, the Digest email, and transaction file exports.

Our heavily calendar-inspired budget creation form gets a facelift that recognizes how far this feature has come. You can now use it in simple or advanced mode, depending on how detailed you want your budget to be.

2020

Custom Dashboards and Rollover Budgeting

We introduce Custom Dashboards, a feature that lets you bring the best of PocketSmith into one highly-configurable location. Dashboards come with 11 widgets that you can customize to show specific account balances, bills, budgets, saved searches, and more.

You can also take personalization even further by making a Dashboard for specific topics. Track your mortgage or a side hustle, show key stats to family members, and focus on a set of budgets or investments. Your imagination is the limit.

After three years of work, we release rollover budgeting, our most-requested feature to date. This gives you the ability to move unspent or overspent amounts from previous budget periods into the current one, opening the door to more flexible budgets, and making it possible to use "envelope" style budgeting systems.

To thank you for spreading the word, we launch the Tell-A-Friend reward program that lets you give your friend a 30-day trial, and then adds 60 days to your subscription if your friend signs up for a paid subscription.

2021

Data Connections

Nearly a decade after adding Bank Feeds to PocketSmith, we ship the Data Connections platform — new technology that connects PocketSmith to a wider range of data sources.

It is a significant investment in the future as this upgrade allows us to add new financial aggregators and services for our users as public APIs for data sharing become increasingly available. This means we can offer more reliable connections to your data, and that we're ready for Open Banking.

For a start, Data Connections gives you access to your data via the best aggregator for your financial service and region, supporting Plaid (US), Akahu (NZ), Salt Edge (UK/EU) and Yodlee (global).

We launch a direct integration with Sharesight using Data Connections to bring in portfolio balances. Alongside this, we introduce balance tracking for accounts without transactions so the historical balances of your investments can be tracked in PocketSmith.

We add more usability improvements to the Income & Expense report, including percentage analysis. We also update the design of our menu to highlight primary features and cluster others, like Reports, in a convenient location.

2022

Sankey widget and AU Open Banking

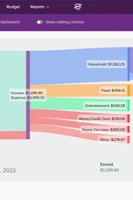

We add a new widget to the Dashboard that displays a Sankey diagram. It shows you how money flows from income to expense, and from parent to child categories, ultimately telling you the story of where your money came from and went. One of our users, Rachel Wilson, writes beautifully about how it works. We also release a Transactions Column Widget, which clearly shows you totals of incomes and expenses for each date period over time.

Accompanying the above, Saved Searches can now be used on the Sankey diagram, earning and spending pie chart, and transactions column widgets. This allows you to scope these widgets more tightly to specifics, for example, by showing a Sankey chart of only transactions over $100, or a pie chart comprising certain labels, or transactions showing only transfers.

Across the ditch, an update to the Australian Competition and Consumer Commission's (ACCC's) rules now allow us to participate in Open Banking, and we begin offering data connectivity through a new relationship with Basiq. Australia's Open Banking regulations represent a big step towards better data reliability for our customers in the region.

2023

Income & Expense, Budget and Category upgrades, and more to come!

We now bring category nesting to the Income & Expense report as a feature you can toggle on and off from the sidebar. Along with this, categories with children can now be rolled up just like on the Budget page.

If you use rollover budgeting, you'll see a setting on the Income & Expense and Budget pages that will let you include or exclude rollover amounts in the report totals, and budget bar totals, respectively.

There are also some quality-of-life updates that will make a big difference to many of our users.

The Categories page now ensures that category income and expense types are clearly visible, and when a sole budget type is updated, its category types are updated with it. Those of us who use labels to organize our transactions can now search for transactions without labels.

We've also made getting bank feed help a customized, guided experience so that people can more easily tell us about any issues they're having with their bank feeds.

But that's not all! We're currently hard at work on a range of very exciting updates that we can't wait to show you later this year – including one you can preview right now.

Thank you for your support. We look forward to building out the future with you, and to give you the one home where all of your financial information is at your fingertips.